ACI Dealing Certificate New Version Exam (002-101)

The ACI Dealing Certificate New Version Exam has been designed to cover the basic competence skills for the new entrants in dealing floors and all other financial markets roles related to foreign exchange, interest rates and commodities instruments. The Syllabus has been built to allow basic understanding of these instruments and the related financial market segments, therefore providing the required competence level for existing or future financial markets professionals.

Moreover, the ACI Dealing Certificate New Version Exam has been redesigned with five topics covering the full range of foreign exchange, interest rates and commodities instruments, as well as their related markets with theoretical and quantitative sessions, in addition to financial markets environment and applications with theoretical questions.

Target Audience

Building upon the competence skills provided by the ACI Dealing Certificate New Version, future financial markets professionals will be expected to prove their knowledge and adherence to good market practices embedded in the FX Global Code and other relevant industry Codes and Regulations.

This certification is designed for :

- Recent entrants and junior dealers (0-24 months experience) in the dealing room

- Middle office and operations personnel

- Compliance and risk officers

Exam Details | ACI Dealing Certificate New Version Exam

So before we set our foot right, it’s important to rain-check for all exam related details and prerequisites to move forward.

The ACI Dealing Certificate New Version Exam 002-101 covers 70 Questions. You get 2 hours to complete the exam. Moreover, the exam fee is For Non-member – 280 €, subject to applicable taxes and For Member – 230 €, subject to applicable taxes . Also, the ACI Dealing Certificate New Version Exam Questions are available in Multiple Choice and Multi-Response Format. Additionally, the passing score is 60% and above.

| Exam Name | AACI Dealing Certificate New Version Exam |

| Exam Code | 002-101 |

| Exam Duration | 2 hours |

| Exam Format | Multiple Choice and Multi-Response Questions |

| Exam Type | New Version |

| Number of Questions | 70 Questions |

| Exam Fee | For Non-member – 280 €, subject to applicable taxes For Member – 230 €, subject to applicable taxes |

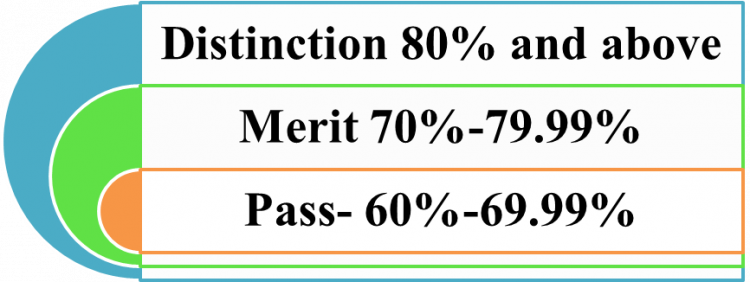

Grading Scheme

Booking an Exam

ACI has an extensive Test Centre network with over 120 centres available in more than 90 countries. To book an exam follow the steps

- Firstly go to the ACI FMA Webshop

- Secondly, select the you wish to take form the list of all certification offered by ACI

- After that click on the ACI Dealing Certificate New Version Exam (002-101) Exam

- Now, you need to enter details regarding your country, testing centre etc.

- Select your preferred date and time

- Then, Register on their portal and pay the exam fee of €250.

- Finally, you will receive a booking confirmation on your email.

Delivery of Certificates

Once you complete the exam, you’ll receive an email with the confirmation of your result. Also, you’ll receive the copy of your electronic certificate attached to the email. A formal paper version of the certificate can only be produced by a specific request to ACI Head Office at a cost of 50€ per certificate.

Exam FAQ

For further queries regarding the Exam you can visit ACI Dealing Certificate New Version FAQ

Course Outline | ACI Dealing Certificate New Version Exam

Understanding the course outline of ACI Dealing Certificate New Version Exam is the next important step. It familiarises you with the exam framework. The exam course includes 5 core subject areas. You should tailor your study plan around these topic baskets to achieve this certification. Also, remember you need to score a minimum of 50% for each topic basket to pass the exam. The Course Outline is as follows:

Financial Markets Environment

- Define financial markets and explain their main functions for the economy

- Define foreign exchange markets, money markets, capital markets and commodities markets.

- Describe how the main economic agents can impact financial markets.

- Outline how financial markets can be segmented under different criteria: term to maturity, product phase (primary and secondary), trade dates and settlement dates, location and regulation, and dealing structures.

- Distinguish between cash/spot and derivatives/Forward markets.

- Distinguish between regulated markets and OTC markets, and understand how both functions work.

- Identify the various types of regulated markets and their dealing structures

- Outline and describe the roles of the main participants in financial markets.

- Define the function of market-making, explain the incentives to make markets and the main risks involved in market making

- Understand how available information impacts the efficiency of markets.

- Explain the key functions of every phase of a financial markets’ transaction, from front office execution to settlement and reporting, distinguishing which steps are responsibility of the front, middle and back-office roles.

- Understand what are the FX Global Code, the Global Precious Metals Code and the United Kingdom Money Markets Code.

- Describe and outline the development of the FX Global Code, of the Global Precious Metals Code and of the United Kingdom Money Markets Code.

- Explain the scope, applications and objectives of the FX Global Code, of the Global Precious Metals Code and of the United Kingdom Money Markets Code.

- Define and identify the Market Participants of the FX Global Code, of the Global Precious Metals Code and of the United Kingdom Money Markets Code.

- Explain the leading principles of the FX Global Code and of the Global Precious Metals Code, as well as explain the underpinning principles of the United Kingdom Money Markets Code.

- Understand the Statement of Commitment to the FX Global Code, to the Global Precious Metals Code and to the United Kingdom Money Markets Code, and how the respective Statement outline the objectives of each of those Codes.

- Understand what are the main regulations applicable to financial markets and their products, as well as their scope, applications and objectives: Markets in Financial Instruments Directive 11 (MIFID 11, including its Regulation MIFIR), Market Abuse Regulation (MAR), Benchmarks Regulation (BMR), Dodd-Frank Wall Street Reform and Consumer Protection Act, European Market Infrastructure Regulation (EMIR). Basel 1, Basel II and Basel III.

2. Foreign Exchange

- Distinguish the preferred base currency and the quoted currency in standard exchange rate notation in a currency pair.

- Identify the ISO codes for the currencies of the G20 countries.

- Distinguish between the big figures and the points/pips in a currency pair.

- Identify a bid/offer spot exchange rate as price-maker and as price-taker to calculate either a base or quoted currency amount

- Identify the best of several spot rates as the buyer or as the seller of an amount of base or quoted currency

- Understand and define the basic dealing terminology and characteristics of FX spot, FX outright forward, FX swap and forward-forward FX swaps.

- Calculate cross-rates from a given pair of exchange rates with all the possible combinations between base and common currencies.

- Calculate and explain the reciprocal rate of an exchange rate.

- Outline the mechanics and roles of benchmark fixings for Ex rates.

- Calculate a FX outright forward rate from a FX spot rate, interest rates and/or the forward points (and vice versa).

- Explain the relationship between the outright forward rate, the forward points, the spot rate and interest rates, including the concept of interest rate parity as well as the concept and possibility of covered interest arbitrage.

- Calculate forward cross-rates.

- Define forward value dates for standard periods and list those periods.

- Describe the structure and mechanics of an FX outright forward and of a FX swap, outline how a FX outright forward can be hedged with a FX spot transaction and money market transactions and outline how a FX swap can be used in place of money market transactions to hedge an FX outright forward and in creating synthetic foreign currency asset and/or liabilities.

- Explain the structure and mechanics of FX forward-forward swaps.

- Understand the concepts of historic rate rollovers and of early or late settlement in FX transactions.

- Outline the application of tom/next and overnight FX swaps in rolling over spot positions and hedging value tomorrow and value-torlay outright rates, and calculate a value-tomorrow rate from a spot rate and tom/next points, and a value-today rate from a spot rate, tom/next points and overnight points.

- Calculate broken-dated FX outright forward rates through linear interpolation.

- Understand the concepts of deliverable and non-deliverable currencies.

- Define a Non-Deliverable Forward (NDF), explain its rationale and describe the structure and the features of these instruments.

- Identify the commodities called precious metals (gold, silver, platinum and palladium) and give their ISO codes.

- Describe the conventional method of quoting gold in the international market in US dollars per ounce.

- Identify a bid/offer spot price as price-maker and as price-taker to calculate the value of a given weight of precious metals.

- .Distinguish between the spot, forward and derivative markets in precious metals.

- Outline the mechanics and role of the precious metals benchmark fixings.

3. Rates

- Define the money markets and interest rate capital

- Describe the main features of the basic types of cash money market instrument in terms of whether or not they are transferable or secured, in which form they pay return (Le. discount, interest or yield); how they are quoted; internationally recognised minimum and maximum terms; and the typical borrowers/issuers and lenders/investors that use each type.

- Outline generally accepted terminology to describe the cashflows of each type of instrument and understand basic dealing terminology.

- Calculate present value and/or future value using the arithmetic techniques of discounting and/or compounding for a money market instrument terminated at maturity and/or for one that is rolled over at maturity

- Calculate simple interest rates using different day count and annual basis conventions, identify the international day count and annual basis conventions for the currencies of the G20 countries.

- Identify same-day, next-day, spot and forward value dates, and maturities under the following business day, modified following business day, preceding business day conventions and end/end rule.

- Identify the conventional frequency and timing of payments for cash money market instruments, including those with an original term to maturity of more than one year.

- Calculate broken dates and rates through linear (straight line) interpolation.

- Define interest rate indices, their methodologies and outline the most internationally used benchmark indices in the rates’ markets.

- Calculate interest rates and yields between the money market basis and bond basis in currencies for which there is a difference, and between annual and semi annual compounding frequencies.

- Calculate the value of a discount-paying money market instrument from its discount rate (straight discount) and calculate a discount rate directly into a true yield.

- Describe the various shapes of a yield curve and basic changes in its shape using market terminology and outline how the shape of the curve can be explained by theories and hypothesis (market segmentation, liquidity preference and expectations)

- Describe the main characteristics of bond instruments aš fixed-income securities and their roles in the function of interest money markets.

- Distinguish between and define what is meant by domestic, foreign and euro currency (offshore) money and bond markets and describe the principal advantages of euro money market instruments.

- Distinguish coupon bonds, zero coupon bonds, covered bonds, sukuk bonds, junk bonds, bond indentures, callable bonds, convertible bonds and floating rate bonds.

- Identify and outline the main characteristics of Islamic money market instruments (mudharabah and murabahah).

- Describe the differences and similarities of classic repos and sell/buy-backs in terms of their legal, economic and operational characteristics.

- Identify and outline the main types of custody arrangements in repo.

- Calculate the value of each type of instrument (except bond instruments) using quoted prices, including the secondary market value of transferable instruments.

- Calculate the present and future cashflows of a repo given the value of collateral and an agreed initial margin.

- Define haircuts and calculate the present and future cashflows of a repo given the value of the collateral and the usage of haircuts.

- Define general collateral (GC) and specials

- Describe and outline the main features of securities financing transactions (SFTS) using lending and borrowing of bonds or commodities, using margin lending and their main characteristics.

- Identify the collateral types and their role in SFTs.

- Understand the main characteristics and objectives of short selling strategies.

- Describe what happens in a repo and other SFTs when income is paid on collateral during the term of the transaction, in an event of default and in the event of a failure by one party to deliver collateral.

- Describe the mechanics and explain the terminology of a forward-forward loan or deposit, and the interest rate risk created by these instruments.

- Calculate a forward-forward rate from two mismatched cash rates and a cash rate from a series of forward-forward rates for consecutive periods.

4. FICC Derivatives

- Describe the main concepts and product definitions of derivatives markets.

- Explain the objectives, risks and advantages in the utilisation of derivatives in financial markets, from trading to risk management.

- Define currency options, explain their terminology and distinguish these options with other currency derivatives and explain how they can be used to hedge currency risk.

- Describe the functions and characteristics of calls and puts, and how they can be combined in the creation of risk reversal (cylinders), straddle and strangle option products.

- Define strike price, market price, the underlying, premium, exercise type, exercise rights and expiry in currency options.

- Calculate the cash value of a premium quote in OTC currency options, describe how OTC and exchange traded currency options are quoted, and when a premium of an OTC currency option is conventionally paid.

- Describe the pay out profiles of long and short positions in calls and puts.

- Explain how FRASs, Interest Rate Swaps, Basis Swaps, Money Market Swaps and Money Market Futures are derivatives of forward-forward positions. and Money Market

- Explain how FRAS, Interest Rate Swaps, Money Market Swaps Futures can be used to hedge interest rate risk.

- Describe the mechanics and terminologies of FRAS, Basis Swaps, Money Market Futures and Interest Rate Swaps (including Overnight Indexed Swaps).

- Outline the contract specifications of the main Money Market Futures (Euribor, Eurodollar, Short Sterling, Euroswiss, Euroyen).

- Define collateral procedures in Money Market Futures such as initial margin, margin call and margin maintenance.

- Outline the principal differences between OTC instruments like FRAS and the Exchange-Traded instruments like Money Market Futures.

- Describe how a futures exchange and clearing house works.

- Explain how Money Market Futures can be used to hedge and price FRAS and Interest Rate Swaps.

- Calculate the settlement amount of FRIES at maturity against their benchmark index.

- Identify and distinguish the main Overnight Indexed Swaps (OIS) used in interest rate markets (CSTR, Fed Funds, Saron and Sonia).

- Define interest rate options, explain their terminology, distinguish these options with other interest rate derivatives and explain how they can also be used to hedge interest rate risk

- Explain the functions and characteristics of caps, floors and swaptions, and how caps and puts can be combined in the creation of collar option products.

- Define strike price, market price, the underlying, premium, exercise type and expiry in interest rate options

- Calculate the cash value of a premium quote in OTC interest rate options, describe how OTC interest rate options are quoted, and when a premium of an OTC interest rate option is conventionally paid.

- Describe the pay-out profiles of long and short positions in caps and floors.

- Define the intrinsic and time values of options and identify the main determinants of an option premium.

- Define delta, gamma, theta, rho and vega in options.

- Understand a delta number and outline what is meant by delta hedging.

- •Explain what is meant by In-The-Money, Out-Or-The-Money or At-The-Money in options

- Explain the basic concepts of mark-to-market calculations for derivatives

5. Financial Markets Applications

- Understand the main risk relevance characteristics of the Basel Accords.

- List and outline the main risk factors for: Market, Credit, Liquidity, Operational Legal, Regulatory and Reputational risk.

- Understand and be able to explain the following aspects of Market Risk :

- Types (Interest Rate, Equity, Currency, Commodity) and components (Position, Settlement and Counterparty):

- How Market Risk arises in the Trading Book,

- Key concepts of Value at Risk and its quantitative techniques:

- The sensitivity tools for Market Risk: duration, basis point value and greeks,

- Limit structures in the dealing room.

- Understand and be able to explain the following aspects of Credit Risk:

- Categories of credit risk : lending, issuer, settlement, counterparty credit risk

- Managing credit risk: limits and safeguards, ratings, credit approval authorities and transaction approval process, aggregating exposure limits by customers, sectors and correlations

- Credit mitigation techniques: collateral; termination clauses, re-set dauses, cash settlement, netting agreements;

- Documentation: covenants, ISDA / CSA.

- Understand and be able to explain the following aspects of Liquidity Risk:

- Objectives and importance of a funding strategy.

- Lessons learned from crises in liquidity risk management; off-balance sheet contingencies, complexity, collateral valuation, Intra-day liquidity risks and cross-border liquidity, measuring and managing stress scenarios, early warning indicators of liquidity risk;

- Liquid and non-liquid assets, the meaning and general concepts of Asset & Liability Management (ALM);

- Impact of main risk factors on the balance sheet (asset and liability sides);

- Explanation of ALM techniques: cash-flow management, duration management, liquidity gaps and mismatches;

- Concept of funds transfer pricing as a methodology to ensure that funding and liquidity costs & benefits are transparently allocated to respective businesses and products.

- Understand and be able to explain the following aspects of Operational Risk:

- Sources of operational risk: systems, people, processes and external events.

- Understand and be able to explain the following aspects of Legal, Regulatory and Reputational Risk:

- Sources of reputational risk and relationship to and from other risk groups:

- Definition of Legal Risk;

- Definition of Regulatory Risk

- Definition of Reputational Risk

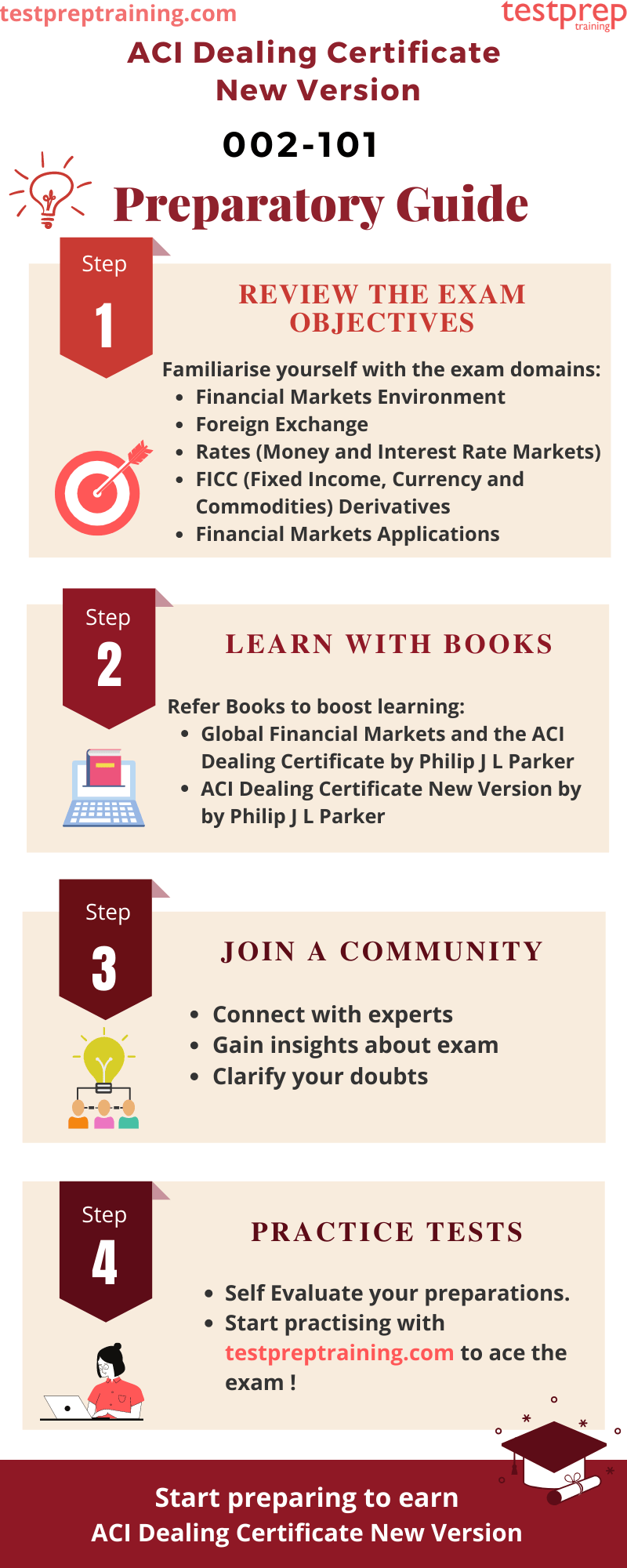

Preparatory Guide for ACI Dealing Certificate New Version Exam

There goes a lot of hard work and consistency in preparation for an exam. It is the key to your lucrative career and opens various opportunities for you. Also, passing the exam can be easy if you choose the right set of resources for yourself. Make sure the content is precise and reliable enough. The resources that you’ll pick will determine how well you prepare and pass the exam. To help you choose the best resources we offer you our Ultimate ACI Dealing Certificate New Version Exam (002-101) Study Guide. This guide will set you on the right track to achieve this certification.

Step 1: Review the Exam Objectives

The first and foremost step is to download the official guide. This guide can be downloaded form ACI Official Website. This guide will provide you detailed information about the exam topics and course. It acts as a blueprint for your exam and is very essential. Also, it’s advised to familiarise yourself with the exam topics before commencing with the preparations. The ACI Dealing Certificate new version exam topics are:

- Financial Markets Environment

- Foreign Exchange

- Rates (Money and Interest Rate Markets)

- FICC (Fixed Income, Currency and Commodities) Derivatives

- Financial Markets Applications

Step 2: Learn with Books

Books are one of the most golden ways to prepare for an exam. They are an essential ingredient in your preparations. They help you gain in depth understanding about the exam course and concepts. While providing you with profound knowledge of the exam fundamentals books also help you with their real world examples and case studies. Such understanding will surely help you ace the exam. We suggest you to refer the following books:

- Firstly, Global Financial Markets and the ACI Dealing Certificate by Philip J L Parker

- Secondly, ACI Dealing Certificate New Version by by Philip J L Parker

Step 3: Join a Study Group

Joining a study group or an online discussion forum is the next step while preparing. Such study groups provides various valuable insights about the exam. Also, these groups help you in connecting with subject matter experts and with your peers who are o the same road for the exam. We recommend you to join a study group to stay updated worth the current changes and prepare well for the exams.

Step 4: Self Evaluate with Practice Tests

Regardless of how you prepare for the exam, a practice test always helps you evaluate your preparations. These practice tests help you diversify your study strategy and ensure the best possible results. Analyzing your answers will help you identify the areas where you need to give special attention to, and will also let you know your alignment with the exam objectives. Moreover, the best way to start doing practice tests is after completing the syllabus. Solving Practice tests can provide you with the confidence you need to be stress-free. Start Practising Now!