A Certificate Course in Foreign Exchange Operations is a program that provides training in the area of foreign exchange operations. The course covers various aspects of foreign exchange operations, including currency conversion, exchange rates, foreign exchange markets, and international trade finance.

The course is designed for professionals who work in the banking and financial services industry, including those who work in international trade finance, corporate treasury, and forex operations. It is also suitable for those who are interested in learning about foreign exchange operations as a career or for personal knowledge.

Certificate Course in Foreign Exchange Operations Glossary

Here are some key terms and definitions related to a Certificate Course in Foreign Exchange Operations:

- Foreign exchange: The exchange of one currency for another.

- Exchange rate: The rate at which one currency is exchanged for another.

- Currency conversion: The process of converting one currency into another.

- Forex market: The market where currencies are traded.

- Spot market: The market where currencies are traded for immediate delivery.

- Forward market: The market where currencies are traded for delivery at a future date.

- Options market: The market where options on currency are traded.

- Currency hedging: The practice of protecting against potential losses due to changes in currency exchange rates.

- International trade finance: The financing of international trade transactions.

- Letters of credit: A financial instrument used to guarantee payment for goods or services in international trade.

- Bills of exchange: A written order to pay a specified amount of money at a certain date in the future.

- Bank guarantees: A promise by a bank to pay a specified amount of money in the event that a borrower fails to meet their obligations.

- Market risk: The risk of loss due to changes in market conditions.

- Credit risk: The risk of loss due to the failure of a counterparty to meet their obligations.

- Operational risk: The risk of loss due to operational failures, such as errors or fraud.

- Risk management: The process of identifying, assessing, and managing risks in order to minimize potential losses.

- Forward contract: An agreement to buy or sell a specific amount of currency at a predetermined rate and date in the future.

- Currency option: A contract that gives the holder the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined price and date in the future.

- Currency swap: An agreement between two parties to exchange a specified amount of one currency for another currency at an agreed-upon rate, with an obligation to reverse the transaction at a future date.

- Arbitrage: The practice of exploiting price differences in different markets to make a profit.

Certificate Course in Foreign Exchange Operations Exam Tips and Tricks

Here are some tips and tricks for preparing for a Certificate Course in Foreign Exchange Operations exam:

- Understand the basics: It’s important to have a solid understanding of the basics of foreign exchange operations, including currency conversion, exchange rates, and the types of foreign exchange markets.

- Review key concepts: Review key concepts such as international trade finance, risk management, and currency hedging strategies.

- Use practice exams: Take practice exams to get a sense of the types of questions that may be asked on the exam. This will help you to identify areas where you may need more review and practice.

- Focus on important topics: Focus on the most important topics that are likely to be covered on the exam, such as currency conversion, exchange rates, and international trade finance.

- Stay up-to-date: Stay up-to-date with the latest news and trends in foreign exchange operations. This will help you to stay informed about changes in the industry and potential impacts on currency exchange rates and foreign exchange markets.

- Seek help: If you’re having trouble understanding a particular concept or topic, don’t be afraid to seek help from your instructor or a tutor.

- Use study materials: Utilize study materials such as textbooks, online courses, and videos to reinforce your understanding of the material.

- Manage your time: Be sure to manage your time effectively so that you have enough time to review all of the material before the exam.

- Stay calm: On the day of the exam, stay calm and focused. Take deep breaths, read the questions carefully, and take your time answering them.

- Read the instructions: Read the instructions carefully and make sure you understand the format of the exam. This will help you to pace yourself and avoid any mistakes.

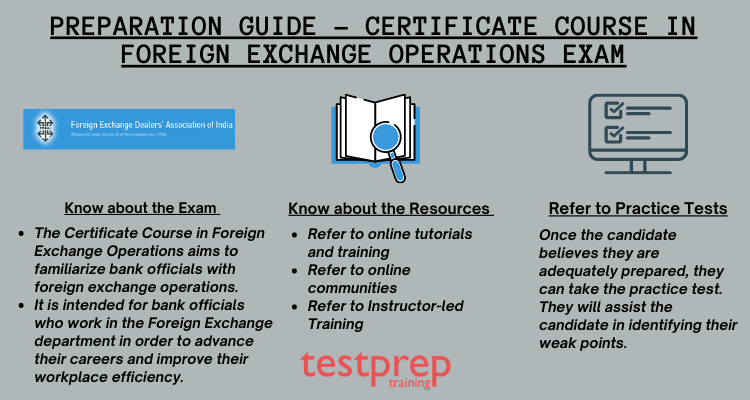

How to pass the Certificate Course in Foreign Exchange Operations Exam?

To summarise, there is no such thing as a one-size-fits-all study strategy. Everyone learns differently and has a different level of experience with the material. The good news is that these essential Certificate Course in Foreign Exchange Operations Exam study tips are available to everyone. Let us begin with the strategy –

Step 1 – Know about the Foreign Exchange Operations Exam syllabus

The Certificate Course in Foreign Exchange Operations exam covers the below-mentioned domains.

A. FEDAI Role and Rules

- Foreign Exchange Rates and Risk Management

- Moreover, Code of Conduct, Ethics/ Compliance, Corporate Governance

B. Regulatory Requirements under FEMA for Resident/ Non-resident Individuals

- Remittance Facilities under LRS

- also, Other Remittance Facilities for Resident Indians/ others

- furthermore, Various foreign currency accounts in India/ abroad

- moreover, Acquisition of Assets, Immovable properties outside India, including investments in securities abroad

- also, Remittance of Assets

- furthermore, Facilities for Non-resident Indians – Deposits Accounts, Investments, Borrowing, etc.

C. Regulatory Requirements under FEMA for Resident/ Non-resident Entities

- Import of Goods & Services and other non-import remittance

- also, External commercial borrowing

- furthermore, Export of goods and services

- moreover, Investments outside India

- also, Investments in India by non-resident Corporates/ FPIs/ Others Entities

- furthermore, Establishments of LO/ BO/ PO in India by foreign entities

D. Documentary Credits & Standby Credits

- ICC guidelines pertaining to INCOTERMS 2010, URC 522

- also, UCP 600, eUCP version 1.1

- furthermore, ISBP – ICC PUB. 745, URBO – ICC PUB. 750, URDG 758

- moreover, DOCDEX Rules – ICC PUB.872

E. Export Finance

- Various finance available by way for Pre-shipment/ Post-shipment finance in Rupees and Foreign Currency

- also, International Factoring, Forfaiting

- furthermore, Export Credit Guarantee Corporation (ECGC)

F. Foreign Trade Policy (FTP) 2015-20

- Various policy issues with specific relevance to AD Banks with the latest updates

Step 2 – Know about the Exam Format

Refer to this table for details about the exam –

| Exam Name Certificate Course in Foreign Exchange Operations | Exam Code Nil |

| Exam Duration 2 Hours | Exam Format Multiple Choice |

| Exam Type Database | Number of Questions 85 Questions |

| Eligibility/Pre-Requisite NIL | Exam Fee Rs. 1000 |

| Exam Language English | Pass Score 50 and above |

Step 3 – Explore Foreign Exchange Operations Career Opportunities

Forex jobs are fast-pace, with odd work hours and long work days because forex markets are open 24 hours a day, five days a week. They necessitate knowledge of, and adherence to, the laws and regulations that govern financial accounts and transactions. Furthermore, If you are legally permitted to work in a foreign country, a career in forex can provide you with the added excitement of living abroad. Knowing a foreign language, particularly German, French, Arabic, Russian, Spanish, Korean, Mandarin, Cantonese, Portuguese, or Japanese, is beneficial and may be required for some jobs.

Hence, this domain offers a very lucrative career along with a steep learning curve which makes it worth exploring!

Step 4 – Refer to the Learning Resources

Here are some resources that will help you ace the exam in one go!

Training offered by the FEDAI

If candidates want to be enrolled in traditional training to be extra prepared or walk the extra mile for the exam, they can contact FEDAI and enroll for it. FEDAI has training centers in three different zones: the South Zone, which is based in Chennai, the North Zone, which is based in New Delhi, and the East Zone, which is based in Kolkata. Also, Candidates can select their zone based on their personal preferences.

Online Community and platform of FEDAI

This website contains everything that aspirants require at the end of the day to complete and satisfy their study routine; candidates can post questions and receive immediate responses, they can give quiz tests, and they can participate in the weekly quiz. Furthermore, It serves as a stage for transformation and rehearsals.

Evaluate yourself with Practise Tests

Practising is the metal that is carve before your jewels are set in place. Practice tests for the Certificate Course in Foreign Exchange Operations are the foundation that is roughen and strengthened for a stronger foundation/favorable outcome. As a result, practicing is the most “basic” mode of any exam. For the best results, candidates should keep an open mind and continue practicing with Certificate Course in Foreign Exchange Operations practice exam tests. Moreover, Good practices produce better results.

Bonus Tip!

- IIBF provides 7 books covering the whole syllabus. Also, there will be a small book call forex for individuals on which you should focus

- Then, the questions asked are basic and specifically from the study materials with problems asked on simple exchange rate conversions.

- Practice with the latest and updated Foreign Exchange Operations Practice Test