Derivatives (Advanced) Module

Derivatives as a tool for risk management tend to be in trend and thus becoming increasingly important in world markets. Moreover, the presence and role of derivatives in India have shown a rapid increase in a regular manner over the years. These instruments are a crucial component of the overall financial sector strategy.

Further, Derivatives have found much of their use in the financial world. Here, the advantages are undisputedly high especially in hedging against risk. Talking about the Derivatives (Advanced) Module, this will help you to understand various derivatives concepts. This offers:

- Firstly, to have full and in-depth knowledge about derivatives.

- Secondly, to learn and understand how to apply advanced techniques of valuation of securities and derivative products.

- Lastly, to learn and understand investment and hedging strategies.

Target Audience

Derivatives (Advanced) Module is best suited for:

- Firstly, Students

- Secondly, Stock-brokers and sub-brokers dealing in derivatives

- Thirdly, Security Market Professionals.

- Fourthly, Finance Professionals

- Then, Portfolio Managers

- Next, Employees with banks and financial institutions.

- Lastly, Individuals with an interest in this area.

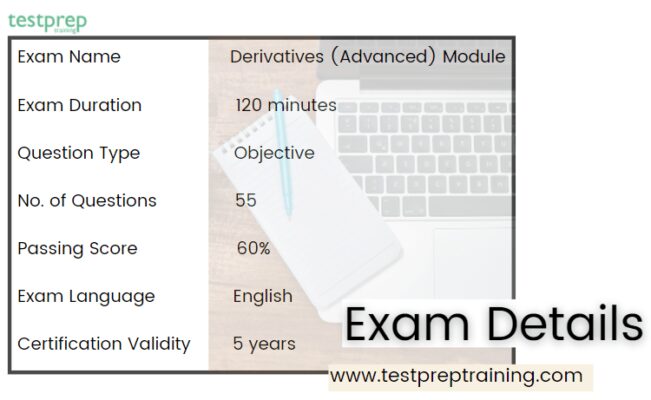

Derivatives (Advanced) Module: Exam Details

NCFM Derivatives (Advanced) Module is an online and self-study based exam. This NCFM module exam can be given in the English language only. During the Derivatives (Advanced) Module exam, an Open Office Spreadsheet will be provided with an allowance for all types of calculators during the test. But, there will be a 0.25% negative marking, if there are any incorrect answers. All NCFM Derivatives Advanced Module Exam Questions are in multiple choice format. You need to secure 60% to pass the exam.

In Derivatives (Advanced) Module:

- Firstly, there will be a total of 55 questions that have to be completed in 120 minutes. The questions will be objective in which you will find four / five alternative answers. And, you have to select the correct one out of them.

- Secondly, to pass the Derivatives (Advanced) Module, it is necessary to score 60%.

- Lastly, the Derivatives (Advanced) Module exam will cost Rs.2006/ inclusive of GST. And, the validity of the NCFM certification is five (5) years.

Exam Registration

Candidates can register for the NCFM exam online using the ‘Online Registration’ link which is available under the ‘Education’ section. After accessing the link, click Certifications and then, complete the registration process by providing details.

However, after completing the registration, you will receive a unique NCFM registration number along with a user id and password. This NCFM registration number is used while enrolling for any module exam. Side by side, a confirmation will be sent both on your email id and mobile number provided during registration. After logging in you can:

- Firstly, make payment and complete the pending one for the NCFM exam.

- Secondly, enroll for the test.

- Thirdly, update the address details.

- Lastly, check the status of the study material. And, view the certificates

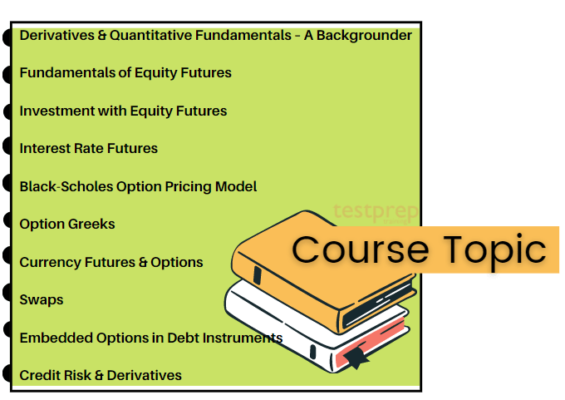

NCFM Derivatives Advanced Module Course Structure

NCFM provides a course outline for the Derivatives (Advanced) Module to help candidates in understanding the topics. This include:

1. Derivatives & Quantitative Fundamentals – A Backgrounder

- Derivative Types

- Beta

- R-Square

- Continuous Compounding

- Option Valuation

- Historical Volatility (σ)

- Normal Distribution

- Share Prices – Lognormal Distribution

- Volatility (σ)

- ARCH(m) Model

- Then, Exponentially Weighted Moving Average (EWMA)

- GARCH Model

- Implied Volatility

2. Fundamentals of Equity Futures

- Contracts

- Selection Criteria

- Stock Selection Criteria

- Secondly, Criteria for Continued Eligibility of Stock

- Then, Criteria for Re-inclusion of Excluded Stocks

- Index Selection Criteria

- Price Steps and Price Bands for Contracts

- Quantity Freeze for Futures Contracts

- Novation

- Margins

- Daily Mark-to-Market Settlement

- Final Settlement

- Cost of Carry

- Determining Stock Futures Price (without Dividend)

- Then, Determining Stock Futures Price (with Dividend)

- Determining Index Futures Price (without Dividend)

- After that, Determining Index Futures Price (with Dividend)

- Cash & Carry Arbitrage

- Reverse Cash & Carry Arbitrage

- The convergence of Spot & Futures

- Contango & Backwardation

- Lastly, Cost of Carry – Commodities

3. Investment with Equity Futures

- The relation between Futures and Spot Price

- Payoff Matrix from Futures

- Long Futures

- Short Futures

- Hedging with Futures

- Basis Risk

- Modifying the Portfolio Beta with Futures

- Rolling Hedges

- Investment Strategies Using Futures

4. Interest Rate Futures

- Interest Risk Management through Futures

- Contracts & Eligible Securities

- Conversion Factor

- Cheapest to Deliver (CTD)

- Contract Structure & Mechanics of FUTIRD

- Contract Structure & Mechanics of FUTIRT

5. Black-Scholes Option Pricing Model

- European Call Option

- European Put Option

- Dividends

- American Options

6. Option Greeks

- Delta

- Firstly, European Call on non-dividend paying stock

- Secondly, European Put on non-dividend paying stock

- Then, European Call on asset paying a yield of q

- Lastly, European Put on asset paying a yield of q

- Gamma

- European Call / Put on non-dividend paying stock

- European Call / Put on asset paying a yield of q

- Theta

- Firstly, European Call on non-dividend paying stock

- Then, European Put on non-dividend paying stock

- After that, European Call on asset paying yield of q

- European Put on asset paying yield of q

- Vega

- European Call / Put on non-dividend paying stock

- European Call / Put on asset paying yield of q

- Rho

- European Call on non-dividend paying stock

- European Put on non-dividend paying stock

7. Currency Futures & Options

- Currency Futures Contracts

- Calculation of Daily Settlement Price of Currency Futures

- Transactions in Currency Futures

- Currency Futures or Forward Rate Agreement

- Currency Options Contracts

- Valuation of Currency Options

- European Call Option

- European Put Option

- Transactions in Currency Options

8. Swaps

- OTC Products

- Interest Rate Swap

- Valuing Interest Rate Swaps

- Valuation based on Bonds

- Valuation based on Forward Rate Agreements (FRAs)

- Currency Swap

- Valuing Currency Swaps

- Swaption

9. Embedded Options in Debt Instruments

- Warrants

- Convertible Bonds

- Call Option in a Debt Security

- Put Option in a Debt Security

- Put & Call Option in a Debt Security

- Caps

- Floors

- Collars

10. Credit Risk & Derivatives

- Credit Risk & Rating

- Default History & Recovery Rates

- Calculation of Default Risk

- Simple Approach

- Present Value Approach

- Mitigating Credit Risk

- Credit Default Swaps

- Collateralized Debt Obligation (CDO)

For More: Check Derivatives (Advanced) Module FAQs

NCFM Procedures

NCFM procedures are designed to help candidates to understand the pattern of the exams. And, this also helps in providing all the details related to the exam in a stepwise manner. Some of them include:

Making Payment

Payment can be completed online by accessing through online NCFM login. However, the validity of the NCFM test fees is revised from 180 days to 90 days. This means that it is necessary to enroll for the NCFM test within 90 days from the date of receipt of payment failing.

Test Taking Procedure

- Firstly, there are appointed NSE test centers that conduct the exams. Candidates can select the test centers at the time of enrollment.

- Secondly, the test center has a rule that states that candidates have to reach the exam center 30 minutes prior to the test time.

- Thirdly, verification will be done before starting the exam in which you have to show an original Photo ID (PAN card, Driver’s License, or any other).

- Next, candidates will get a backup sheet and rough sheet(s) during the exam. And, they can also bring a scientific calculator and a pen during the test.

Uploading Photo

Candidates can upload photos using the ‘Upload Photo’ link. You can access this link after login in NCFM portal. The uploaded photo should be passport size that has dimensions 3 X 3 cm or 1 X 1 inch or 150 X 180 pixels. And, the format of the image should be JPEG, and the file size should be below 30 KB.

Issuing Certificate

Candidates passing the exam will receive the certification for modules at the test center itself. However, those getting failed the exam will only receive a scorecard.. The candidates need to ensure that they must collect their results before leaving the test center. Further, candidates can view or check the certification status and certificate online. This can be done using the link ‘Query/Report’ that is available in their NCFM online login portal.

Study Guide: Derivatives (Advanced) Module

Getting Familiar with Exam Objectives

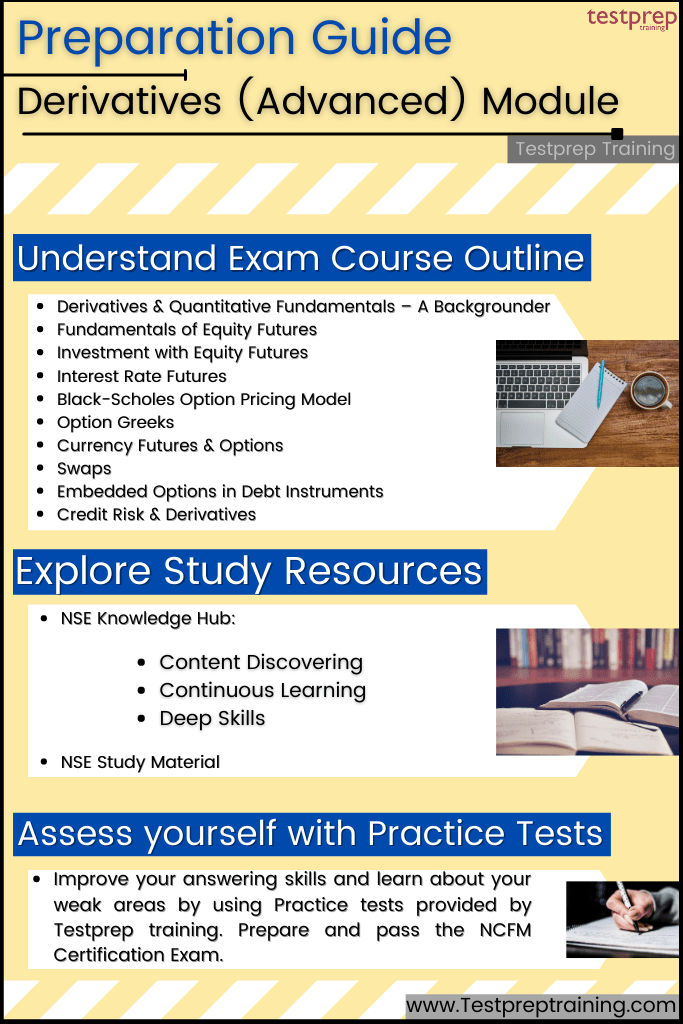

For Derivatives (Advanced) Module exam, NCFM provides the course outline that has topics divided into various sections and subsections. This course outline helps candidates to understand and learn the concepts more accurately and start their preparation in a sequential way. However, the topics for Derivatives (Advanced) Module includes:

- Firstly, Derivatives & Quantitative Fundamentals

- Secondly, Fundamentals of Equity Futures

- Thirdly, Investment with Equity Futures

- Fourthly, Interest Rate Futures

- Then, Black-Scholes Options Pricing Model

- After that, Option Greeks

- Next, Currency Futures & Options

- Then, Swaps

- After that, Embedded Options in Debt Instruments

- Lastly, Credit Risk & Derivatives

Knowledge Hub: NSE

NSE knowledge hub provides personalized and community-based learning with an AI-First and Mobile-First ecosystem. This knowledge hub is powered by advanced Artificial Intelligence (AI) technology that provides a learning platform to help in financial learning. Moreover, this also provides support to various academic institutions for preparing advanced future-ready talent for the financial services industry. Using NSE Knowledge Hub candidates can:

- Firstly, have a chance to become a part of a growing learning community.

- Secondly, access the unlimited exam content and resources.

- Thirdly, get assistance from experts in this field.

- Lastly, learn from anywhere.

Further, there are NSE knowledge hub methods such as:

Content Discovering

- In this, candidates will get an understanding of banking, insurance and finance topics. Here, they discover content in various domains of finance.

Continuous learning

- This provides formal and informal learning with having contents arranged according to the individuals areas of interests and goals.

Deep skills

- This provides deep skilling pathways at a marketplace with having well-known providers of courses, assessments, labs and credentials.

NSE NCFM Derivatives Advanced Module Study Material

NSE provides study material for all the module exams that are in the form of a workbook which can be issued after making payment for the module. For the Derivatives (Advanced) Module, you can download the workbook by logging into your account from the E-Library option. However, candidates can buy these Workbooks for NCFM modules by sending a request letter with a demand draft of Rs. 500/- per module per workbook. The request letter should have:

- Firstly, valid name of the candidates

- Secondly, the name of the module

- Thirdly, complete postal address

- Next, contact and demand draft details.

- Lastly, the demand draft should have the name of the candidate and module name on the backside.

Start Taking Practice Tests

NCFM Derivatives Advanced Module Practice Tests can be beneficial while studying for the exam. As the NCFM modules are designed for self-learning so it is best to use practice tests for getting perfection. Moreover, by taking theNCFM Derivatives Advanced Module Sample Questions, you will not only improve your answering skills but it will also help you to improve your weak areas. Further, this can result in enhancing your knowledge about the concepts of this module to get a strong revision. Strengthen your preparations with NCFM Derivatives Advanced Module Practice Exam now!