Portfolio Management Professional (PfMP)

The Portfolio Management Professional (PfMP) exam certifies and signifies candidates’ ability and proficiency in the collaborative and cooperative management of portfolios to accomplish strategic leads. This examination will prove the candidates’ mastery and blossom the CV that indicates the possession of the capability of aligning projects, and programs with strategic leads and investing the right resources to deliver the expected merit and quality.

Target Audience

The Portfolio Management Professional Certification is designed and developed for practitioners at the executive or senior level; managing a portfolio of projects/programs aligned with an organizational and strategic assemblage of work.

PMI (PfMP): Portfolio Management Professional Sample Questions

Recommended Knowledge and Prerequisites

Applicants must have 96 months of professional business experience within the last 15 years.

AND (either one from below)

- A Secondary degree (high school diploma, associate’s degree, or the global equivalent) and 84 months of portfolio management experience

OR

- A Four-year degree (bachelor’s degree or any other degree which is globally equivalent) and 48 months of portfolio management experience

Check: Portfolio Management Professional (PfMP)® Interview Questions

Exam Details

| Exam Name Portfolio Management Professional | Exam Code PfMP |

| Exam Duration 4 Hours | Exam Format Multiple Choice and Multi-Response Questions |

| Exam Type Professional | Number of Scored Questions 150 Questions |

| Exam Eligibility 1 year | Exam Fee Member: US $800 ; Non-Member: US$1000 |

| Exam Language English | Validity 3 years |

PMI Portfolio Management Professional (PfMP) FAQ

For More Details See – Portfolio Management Professional (PfMP) FAQ

Course Outline

The following domains comprise of the Portfolio Management Professional (PfMP) certification exam.

Strategic Alignment 25%

- Evaluate organizational strategic goals and objectives using document reviews, interviewing, and other information-gathering techniques in order to understand the strategic priorities.

- Identify prioritization criteria (e.g., legislative, dependencies, ROI, stakeholder expectations, strategic fit) using information gathering and analysis techniques in order to create a basis for decision-making.

- Rank strategic priorities by working with key stakeholders and using qualitative and quantitative analyses in order to provide a guiding framework to operationalize the organizational strategic goals and objectives.

- Identify existing and potential portfolio components by reviewing documentation such as business plans/proposals in order to create portfolio scenarios.

- Create portfolio scenarios (what-if analysis) by reviewing components against prioritization criteria and using analysis techniques (e.g., options analysis, risk analysis, SWOT analysis, financial analysis) in order to evaluate and select viable options.

- Recommend portfolio scenario(s) and related components, based on prioritization analysis/criteria, in order to provide governance with a rationale for decision-making.

- Determine the impact on portfolio and portfolio components due to changes in strategic goals and objectives, in order to sustain strategic alignment.

- Create a high-level portfolio roadmap working with key stakeholders using prioritization, interdependency analysis, and organizational constraints in order to confirm and communicate the portfolio component’s sequencing, dependencies, and strategic alignment.

Governance 20%

- Define and establish a governance model including the structure (including but not limited to steering committees, and governance boards), policies, and decision-making roles, responsibilities, rights, and authorities in order to support effective decision-making and achieve strategic goals.

- Determine portfolio management standards, protocols, rules, and best practices, using organizational assets (such as information systems, and subject matter experts) and industry standards in order to establish consistent portfolio management practices.

- Define and/or modify portfolio processes and procedures including but not limited to benefits realization planning, information management, performance, communication, risk management, stakeholder engagement, resource management, and change management in order to manage the portfolio efficiently and effectively.

- Create the portfolio management plan including, but not limited to, roles and responsibilities, governance model, escalation procedures, risk tolerances, and governance thresholds, change control and management, key performance indicators, prioritization model, and communication procedures using standards, models, and other organizational assets in order to ensure effective and efficient portfolio management.

- Make recommendations and obtain approval regarding portfolio decisions (e.g, components, plans, budget, roadmap) through communication with key decision-makers as defined by the governance model, in order to authorize the execution of the portfolio.

Portfolio Performance 25%

- Initiate the portfolio using the portfolio roadmap and supporting artifacts in order to authorize the portfolio structure and activate the components.

- Collect and consolidate key performance metric data, as defined by portfolio governance, and use various techniques, in order to measure the health of the portfolio.

- Monitor the portfolio performance on an ongoing basis, using reports, conversations, dashboards, and auditing techniques in order to ensure portfolio effectiveness and efficiency and maintain strategic alignment.

- Manage and escalate issues by communicating recommended actions to appropriate decision-makers for timely approval and implementation of the proposed solution(s).

- Manage portfolio changes using change management techniques, in order to improve portfolio performance and maintain strategic alignment.

- Balance portfolio and prioritize portfolio components, using established criteria and methods in order to optimize resource utilization and achieve strategic portfolio objectives.

- Analyze and optimize the consolidated allocation/reallocation of capacity (e.g., people, tools, materials, technology, facilities, financial) using supply/demand management and scenario analysis techniques to ensure portfolio efficiency and effectiveness.

- Update and refine existing portfolio road maps, using change analysis in order to facilitate the reallocation of organizational resources to the portfolio.

- Measure the aggregated portfolio performance results against the defined business or strategic goals and objectives in order to demonstrate progress toward the achievement of business or strategic goals.

- Maintain records by capturing portfolio artifacts, such as approvals, prioritizations, and other decisions, in order to ensure compliance with organizational policies, regulatory requirements, and portfolio management standards.

Portfolio Risk Management 15%

- Determine the acceptable level of risk for the portfolio, based on organizational and stakeholder risk tolerances, in order to provide input to governance.

- Develop the portfolio risk management plan, using governance risk guidelines, processes, and procedures and other organizational assets in order to capitalize on opportunities, and respond to risks.

- Perform dependency analysis to identify and monitor risks related to the interdependencies and interdependencies within or across portfolios in order to support decision-making.

- Develop, monitor, and maintain portfolio-level risk register, including risks to strategic goals and objectives, to business value, and escalated from portfolio components, using risk management processes in order to support decision making.

- Promote common understanding and stakeholder ownership of portfolio risks, through communications with stakeholders, in order to facilitate risk response.

- Provide recommendations and obtain approval for a portfolio management reserve, based on aggregate portfolio risk exposure, in order to optimize portfolio strategic goals and objectives.

Communications Management 15%

- Analyze internal and external stakeholders using techniques such as meetings, interviews, and surveys/questionnaires, in order to identify stakeholder expectations, interests, and influence on the success of the portfolio.

- Create the aggregate communication strategy and plan, including methods, recipients, vehicles, timelines, and frequencies in order to enable effective communication with stakeholders.

- Engage stakeholders, through oral and written communication, to ensure awareness, manage expectations, foster support, and build relationships and collaboration for the success of the portfolio roadmap.

- Maintain the communication strategy and plan by evaluating current communications capabilities, identifying gaps, and documenting the communications plan to meet stakeholder requirements.

- Prepare and/or facilitate stakeholder understanding of portfolio management-related processes, procedures, and protocols using organizational assets (e.g., information systems, training delivery methods) in order to promote common understanding and application of the portfolio management process.

- Verify the accuracy, consistency, and completeness of portfolio communication, utilizing governance guidelines, to maintain credibility and satisfaction with all stakeholders.

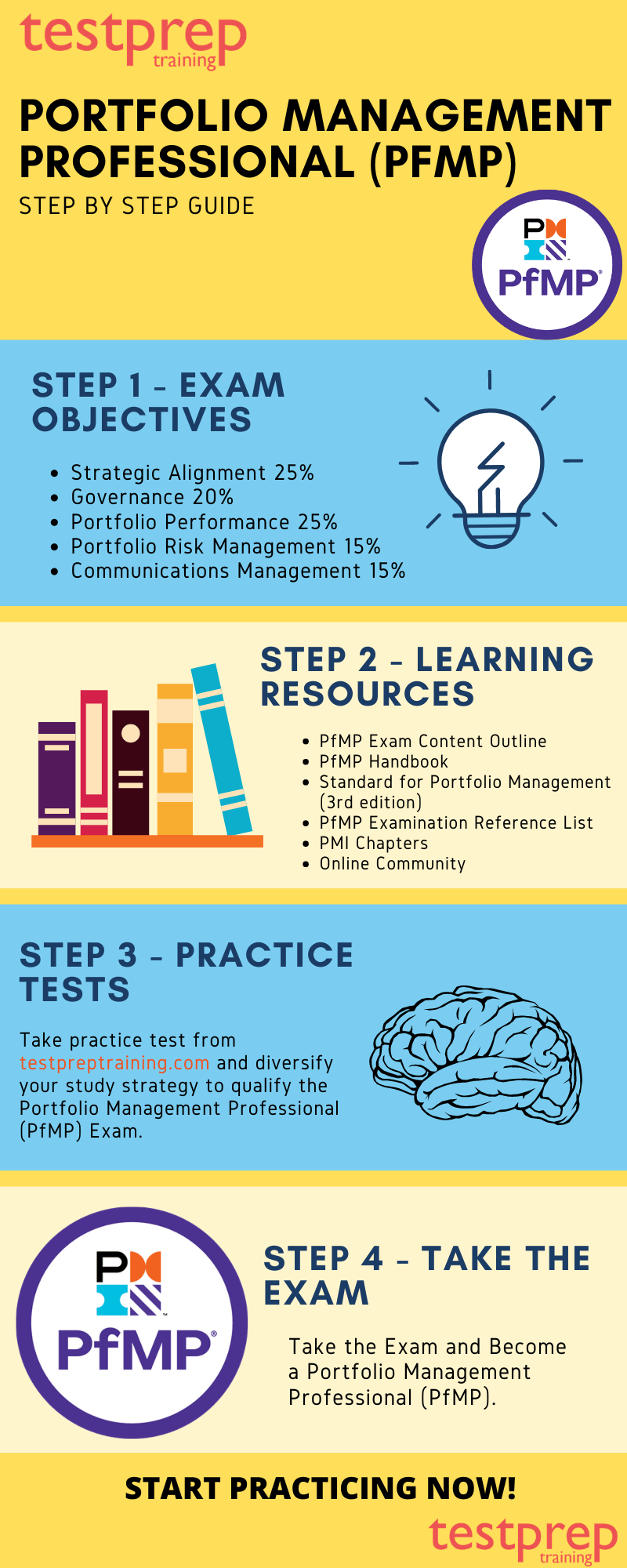

Preparation Guide for Portfolio Management Professional (PfMP) Exam

Recall that the way to get ready well is to begin early. You have to devise an examination plan remembering the course modules and the time term left until the last, most important test. Continuously start by taking a shot at your more fragile areas. This study guide will assist you in maintaining a strategic distance from interruptions.

Learning Resource 1: PfMP Exam Content Outline

The PfMP Content Outline explains all about the topics and their weightage and importance. It’s a document with significance as the exam outline is of the first things that candidates should pin up and have in front of their sight. This document creates clarity regarding “what’s going to come for the exam and how much importance it carries?”

Learning Resource 2: PfMP Certification Handbook

Everything about the Portfolio Management Professional exam will be in this PfMP Handbook. This handbook is a good resource for candidates as it includes all the answers to their doubts and also the questions they didn’t think of. It includes everything from the introduction, to exam policies to results and all the procedures/ processes one needs to know.

Learning Resource 3: Standard for Portfolio Management (3rd edition)

The Project Management Institute has many guidelines, policies, rules, regulations, relations and history, and publications. This document is filled with those and is formulated via a voluntary consensus standards development process. Though, it doesn’t write/review/edits this particular document. This process brings together volunteers and seeks out the views of people who have an interest in the area. This document includes topics areas; like –

- The audience for The Standard for Portfolio Management

- What is a Portfolio?

- The Relationships Among Portfolios, Programs, and Projects

- What is Portfolio Management?

Learning Resource 4: PfMP Examination Reference List

The reference list provided by the institute has reference links that can help aspirants while studying. Though, as mentioned above for the publication, the institute takes no guarantee or responsibility of the content being reliable or accurate. It doesn’t state that the resources in the Pdf to be a guaranteed measure for passing the exam. All the resources, just like this document is available on the official website.

Learning Resource 5: PMI Chapters

This resource helps aspirants review self-study books published by accredited Registered Education Providers (R.E.P.s) and other reputable training organizations. There are approximately 3 million students worldwide from 82 countries, major industries, and firms accessing qualitative content through this medium.

Learning Resource 6: Online Community

A good way to gain knowledge and know where you stand in any competition is to join online forums and study groups. Here, you will be able to make equations with other competitors and keep yourself motivated. Not only, will this be beneficial in the PfMP exam prep, because of the exposure it provides, but you will also be able to get all your questions and doubts cleared here.

Evaluate with Pfmp Practice Exam

Last but not the least, Practice makes a man perfect. The more you practice, the more you will excel. Several practice tests/ mock tests/ online series are available for free, on the internet. Solving them will not only make you familiar with the exam environment, and increase your confidence, but will also help you identify the areas where you lack in and need to pay special attention. But what’s important here is that you go for an authentic and updated practice test. So start with your quest for success Here