The FIMMDA-NSE exam is a comprehensive assessment of an individual’s knowledge of the Indian debt market, money market, and derivatives market. The exam is designed to test the candidate’s understanding of market dynamics, risk management, regulatory framework, and other related areas.

Passing the FIMMDA-NSE exam is a crucial step for individuals who want to establish their credibility as financial market professionals. Our blog will provide you with a step-by-step guide on how to prepare for the exam, along with some tips and tricks that will help you to succeed in your attempt.

This article will discuss the format, structure, and syllabus of the FIMMDA-NSE exam. We’ll also share useful study materials and resources to help you prepare for the exam. Furthermore, we’ll give you effective study tips to enhance your confidence and improve your likelihood of passing the exam in your initial try.

Whether you are a fresh graduate or a seasoned professional looking to advance your career in the financial markets, the FIMMDA-NSE exam is an essential certification that will open up new opportunities for you. By following the advice and strategies in our blog, you can increase your likelihood of success in the FIMMDA-NSE exam and position yourself for a successful career in the financial market industry.

FIMMDA-NSE Exam Glossary

The FIMMDA-NSE exam is an exam conducted by the Fixed Income Money Market and Derivatives Association of India (FIMMDA) and the National Stock Exchange (NSE) to certify professionals in the Indian debt market. Here is a glossary of terms that may be relevant for the exam:

- Bond: A debt security is like a loan given by an investor to a borrower, usually governments or companies.

- Yield: The profit earned from a bond, shown as a percentage of its original value.

- Coupon rate: The percentage of interest paid on a bond compared to its initial value.

- Credit Rating: A judgment of how likely a borrower can repay its debt, given by agencies like CRISIL, CARE, or ICRA.

- Debenture: A bond without specific collateral, representing a debt agreement.

- Commercial Paper: Short-term company debt for operational funds.

- Repo Rate: Interest rate banks pay to borrow from the central bank.

- Reverse Repo Rate: Interest rate banks earn lending to the central bank.

- Treasury Bill: Short-term government debt for quick funds.

- Call Money Market: Where banks exchange overnight loans.

- Certificate of Deposit: Bank time deposit for long-term needs.

- Credit Default Swap: Derivative guarding against borrower default.

- Interest Rate Swap: Derivative exchanging interest payments.

- Forward Rate Agreement: Derivative agreeing on future fixed interest rate.

- Basis Risk: Risk from financial instrument relationships behaving differently.

- Liquidity Risk: Risk of selling a security at lower value due to lack of buyers.

- Market Risk: Risk of security value change from market shifts.

- Operational Risk: Risk from human errors, system failures, or fraud.

- Systemic Risk: Risk of financial crisis from interconnected failures.

- Credit Spread: The difference between corporate and government bond yields.

How to pass FIMMDA-NSE exam?

The Fixed Income Money Market and Derivatives Association of India (FIMMDA) and National Stock Exchange of India (NSE) conduct the FIMMDA-NSE Debt Market (Basic) Module exam for individuals seeking to enter or enhance their career in the debt market. To pass the exam, you need to have a good understanding of the fundamental concepts of debt market, fixed income securities, and related financial instruments.

Official preparation resources for the FIMMDA-NSE Debt Market (Basic) Module exam include:

- NSE Academy’s E-learning Course: The NSE Academy provides an e-learning course for the FIMMDA-NSE Debt Market (Basic) Module exam. It covers various topics such as the bond market, treasury bills, commercial papers, and more. The course includes interactive quizzes, case studies, and assessments to help you prepare for the exam. The course is available on the NSE Academy website.

Link: https://www.nseindia.com/learn/online-course-fimdma-nse-debt-market-basic-module

- FIMMDA Study Material: The Fixed Income Money Market and Derivatives Association of India (FIMMDA) provides study material for the FIMMDA-NSE Debt Market (Basic) Module exam. The study material covers topics such as fixed income securities, bond valuation, yield curve, and more. You can access the study material on the FIMMDA website.

Link: https://www.fimmda.org/fimmdansemodule.php

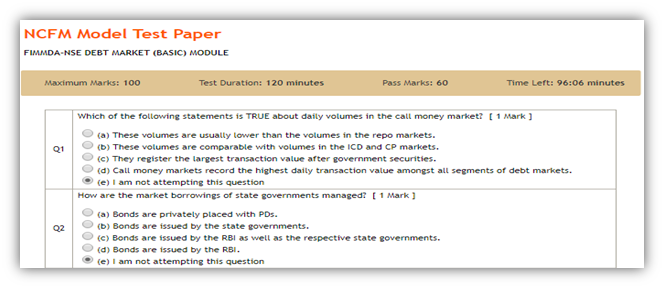

- NSE Mock Test: The NSE provides a mock test for the FIMMDA-NSE Debt Market (Basic) Module exam. The practice test creates a real exam-like setting, letting you assess what you know and find where you can get better. You can try the practice test on the NSE website.

Link: https://www.nseindia.com/learn/certificate-in-financial-markets-mock-tests

- NSE Study Material: The NSE provides study material for various certification exams, including the FIMMDA-NSE Debt Market (Basic) Module exam. The study material covers topics such as debt market instruments, bond valuation, and more. You can access the study material on the NSE website.

Link: https://www.nseindia.com/learn/certification

By utilizing these resources and preparing well, you can increase your chances of passing the FIMMDA-NSE Debt Market (Basic) Module exam.

What is NCFM?

NSE Academy Certification in Financial Markets is another name for NCFM. The National Stock Exchange of India provides this accreditation (NSE). NCFM is also for persons who deal with financial handlers and want to have a better grasp of how to provide better service.

In addition, the NCFM module now includes 11 Foundation, 21 Intermediate, and 15 Advanced certificates. As a result, in order to receive the certification, the candidate must pass the specific test.

Why go for NCFM certification?

Students studying commerce and business management benefit greatly from the NCFM credentials. Furthermore, those interested in a career in banking and finance will benefit from this. So, here are a few advantages:

- First of all, this will give you a steady start to your career in finance.

- Subsequently, attaining certification from NCFM will provide steady growth as well as great earnings.

- Moreover, candidates do get higher opportunities in banking and financial management.

- Consequently, as securities markets offer a great career in finance and commerce. Therefore, NSE Certifications and NCFM courses add an extra edge to your abilities and skills after graduating in commerce.

NSE FIMMDA Exam Overview

Different forms of debt instruments, such as bonds, T-Bills, and CDs, are covered in the FIMMDA-NSE Debt Market Basic Module (Foundation) exam. Furthermore, it provides information about the Indian debt market as well as the trading process of a debt instrument on the stock exchange. It also gives useful information on the Indian debt market and its many components. This also provides insight into the trading process of debt instruments on stock markets, as well as bond valuation.

Subsequently, this exam will help the student understand the following concept and fundamentals-

- To begin, the applicant will quickly grasp the basic properties of debt instruments.

- Secondly, on the NSE-WDM Segment, you will learn how to trade debt products.

Exam Format:

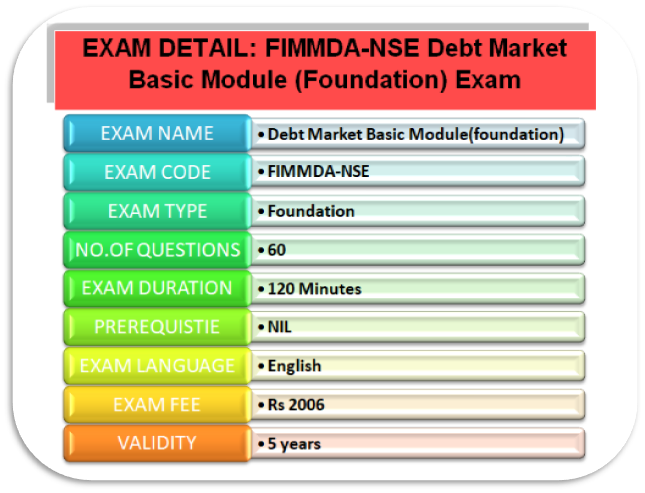

It’s usually a good idea to go over all of the relevant test content before taking an exam. Exam information should be known ahead of time to avoid any trouble. As a result, we’ve included all of the information you’ll need to apply for the FIMMDA-NSE test.

- There are 60 multiple-choice questions in the NSE FIMMDA Debt Module test. Furthermore, the exam will last 120 minutes.

- To be eligible for the exam, the candidate must have a score of at least 60%. This accreditation is also only good for five years.

- In addition, the FIMMDA-NSE test costs Rs.2006/- (Rupees Two Thousand and Six Only including GST).

- Furthermore, the FIMMDA NSE Debt Market Module Exam Questions are only available in English.

- Meanwhile, a basic understanding of computers is essential. Because the test is given in English, applicants must be fluent in the language.

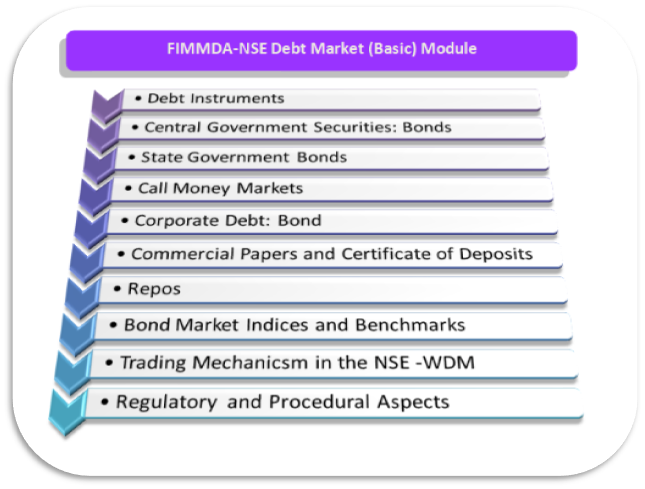

Course outline: FIMMDA-NSE Exam

Indeed, NSE provides a course overview to the applicant. As a result, this section contains all of the courses necessary to pass the FIMMDA-NSE test. Furthermore, all of the courses are sorted into groups based on the candidate’s preferences. The following topics are covered in the FIMMDA NSE Debt Market Module Course:

Certainly, the modules listed above cover all of the competencies needed to pass the FIMMDA-NSE test. In a nutshell, simply make sure you have all of the talents listed above and you’ll be OK. Furthermore, as soon as you feel prepared to take the FIMMDA-NSE test, go ahead and schedule it. As a result, the next part covers the entire exam scheduling procedure.

Registrating for FIMMDA-NSE Exam

NSE provides candidates the flexibility to choose when to take the exam. It’s easy. Just remember to pick a time when you’re ready. Here’s how you can schedule the FIMMDA-NSE exam:

- First of all, the candidate has to access the link ‘Online Registration’ available under Education>Certifications>Online Register / Enroll.

- Secondly, after registration candidate will receive a unique NCFM registration number along with a user id and password.

- Subsequently, the candidate can easily access their NCFM account to make payment / enroll for test / update address/check study material status / view certificates etc.

- Lastly, just pay the fees and select your slot and it’s done.

Deferral Policy: FIMMDA-NSE Exam

Candidates are not allowed to reschedule. However, the candidate has to enroll again to appear for the FIMMDA-NSE exam.

Exam Related Queries

We have provided all the details regarding the FIMMDA-NSE exam. But, in case any candidate is facing any trouble regarding the certification exam, the candidate can visit testpreptraining.com. Moreover, this will serve as your one destination to all your problems.

Certainly, after acquiring all the details of the FIMMDA-NSE exam, it’s time for a preparatory guide.

Preparatory Guide for the FIMMDA-NSE Exam

Your proper planning prevents poor performance!

Remember, the FIMMDA-NSE test isn’t too hard. So, passing it and getting certified should be achievable. But, if you don’t prepare well, you might face difficulties. That’s why we recommend you go through our preparation guide. It will help you get ready!

1. NSE E-Books

The NSE sends eBooks to candidates for preparation after they have paid and reserved a spot. In a similar manner, the eBooks cover the full curriculum. However, this is only useful if you want to get the bare minimum on the exam. As a result, if you rely only on this, you will not succeed. So, make sure you rely on various external references or training program for preparation.

2. NCFM Classroom Training

A large number of students are enrolling at institutions to obtain NCFM certifications. These institutes also provide candidates with study materials and sample examinations. As a result, enrolling in this university will help you to adequately prepare for the examination.

3. NCFM Online Training

Candidates must be physically present in the classroom for classroom instruction. Online training, on the other hand, allows applicants to sit at home and take advantage of all of the perks while still preparing for the exam. Furthermore, this course will provide you with ideal options. You may also enroll in the FIMMDA NSE Debt Market Module Training at any time during the year. Furthermore, you may take advantage of the online instruction from any place.

4. Go Old school with Books

Now that you’ve completed your training, you’re ready to apply what you’ve learned. It’s time to get back to basics with literature. As you may be aware, books are an excellent resource for gaining knowledge in a non-disruptive manner. So, for those of you who are interested, here are a few books that could be of interest.

- Fundamentals of The Bond Market written by Esme Faerber.

- Corporate Debt Market in India written by Dr Raju G.

- Debt Markets and Analysis: + Website (Bloomberg Financial) written by R. Stafford Johnson.

5. Self-evaluation time

Finally, we’ve reached the conclusion of the preliminary guide. In addition, this final phase will provide the candidate a clear picture of the issues in which they are missing. So, once you’ve gone through the full syllabus, make sure you’re going over sample tests. Most significantly, all of the FIMMDA NSE Debt Market Module Practice Tests are created to simulate the real-world test scenario. Practice papers, on the other hand, might come from a variety of places. Above all, remember that the more you put yourself to the test, the better you will become. Try a FIMMDA NSE Debt Market Module Free Test now!

Strategies to qualify the FIMMDA-NSE exam

Now that you have the full preparatory guide. Let’s understand how to strategies for the preparation.

- First thing first, candidate should not rely on mugging. But instead, effective learning will offer great results.

- Secondly, keep in mind that certain topics have high weight age in the examination. Therefore, prepare accordingly.

- Thirdly, make sure to practice as much as you can.

- Fourthly, while attempting the examination understand the question and then attempt it.

- Last but least, candidate should manage time for better results.

In Conclusion

Adding certification to your CV can undoubtedly help you stand out and land a job. So, if you want to progress your job and are driven to achieve your goals. After that, passing the FIMMDA-NSE test would be the final step toward certification. In other words, a certification test such as the FIMMDA-NSE exam will demonstrate that you possess the necessary abilities for the position. This will also demonstrate your dedication to your goals and ambitions. Training and certification do have an influence on your career. It also has financial advantages. So, don’t question your value, and be ready to strap up! Prepare yourself by using all of the materials we’ve mentioned thus far, as well as making good use of your time. Most significantly, the FIMMDA-NSE test is fully attainable with these resources.

SO TAKE YOUR CAREER TO THE NEXT LEVEL!