Looking for the best way to prepare for the Securities Market Module (Advanced) Exam? You’re in luck! This article is here to help you get ready for the exam. In recent times, the security sector of India has taken a leap with India’s economy with the global trade. Therefore, individuals must be skilled to influence and generate business. As a result, NSE certifications like NCFM allows candidates to establish a high career in Securities Market. So, sit tight as there is more to come that will help you qualify the exam with flying colours.

What is NCFM?

NCFM is also known as NSE Academy Certification in Financial Markets. This certification is offered by the National Stock Exchange of India (NSE). In addition, NCFM is for people working with financial handlers and develop an important understanding for better quality services. Moreover, the NCFM module presently constitutes of 11 Foundation, 21 Intermediate, and 15 advanced certifications. Therefore, the candidate needs to qualify the particular exam to earn the certification.

Why go for NCFM certification?

The NCFM certifications provide an extraordinary advantage to students in commerce and business management. Moreover, this is beneficial for candidates who want to have a career in banking and finance. So, here are some of the benefits:

- First of all, this will give a steady start to your career in finance.

- Subsequently, attaining certification from NCFM will provide steady growth as well as great earnings.

- Moreover, candidates do get higher opportunities in banking and financial management.

- Consequently, securities markets offer a great career in finance and commerce. Therefore, NSE Certifications and NCFM courses add an extra edge to your abilities and skills after graduating in commerce.

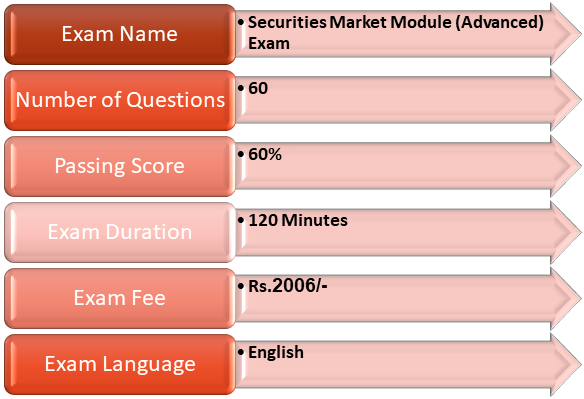

All Exam Details Here!

Before venturing onto any exam, its very important to understand and get familiar with each and every detail of the examination. Therefore, in this section, we are providing every detail, that you must know so that there ar4e no surprises on the exam day. So, avoid skipping this section if you wish to qualify for the exam.

Exam Overview

This Securities Market Module (Advanced) Exam intends to provide a piece of comprehensive and in-depth knowledge about the securities markets. While it’s not mandatory, it’s a good idea to complete the NCFM Beginners modules before tackling this one, even though it’s not a strict requirement.

Additionally, securities markets play a vital role in gathering savings for productive investments, which can boost a country’s long-term economic growth. They also contribute significantly to transforming the economy into a more efficient, innovative, and competitive marketplace.

Target Audience

The exam is most suitable for the following list of candidates-

- First of all, students of Management and Commerce

- Secondly, Security Market Professionals

- Subsequently, Finance Professionals

- Also, representatives with banks and financial institutions.

- Lastly, any candidate who has an interest in this subject

Basic Exam Details

Candidates need to understand that the exam is online and conducted all over India. One has to study on their own, i.e. the NCFM is not going to provide any classes. Also, Open Office Spreadsheet will be provided to each and every candidate. In addition, the exam is only available in the English language. The exam consists of 60 questions. However, keep in mind that one has to score at least 60% and above to qualify the same. Also, remember that there is 0.25% negative marking for incorrect answer. Lastly, the exam consists of only multiple-choice questions only.

And, finally, we are through with the exam details. Hopefully, now you have a clear vision about the exam question paper. And, for the next step, you must be acquainted with the course outline. This will enable you to prepare with the utmost focus. So, without a delay let’s move on to the course outline.

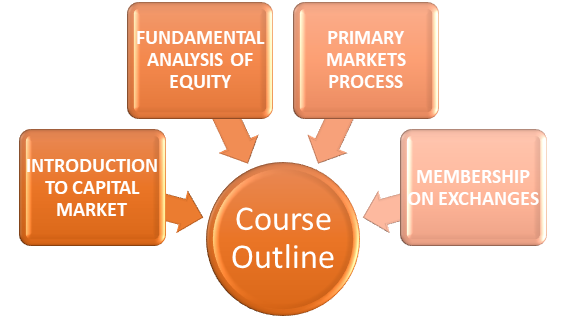

Course Outline

From our previous experience, we come across so many candidates pay the least importance to the course outline. Therefore, allows us to put you on the right pathway. As an extra benefit, let’s just make you aware of the fact that half of the preparation is done the moment you’re familiar with each topic under course outline. So, we urge not to skip this part, no matter what. In the same light, let’s begin with the exam objectives.

INTRODUCTION TO CAPITAL MARKET

- Fundamental Role

- Capital Market Segments

- Products / Instruments

- Institutions & Intermediaries

- Indices

- Capital Assets Pricing Model (CAPM )

- Reforms in Indian Securities Markets

FUNDAMENTAL ANALYSIS OF EQUITY

- Purpose

- Financial Statement Analysis

- Sector-Specific Ratios

PRIMARY MARKETS PROCESS

- Typical Fund Raising Stages

- IPO Process

- Why IPO?

MEMBERSHIP ON EXCHANGES

- Stock Broker

- Trading Members

- Clearing Members

- Membership Norms

- Also, Trading Membership – Admission Procedure

- Trading Membership – Surrender Procedure

- Not to mention, Trading Membership – Suspension & Expulsion

- Authorized Persons

This marks the end of the course outline. And, we hope by the end of it, you might have got a brief idea about the examination. So, now it’s time for the step by step preparatory guide

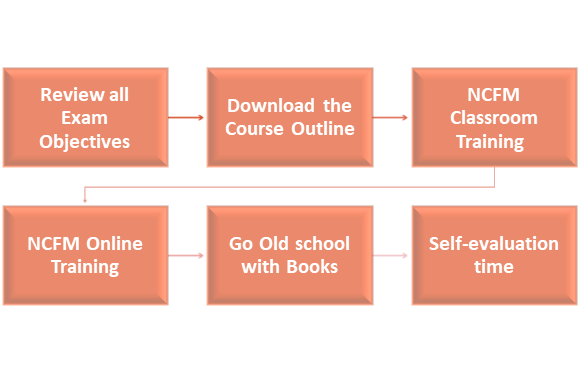

A step by step Preparatory Guide

Your proper planning prevents poor performance!

Passing the Securities Market Module (Advanced) Exam is not as tough as it may seem. With proper preparation, you can pass it and earn your certification. However, neglecting to prepare for the exam can lead to unfavorable outcomes. That’s why we strongly advise you to follow this preparation guide.

Review all Exam Objectives

Before embarking on any journey, it’s crucial to understand what you’re getting into. In the same way, thoroughly reviewing each exam objective is a key part of your preparation. So, make sure you visit the Official website of NCFM, to have a clear view. Since it is the most authentic site to provide any information regarding the Securities Market Module (Advanced) Exam.

Download the Course Outline

The second most important step is to download the Course outline. It includes all the areas and subjects covered in the exam. Therefore, be sure to get the Course Outline. This will help you prepare for the Securities Market Module (Advanced) Exam while keeping all the objectives in mind.

NCFM Classroom Training

There are a number of students enrolling themselves into institutes for NCFM certifications. Further, these institutes offer candidates with study material and mock tests as well. Therefore, enrolling yourself into this institution will allow you to prepare well for the examination.

NCFM Online Training

While classroom training includes candidates to be physically present in the class. Whereas, online training will help candidates to sit at home enjoy all the benefits and prepare well for the exam. Moreover, this training will offer you with perfect solutions. Further, you can enrol in this training at any time of the year. In addition, you can easily access online training from any location.

Go Old school with Books

Now that you’ve gained knowledge through training, it’s time to turn to traditional books. Books are a reliable resource for learning without distractions. So, here are some recommended books for you.

- Securities Laws and Capital Markets New Syllabus Latest Edition CS Executive By CS Sangeet Kedia

- Membership & Nonmembership by International Monetary Fund

- IPO (Initial Public Offer): Planning & Process by Sanjay Khare

Self-evaluation time

Finally, we’ve reached the last step of this preparatory guide. This step will help you identify the areas where you might need more practice. After going through the entire syllabus, be sure to take sample tests. These practice tests are designed to simulate the real exam conditions. You can find practice papers from various sources. The key is to test yourself as much as possible to improve your skills. SO START PRACTICING NOW!

Strategies to qualify the Securities Market Module (Advanced) Exam

Now that you have the full preparatory guide. Let’s understand how-to strategies for the preparation.

- First thing first, the candidate should not rely on mugging. But instead, effective learning will offer great results.

- Secondly, keep in mind that certain topics have high weightage in the examination. Therefore, prepare accordingly.

- Thirdly, make sure to practice as much as you can.

- Fourthly, while attempting the examination understand the question and then attempt it.

- Last but least, the candidate should manage time for better results.

Expert’s Corner

Certainly, adding a certification to your resume can make you stand out and increase your chances of getting hired. So, if you aspire to advance in your career and are motivated to follow your dreams, passing the Securities Market Module (Advanced) Exam is the final step to becoming certified. In simpler terms, a certification exam like the Securities Market Module (Advanced) Exam will demonstrate that you have the necessary skills for the job and show your dedication to your goals and ambitions.

Training and certification can positively impact your career and even lead to financial benefits. So, have confidence in your abilities, and get ready! Use the resources we’ve discussed along with effective time management, and you can certainly succeed in the Securities Market Module (Advanced) Exam.

SO TAKE YOUR CAREER TO THE NEXT LEVEL!