ACI Dealing Certificate (002-100)

The ACI Dealing Certificate (002-100) exam has expired on 31st March 2021. The replacement available is ACI Dealing Certificate New Version

The trading in financial markets is becoming increasingly automated. This current shift calls for expertise in the field of financial markets and its tools. This has led to a great increase in demand of professionals who are equipped with the understanding of financial markets and its instruments. The ACI Dealing Certificate is a proof of your skills and expertise. This certificate exam tests your knowledge of the characteristics and pricing of the financial market instruments, market forces market risks and regulations.

The ACI Dealing Certificate makes you job ready by providing the necessary skills that fulfil the industry demand.

What is ACI Dealing Certificate?

The ACI Dealing Certificate is a foundation programme by ACI. It provides you with the working knowledge of the structure and operation of the major foreign exchange and money markets. You are equipped with the ability to apply the fundamental mathematics used in these markets. Moreover you will learn the application of the fundamental mathematics used in core products (cash, forwards and derivatives) and basic skills required for competent participation.

Why go for ACI Dealing Certificate (002-100)?

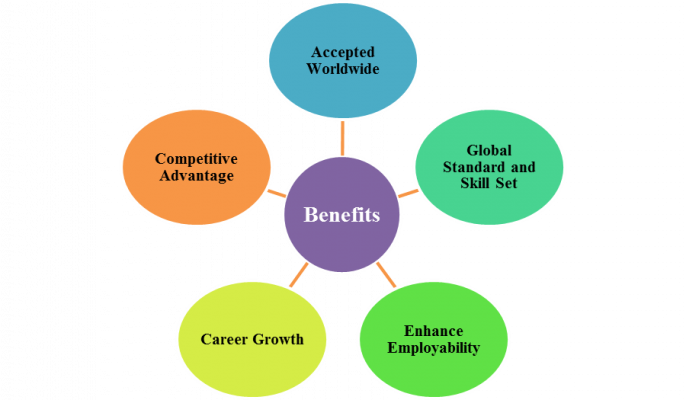

Accepted World Wide

This certification is accepted worldwide hence it increases your opportunities nationally as well as internationally.

Global Standard and skill set

The ACI Dealing Certificate Exam helps you learn a global standard and a skill set which is unique in treasury.

Career Growth

ACI Dealing Certificate promises you a career growth by making you a part of global community of thousands of ACI certificate holders

Enhance Employability

This certification fulfils the requirements established by financial services authorities for regulated activities. Thereby, enhancing your employability.

Competitive Advantage

With the understanding acquired from this certification you will enable your organisation to successfully pass risk assessments conducted by regulators. This will come as a competitive advantage when compared to your non certified peers.

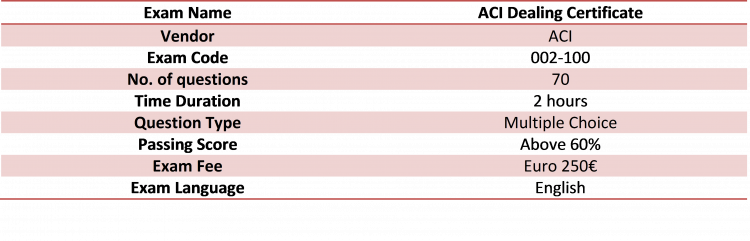

Exam Details

The ACI Dealing Certificate is a two hour exam that includes 70 multiple choice questions. This exam covers a vast syllabus and surely makes you job ready. Lets begin with understanding the basic details of the exam.

Target Audience

ACI Dealing Certificate is designed for:

- New entrants and junior dealers (0-18 months experience) in the dealing room

- Middle office and operations personnel

- Auditors and compliance officers

The ACI Dealing Certificate is a precursor to the ACI Diplomas.

Grading Scheme

Registration

The ACI Dealing Certificate New Version Exam is delivered in English language.

- For Non-ACI Members, the price of the ACI Dealing Certificate Exam is 250 €, subject to applicable taxes.

- For ACI Members, the price of the ACI Dealing Certificate New Version Exam is 230 €, subject to applicable taxes.

Booking an Exam

ACI has an extensive Test Centre network with over 120 centres available in more than 90 countries. To book an exam follow the steps

- Firstly go to the ACI FMA Webshop

- Secondly, select the you wish to take form the list of all certification offered by ACI

- After that click on the ACI-Dealing Certificate 002-100 Exam

- Now, you need to enter details regarding your country, testing centre etc.

- Select your preferred date and time

- Then, Register on their portal and pay the exam fee of €250.

- Finally, you will receive a booking confirmation on your email.

Delivery of Certificates

Once you complete the exam, you’ll receive an email with the confirmation of your result. Also, you’ll receive the copy of your electronic certificate attached to the email. A formal paper version of the certificate can only be produced by a specific request to ACI Head Office at a cost of 50€ per certificate.

Exam Policies

The ACI Dealing Certificate Exam has 70 MCQ questions to be attempted in 2 hours. Also, as this exam covers fundamental mathematics for markets you will be allowed to use a calculator. You can use a handheld calculator, provided it is according to the guidelines of the exam.

Additionally, you may ask the Test Centre for a printed ACI Formula Sheet. Erasable boards are also available on request.

For further queries regarding the Exam you can visit ACI Dealing Certificate FAQ

Course Overview

There are 7 core subject areas in the ACI Dealing Certificate, split in 9 Topic Baskets. The 7 core domains are as follows

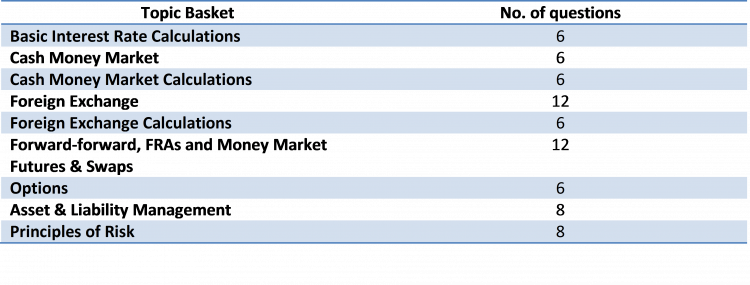

Topic Basket

This exam covers 9 topic baskets-

Course Outline

In addition to the topics outlined below, you are expected to be up-to-date with the latest events and changes in the markets. Following are the major 7 Course Domains

Domain 1: Basic Interest Rate Calculations

- To understand the principles of the time value of money.

- To be able to calculate short-term interest rates and yields, including forward-forward rates, and to use these interest rates and yields to calculate payments and evaluate alternative short-term funding and investment opportunities.

- Understand how information is plotted in a yield curve, the terminology describing the overall shape of and basic movements in a curve, and the classic theories which seek to explain changes in the shape of a curve.

- They should also know how to plot a forward curve and understand the relationship between a yield curve and forward curves

Domain 2: Cash Money Markets

- To understand the function of the money market, the differences and similarities between the major types of cash money market instrument and how they satisfy the requirements of different types of borrower and lender.

- To know how each type of instrument is quoted, the quotation, value date, maturity and payment conventions that apply and how to perform standard calculations using quoted prices.

- Given the greater inherent complexity of repo, a good working knowledge is required of its nature and mechanics.

Domain 3: Foreign Exchange

- To understand and be able to apply spot exchange rate quotations.

- Understand basic spot FX dealing terminology and the role of specialist types of intermediary.

- Recognise the principal risks in spot and forward FX transactions.

- Calculate and apply forward FX rates, and understand how forward rates are quoted.

- Understand the relationship between forward rates and interest rates and time options.

- To be able to describe the mechanics of outright forwards, FX swaps and forward-forward FX swaps, explain the use of outright forwards in taking currency risk and explain the use of FX swaps in rolling spot positions, hedging outright forwards, creating synthetic foreign currency assets and liabilities, and in covered interest arbitrage.

- Display a good working knowledge and understanding of the rationale for NDFs. To be able to recognise and use quotes for precious metals, and demonstrate a basic understanding of the structure and operation of the international market in precious metals.

Domain 4: Forward-forwards, FRAs and Money Market Futures & Swaps

- To understand the mechanics of and how to use money market interest rate derivatives to hedge interest rate risk.

- explain how FRAs, money market futures and money market swaps are derivatives of forward-forward positions, and outline the advantages of derivatives

- identify the overnight indexes (OI) for euro, sterling, Swiss francs and US dollars

Domain 5: Options

- To understand the fundamentals of options.

- To recognise the principal classes and types, and understand the terminology, how they are quoted in the market, how their value changes with the price of the underlying asset and the other principal factors determining the premium, how the risk on an option is measured and how they are delta hedged. \

- To recognise basic option strategies and understand their purpose

Domain 6: Principles of Asset & Liability Management

- To understand the fundamentals of Asset & Liability Management as a practice of managing and hedging risks that arise due to mismatches between the asset side and the liability side of the balance sheets of a bank.

- Explain how main risk factors like funding and liquidity risk, market risk (FX, Interest Rate, Equity, Commodity, etc.), credit risk, leverage risk, business risk and operational risk are interrelated and how they affect the balance sheet of a financial institution.

- Describe common risk management and hedging techniques which help control these effects and to understand how these techniques are used to set up a state-of-the-art ALM approach.

Domain 7: Principles of Risk

- To understand why risk is inherent in banks business models and why effective risk management is a key driver for banks success.

- Describe major risk groups: credit, market, liquidity, operational, legal, regulatory, and reputation risk. They will understand the significance of risk groups for different banking businesses and units.

- Overview about methods and procedures needed to manage these risk types and extend their understanding to different risk/return profiles of shareholders, regulators and debt providers.

Preparatory Guide

Preparing for an exam is the real task. You need to consistent and motivated enough to work really hard and achieve this credential. Here we present you with our step by step preparatory guide to help you on your journey and provide you with all useful insights about the exam.

Step 1- Download the Official Guide

The first and foremost step is to download the official guide. This guide can be downloaded form ACI Official Website. This guide will provide you detailed information about the exam topics and course. It acts as a blueprint for your exam and is very essential.

Also, it’s advised to familiarise yourself with the exam topics before commencing with the preparations. Therefore you need to download to official guide to have clarity about the exam course.

Step 2- Set up a Study Schedule

Devising a Study Plan is the next step. You need to devote time to your preparations daily. The ACI Dealing Certificate Exam covers a huge syllabus. Moreover, you need to be well updated with the current changes to as to clear the exam. All this can be achieved if you stay consistent with your preparations. Make a study plan which helps you prepare well and also avoids distractions. Remember, consistency is the key so start early and devote time to your preparations daily.

Step 3- Refer Books and learning resources

Books are one of the most golden ways to prepare for an exam. They are an essential ingredient in your preparations. They help you gain in depth understanding about the exam course and concepts. While providing you with profound knowledge of the exam fundamentals books also help you with their real world examples and case studies. Such understanding will surely help you ace the exam

We recommend you to refer the book recommended by ACI – A Guide to the ACI Dealing Certificate. This book covers the entire curriculum of the exam and can also be used with the e-learning tools provided by ACI.

Additionally, you can refer the Mastering the ACI Dealing Certificate: How to pass the ACI Education Level 1 Examination (Financial Times Series)

Step 4- Go for the Training Course

Training is a must while preparing. Training courses provide hands on experience and practical knowledge about the exam. Such understanding is necessary while preparing for ACI Dealing Certificate Exam.

ACI offers its own training course by their ACI Trainers to aid your preparations. In this intensive and targeted training, that lasts for five days, you are provided with deep knowledge about the core concepts of the exam. You are required to study relevant modules of the supplied learning tool each day before the exam.

The training course can be taken up either as face to face training or home study.

In the face to face training you are provided with an instructor and you learn in real time. You also get a chance to interact with the instructor and clarify your queries.

The home study or user distance learning packages help you study at your own pace. Also you can request for purchasing a limited-duration e-mail tutor help-line that will guide you through the exam.

Make sure you enrich your preparations with such training courses and ace the exam.

Step 5- Join a community

Joining a study group or an online discussion forum is the next step while preparing. Such study groups provides various valuable insights about the exam. Also, these groups help you in connecting with subject matter experts and with your peers who are o the same road for the exam. We recommend you to join a study group to stay updated worth the current changes and prepare well for the exams.

Step 6- Take up practice Tests

Final step of your preparations is to analyse how prepared are you for the real exam. Here comes the importance of practice tests. Attempting practice tests, help you identify your weaker areas and keeps your preparations under check. Such tests also provide you with the real exam experience and you learn to manage time accordingly. Strengthening your weaker areas will definitely make you confident about your preparedness. Also, attempting multiple tests and out performing yourself in each subsequent test will boost your confidence an esteem. So Start practicing now and stay ahead of your competition.