NISM Series-X-B: Investment Adviser (Level 2)

NISM Series-X-B: Investment Adviser (Level 2) Certification exam provides knowledge about investment adviser or principal officer of a non-individual investment adviser. This is processed under SEBI (Investment Advisers) Regulations, 2013, and persons associated with investment advice. However, there are two levels for the Investment Advisor certification:

- Firstly, NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination

- Secondly, NISM-Series-X-B: Investment Adviser (Level 2) Certification Examination

So, for earning NISM Investment Advisor certification, individual investment adviser or principal officer of a non-individual investment adviser, and persons associated with investment advice are required to pass both the levels. This is to fulfill the requirements under SEBI (Investment Advisers) Regulations, 2013.

NISM Series-X-B: Investment Adviser (Level 2): Exam Overview

NISM Series-X-B: Investment Adviser (Level 2) Certification exam enhances the quality of investment advisory and related services in the financial services industry.

Certification Learning Objectives

After passing the NISM Series-X-B: Investment Adviser (Level 2) Certification exam, you will be able to gain certain knowledge and skills. This include

- Firstly, you will know the comprehensive financial planning in the context of households for applying the planning elements learned in the Level 1 Certification Examination.

- Secondly, you will be able to understand the structure and performance of securities markets. And, also the importance of asset allocation and the impact of the market movement on the performance of the assets.

- Thirdly, knowledge in the practical aspect of product selection, portfolio construction, and rebalancing based on clients’ requirements.

- Lastly, knowledge of the compliance, operations, and service elements in investment advice.

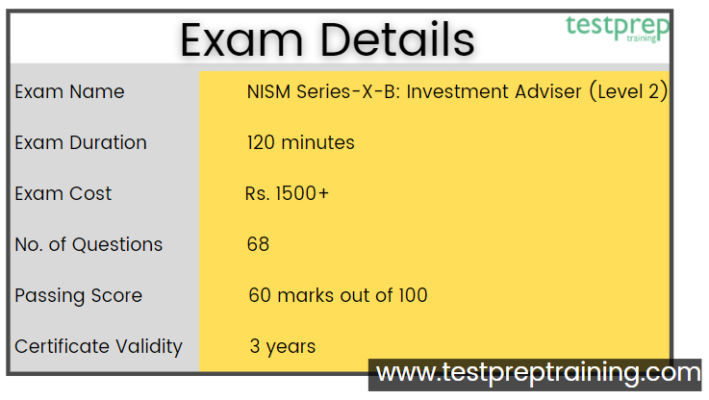

NISM Series-X-B: Investment Adviser (Level 2): Exam Details

- NISM Series-X-B: Investment Adviser (Level 2) Certification exam consists of eight (8) caselets with four (4) multiple-choice questions. These are of 2 marks each per caselet.

- Further, it has 36 multiple-choice questions of 1 mark each adding up to 100 marks.

- To complete the NISM Investment Advisor Level 2 Exam Questions, you will get a time duration of 2 hours.

- And, to pass the exam you need to score 60 marks. However, there is a negative marking of 25% of the marks assigned to NISM Investment Advisor Level 2 Questions.

- This exam will cost you Rs. 1500+ ( + Payment gateway charges extra).

You must know that the passing Certificate will be given only to those candidates who have their Income Tax Permanent Account Number (PAN) updated in their registration details.

Exam Registration

For NISM Series-X-B: Investment Adviser (Level 2) Certification exam registration, you can click on “Register”. After that, fill in the Online Registration Form that is available on the NISM Online Certification System. However, for those who have already registered with NISM Portal. They can log in by using the Email address and Password. Further, after logging in, you can access the following:

- Firstly, check Seat Availability and then, schedule a Test / Enroll Online.

- After that, making a payment using a credit card or debit card.

- Next, Download Admit Card / Study Material (after enrollment)

- Lastly, access Exam Results and Verify Skills

Exam Course Structure

For NISM Series-X-B: Investment Adviser (Level 2) Certification exam there are seven units that NISM provides to help you in exam preparation. The NISM Investment Advisor Level 2 Syllabus units contain sections and subsections.

Unit 1: Understanding Securities Markets and Performance

1.1. Knowing the working of equity markets

1.1.1. Primary Markets

1.1.2. Secondary Markets

1.2. Interpreting key equity market indicators

1.2.1. Equity Indices

1.2.2. Relative Valuations Indicators

1.3. Interpreting risk and return from equity investing

1.3.1. Price and Value

1.3.2. Fundamental and Technical Analysis

1.4. Comparing and contrasting various tools and options in equity investing – direct, IPOs, Mutual funds and PMS

1.4.1. Direct Investment

1.4.2. Investment through Portfolio Management Services (PMS)

1.4.3. Investment through equity mutual funds

1.5. Knowing the working of debt markets

1.5.1. Short Term Debt Markets

1.5.2. Long Term Debt Instruments

1.6. Understanding debt market analytics and indicators

1.6.1. Structure of a Fixed Income Instrument

1.7. Understanding risk and return in debt investing

1.7.1. Benefits of investing in debt securities

1.7.2. Risks of Investing in Debt Securities

1.8. Comparing and contrasting various debt products – saving schemes, bonds, deposits and debt mutual funds.

1.8.1. Deposits and Saving Schemes

1.8.2. Debt Securities

1.8.3. Debt Mutual Fund Schemes

1.9. Understanding derivative markets, products and strategies

1.9.1. Futures

1.9.2. Options

1.10. Understanding how derivatives can be used to hedge

1.10.1. Hedging

1.10.2. Speculation

1.10.3. Arbitrage

1.11. Interpreting derivative indicators

1.12. Understanding the structure of Foreign Exchange Market; difference between spot and forward exchange rates; settlement periods; effect of interest rates

1.12.1. Market Segments

1.13. Knowing the calculation of forward exchange rates using: premiums and discounts; interest rate parity

Unit 2: Operational Aspects of financial transactions

2.1. Knowing Investor types and the acquisition process

2.1.1. Who can Invest?

2.1.2. Acquisition Process

2.1.3. Terms of Offer

2.1.4. Regulatory Requirements

2.1.5. Mandatory Investor Information

2.1.6. Investor Folio or Account

2.2. Learning about PAN, KYC and other processes

2.2.1. Permanent Account Number (PAN)

2.2.2. Knowing Your Customer Process

2.3. Knowing about the Demat and Remat processes

2.3.1. Dematerialisation

2.3.2. Rematerialisation of Securities

2.4. Learning about the PoA and other agreements

2.4.1. General Power of Attorney

2.4.2. Specific Limited Power of Attorney

2.5. Understanding the processes involved for account opening of Non-Resident Investors (NRIs)

2.6. Understanding the process of Consolidating, reorganising and folio-keeping

2.6.1. Change of Address and Contract Details

2.6.2. Change in Name

2.6.3. Change in Status

2.6.4. Marking a Lien

2.6.5. Transmission

2.7. Understanding the process flow in Special situations: minor turns major, NRI to RI and RI to NRI

2.7.1. Minors as Investors

2.7.2. Minor turned Major

2.7.3. NRI to Resident India

2.7.4. Resident India to NRI

2.8. Knowing the Operational aspects related to joint accounts, lien, nomination, transmission

2.8.1. Joint Holding

2.8.2. Nomination

2.8.3. Payment Instruments

2.9. Learning about the documentation required for financial advice

Unit 3: Personal Financial Planning

3.1. Computing and interpreting personal finance ratios

3.1.1. Saving Ratio & Expenses Ratio

3.1.2. Total Assets

3.1.3. Total Liabilities

3.1.4. Leverage Ratio

3.1.5. Net Worth

3.1.6. Solvency Ratio

3.1.7. Liquid Assets

3.1.8. Liquidity Ratio

3.1.9. Financial Assets Ratio

3.1.10. Debt to Income Ratio

3.2. Understanding cash flow analysis and determine surplus

3.3. Understanding Budgetary mechanism for households

3.4. Learning about contingency planning

3.5. Estimating financial goals

Unit 4: Comprehensive Financial Planning

4.1. Understand Leverage and debt counselling

4.2. Understanding Interpretation of liquidity, investment and long-term needs

4.3. Learning about Prioritising and Financing the financial goals

4.3.1. Purpose of the debt

4.3.2. Cost of debt

4.3.3. Maturity of debt

4.3.4. Debt Rescheduling

4.4. Learning about Risk profiling and processes in financial planning

4.4.1. Credit Score

4.5. Evaluate insurance needs for life and general insurance (Part of this is in Level 1)

4.6. Evaluating choices in retirement planning

4.6.1. Ensuring adequate focus on important goals

4.6.2. Differentiating between consumption expenditure

4.6.3. Identifying the holes in the household budget

4.6.4. Allocation to various categories of expenses

4.6.5. Staggering the timing of certain goals

4.6.6. Windfalls

4.7. Creating and interpreting comprehensive financial planning solutions for the household

4.8. Understanding Asset Allocation

4.9. Knowing the Model Portfolios

4.9.1. Young Call center/BPO employee with no dependents

4.9.2. Young Married single income family with two school going kids

4.9.3. Single income family with grown up children who are yet to settle down

4.9.4. Couple in their seventies, with no immediate family support

4.10. Knowing the Fundamental Principles of Insurance

4.10.1. Utmost good faith (Uberrimae Fidei)

4.10.2. Insurable interest

4.11. Knowing the Role of Insurance Advisor

4.11.1. Identify the insurance need

4.11.2. Estimate the insurance coverage

4.11.3. Identifying the most suitable insurance product

4.11.4. Optimise the insurance premium

4.11.5. Monitor the insurance coverage

4.12. Knowing the Life Insurance Products

4.12.1. Term insurance

4.12.2. Endowment

4.12.3. Whole Life

4.12.4. Unit-Linked Insurance

4.12.5. Variable Insurance products

4.12.6. Mortgage Insurance

4.13. Knowing the Non-Life Insurance Products

4.13.1. Health Insurance

4.13.2. Personal accident insurance

4.13.3. Travel Insurance

4.13.4. Motor Insurance

4.13.5. Property insurance

4.13.6. Fidelity insurance

4.13.7. Directors and Officers insurance

4.13.8. Keyman insurance

4.14. Understanding Retirement Planning

4.14.1. Amount required in each month of retired life

4.14.2. Nature of retirement benefits available

4.14.3. Inflation rate

4.14.4. Number of years to retirement

4.14.5. Number of retirement years to provide for/No. of years in retirement

4.14.6. Likely rate of return on investment of retirement corpus

4.15. Knowing the Philanthropy

4.16. Understanding Comprehensive Financial Planning

Unit 5: Product analysis and selection

5.1. Understand risk, return and portfolio construction principles

5.1.1. Return on Investment

5.1.2. Risk in Investment

5.1.3. Portfolio Construction Principles

5.2. Learning about Return targets, risk profile and optimization

5.2.1. Return, Risk and Combining Asset Classes

5.3. Understanding the impact of market cycles on asset allocation and product selection

5.4. Evaluating and selecting equity funds, debt funds and other funds

5.4.1. Principles of fund selection

5.4.2. Selecting Equity Funds

5.4.3. Selecting Debt Funds

5.4.4. Selecting Hybrid Funds

5.4.5. Other Funds

5.5. Attribute portfolio performance and evaluating the investment alternatives

5.5.1. ELSS vs. Tax Saving Instruments

5.5.2. ELSS vs. Other Tax Saving Instruments

5.5.3. Mutual Funds vs. Public Provident Fund (PPF)

5.5.4. Direct Equity vs. Equity Funds

5.5.5. Physical Gold vs. Gold Funds

5.5.6. Debt Instruments vs. Debt Funds

5.5.7. Bank Fixed Deposit vs. Fixed Maturity Plans

5.6. Evaluating mutual fund portfolios for revisions and rebalancing

5.6.1. Reviewing Mutual Fund Portfolio

5.6.2. Equity Fund Evaluation

5.6.3. Debt Fund Evaluation

5.7. Understanding and interpreting the impact of elements of macroeconomic policies on asset allocation

5.7.1. Gross Domestic Product

5.7.2. Business Cycles

5.7.3. Composition of GDP

5.7.4. Index of Industrial Production

5.7.5. Aggregate Demand

5.7.6. Current Account Deficit

5.7.7. Inflation

5.7.8. Inflation and Monetary Policy Action

5.7.9. Prices and Asset Valuation

5.7.10. Money Supply Indicators

5.7.11. Transmission of Policy Initiatives

5.7.12. Government Finances

5.8. Interpreting behavioural biases in decision making and portfolio management

Unit 6: Regulatory and Compliance Aspects

6.1. Understanding Disclosure requirements

6.1.1. Definitions

6.1.2. Registration

6.1.3. Exemption from Registration

6.1.4. Qualification and Certification Requirement

6.1.5. Capital Adequacy

6.1.6. Validity of Registration

6.1.7. Conditions of Certificate

6.1.8. General Responsibility

6.1.9. Suitability

6.1.10. Disclosure to Clients

6.1.11. Maintenance of Records

6.1.12. Appointment of Compliance Officer

6.1.13. Redressal of Client Grievances

6.1.14. Segregation of Execution Services

6.1.15. Code of Conduct for Investment Advisers

6.2. Understanding compliances related to transactions

6.3. Evaluating and documenting costing, taxation and procedures

6.4. Understanding Regulation relating to insurance, pension and investment products

6.5. Understanding Investor queries, grievance redressal, and service elements

6.5.1. Redressal in Capital Market

6.5.2. Redressal in Banking

6.5.3. Redressal in Insurance

6.5.4. Other Redressal Fora

6.5.5. Securities Appellate Tribunal

Unit 7: Case studies in Comprehensive Financial Advice

7.1. Understanding practical aspects of providing financial advice through case studies

NISM Exam Policies

NISM provides various exam policies to help candidates in understanding the exam procedures and after exam rules. In the next section, we will learn and understand some of the policies for the NISM certifications.

- Refund Policy

- The refund policy states that fees once paid through the payment gateway shall not be refunded. But, for other reason, this can be done if:

- Firstly, multiple times debiting from a Candidate Card/Bank Account due to technical error. Next, it can be the candidate’s account being debited with an excess amount in a single transaction due to a technical error.

- Secondly, due to technical error, payment being charged on the Candidate Card/Bank Account but the enrolment for the examination is unsuccessful.

- The refund policy states that fees once paid through the payment gateway shall not be refunded. But, for other reason, this can be done if:

- Special Accommodation

- For any candidate, if there is a requirement of special accommodation for the NISM Certification Exam. Then, such candidates may inform NISM. Further, it is necessary to send the form to NISM at least 30 days in advance. Then, approval for Special Accommodation will be provided to the requesting candidate by NISM after assessing its need.

- Re-schedulement Policy

- Candidates can reschedule an enrolled exam by logging into the NISM Certification Portal. This should be done at least 15 days prior to the exam date, subject to the availability of examination dates and exam slots.

For More Information visit: NISM Series-X-B: Investment Adviser (Level 2) Certification exam FAQs

Preparation Guide for NISM Series-X-B: Investment Adviser (Level 2) Certification

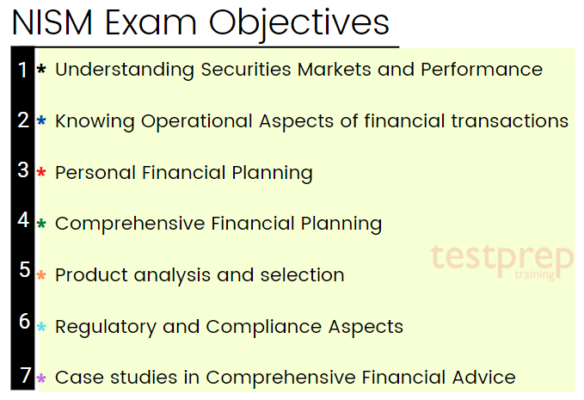

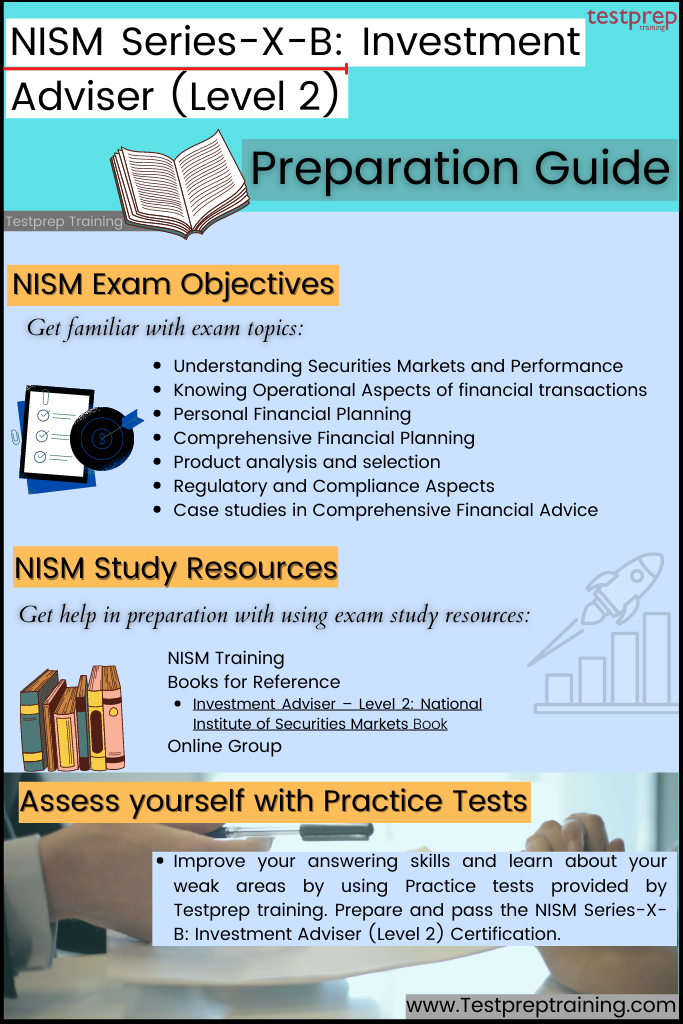

Understanding Exam Objectives

Exam objectives prove to be beneficial during the exam preparation time. These topics are divided into sections and subsections, that makes it easier for candidates to start preparing in an accurate manner. However, for NISM Series-X-B: Investment Adviser (Level 2) Certification exam the objectives include:

- Firstly, Securities Markets and Performance

- Secondly, Operational Aspects of financial transactions

- Thirdly, Personal Financial Planning

- Then, Comprehensive Financial Planning

- Next, Product analysis and selection

- After that, Regulatory and Compliance Aspects

- Lastly, Case studies in Comprehensive Financial Advice

NISM Investment Advisor Level 2 Training

NISM provides various training programs for securities market participants, including regulators. This mainly focuses on policy creation and implementation. Further, these training programs help securities professionals to stay up to date with the latest market legal framework, products, processes, and technologies. These training programs in various formats like classroom lectures, workshops, role-playing, and interaction with experts.

NISM offers institutions that provide capacity building support for the initiative of SEBI in promoting financial and investor education. However, for this, the criteria for identifying the individuals and organizations is done by SEBI.

Using Exam Reference Books

For those who have the ability to self-study then using NISM Investment Advisor Level 2 Books will be helpful to pass this Certification exam. This helps in understanding the core of the topics. NISM provides a book for NISM Series-X-B: Investment Adviser (Level 2) Certification exam that is Investment Adviser – Level 2: National Institute of Securities Markets. This book will help to gain a knowledge benchmark for an individual investment adviser or principal officer of a non-individual investment adviser, under SEBI Regulations, 2013, and persons associated with investment advice.

Joining Online Study Groups

During the preparation for an exam, joining online groups or communities can be really beneficial. That is to say, there you can discuss any of your queries and get the best possible answer. Moreover, these groups have professionals that will keep you up to date with the latest happenings for the NISM exams.

Start Using Practice Tests

Practice tests give an advantage to candidates to learn and revise things more accurately. Moreover with assessing yourself, you will be able to work on your time-management and answering skills as well as learn about your weak areas. These skills will help you to save a lot of time during the exam. However, the best way to start taking NISM Investment Advisor Level 2 Mock Tests is after completing one full topic as this will work as a revision part for you. Lastly, do some hard work to find the best and unique practice tests and get yourself prepared. Start preparing with Free NISM Investment Advisor Level 2 Practice Tests now!