Capital Market (Dealers) Module (CMDM) (Intermediate)

The Capital Market (Dealers) Module (CMDM) (Intermediate) offered by NSE is a very valuable examination. The NCFM Capital Market (Dealers) Module (CMDM) (Intermediate) is specially beneficial for anybody from the Stock market operations. It offers its candidates with the useful knowledge and operational skills-sets necessary for dealers in the equity market segment. However, candidates should make sure they have complete knowledge of the corporate world specially related to stock market operations.

Exam Details

This is an online, self-study test that is conducted in English throughout India. The exam has a total of 60 questions that must be answered in two hours. Only objective type questions are included in the question paper. To pass the exam, candidates must achieve a score of 50 (50 percent), with a maximum score of 100. Please keep in mind that wrong answers will result in a 0.25 percent penalty. Additionally, all sorts of calculators are permitted throughout the exam. A spreadsheet in Open Office will be given. Click the radio button next to the alternative to choose your answer. If you qualify the exam then you are provided with a certificate which is valid for next 5 years from the date of the test. The course total fee is Rs. 2006 (including GST) only.

Eligibility Criteria

There is no eligibility criteria for this exam.

Learning Objectives

The Capital Market (Dealers) Module (CMDM) (Intermediate) ensures the following learning objectives to its candidates:

- To understand the capital market trading operations of NSE.

- To understand the clearing, settlement and risk management processes.

- Know about the eligibility criteria for seeking membership at NSE.

- To learn the other important regulatory aspects.

Target Audience

- Employees of Stock Brokers and Sub-Brokers

- Students

- Teachers

- Employees of BPO/IT Companies

- Investors

Schedule your Exam

Before taking the Insurance module, here are some registration tips that you should follow:

- Candidates can register online by accessing the link ‘Online Registration’ available under Education>Certifications>Online Register / Enroll.

- Once registered, you will get a unique NCFM registration number along with a user id and password. Confirmation will be sent to the email id and mobile number entered during registration.

- If you don’t have your NCFM registration number you first need to register yourself with NCFM.

- Using the same, you can access your online NCFM account to make payment / enroll for test / update address / check study material status / view certificates etc.

- Candidates are required to ensure that their latest address is updated in their online NCFM profile. To update address candidates need to access the link ‘Edit Profile’ available in their NCFM online login.

- Moreover, NCFM registration number is unique and a candidate has to use the same NCFM registration number while enrolling for any module.

Online Payment Procedure

- Candidates can make payment online by accessing their online NCFM login through the login page available under Education>Certifications>Online Register / Enroll.

- Candidates need to enroll for the NCFM test within 90 days from the date of receipt of payment failing which he/she is required to enroll himself/herself again by paying the fees afresh at the prevailing fee structure.

- Fees once paid shall not be refunded.

- In case of any payment related queries, please write to email ID: [email protected].

- Moreover, NSE Academy has introduced its payment gateway page for online payments. This new payment gateway is implemented on 17 Jan 2017:

- Visa/Master Credit Card

- 50+ Banks for Net banking

- 10+ Wallets & Cash card

- IMPS

- EMI option for Credit Card of selected Banks

Before taking the test

- Firstly, Candidates can enroll for the test center, module, date and time as per their requirement by accessing the link ‘Enrollment / Book your seat’ in their NCFM online login.

- Secondly, Hall ticket can be printed by accessing the link ‘Query / Report’ in the candidate’s individual NCFM online login.

- Thirdly, Candidates will receive an intimation regarding the same on their mobile number and email id registered with us.

- Lastly, Please note that payment and photo upload are necessary for enrollment. Once enrolled, test cannot be rescheduled.

Taking the Test

- Candidates need to be present at the test center 30 minutes prior to the test time. If you reach the test center 30 minutes after their scheduled test time would not be allowed to take the test.

- One need to carry an original Photo ID proof of verification. Valid photo ID proof include PAN card, Driver’s License, Passport, Employee ID, Voter’s ID card or Student ID card issued by college or school.

- On arrival at the designated test center on the test date, the NSE Academy test administrator would verify the identity of the candidate and then grant him access to the test terminal.

- In case the candidate is not present at the venue at the given test time for any reason. The test paper of the candidate would mark absent. In such cases, the candidate would need to seek fresh enrollment.

- The candidate may bring a scientific calculator and a pen to the test venue. A backup sheet and rough sheets would be provided to the candidates for carrying out their workings during the test.

- Moreover, any candidate found using any unfair means including use of mobile phone or in possession of any unfair material during the test will be expelled from the test venue and his test would be cancelled.

For More: Check Capital Market (Dealers) Module (CMDM) (Intermediate) FAQs

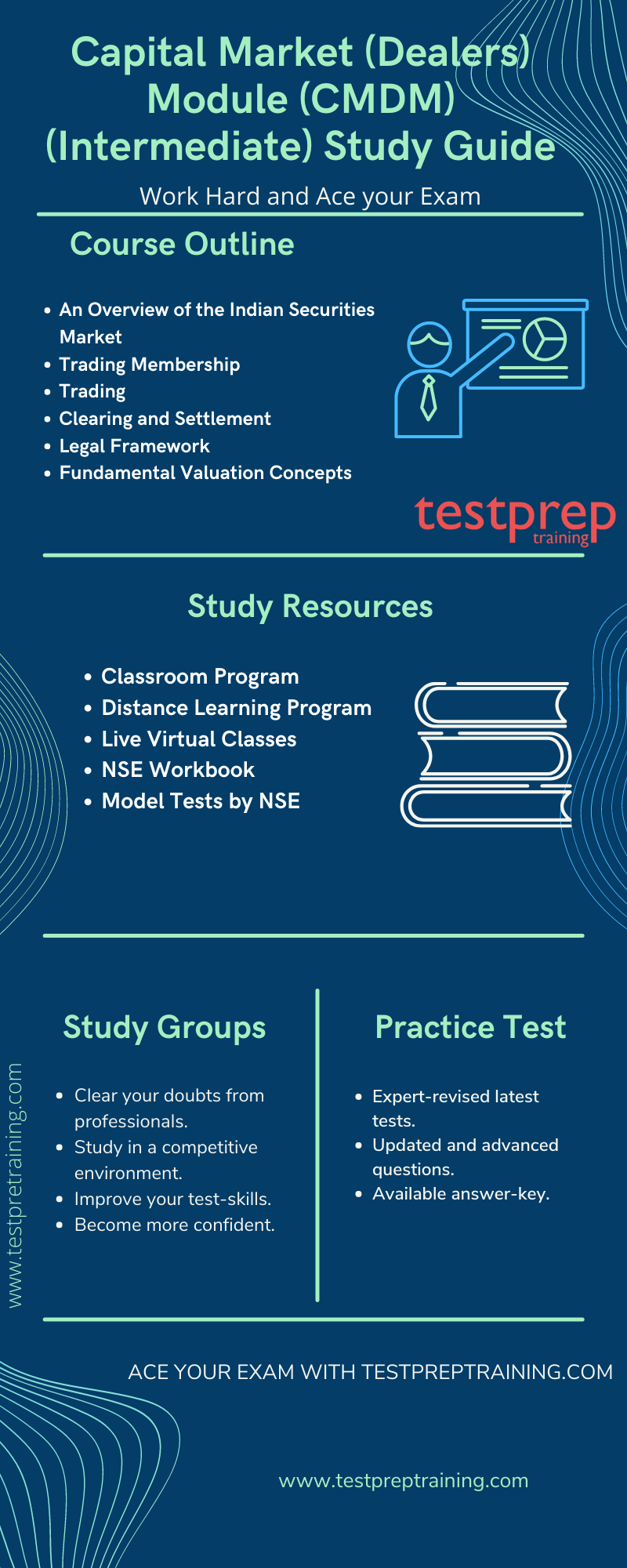

Course Outline

The Capital Market (Dealers) Module (CMDM) (Intermediate) provides its course outline as:

- An Overview of the Indian Securities Market

- Market segments, Key indicators of securities market, Products and participants, Market segments and their products, Reforms in Indian securities markets.

- Trading Membership

- Stock brokers, NSE membership, Surrender of trading membership, Suspension and expulsion of membership, Declaration of defaulter, Authorized person, Sub-brokers, Broker-clients relations, Sub-broker-clients relations, Investor service cell and arbitration, Code of Advertisement.

- Trading

- Introduction, NEAT system, Market types, Trading system users hierarchy, Local database, Market phases, Logging on, Log off/exit from the application, Neat screen, Invoking an inquiry screen, Order management, Trade management, Moreover, Limited physical market, Block trading session, Retail debt market (RDM), Trading information downloaded to members, Internet broking, Wireless application protocol (wap), Computer to computer link (ctcl) facility.

- Clearing and Settlement

- Introduction, Key terminologies used in clearing and settlement process, Transaction cycle, Settlement agencies, Clearing and settlement process, Securities and funds settlement, Moreover, Shortages handling, Risks in settlement, Risk management, International securities identification number, Data and report downloads.

- Legal Framework

- SEBI (intermediaries) regulations, 2008, SEBI (prohibition of insider trading) regulations, 1992, SEBI (prohibition of fraudulent and unfair trade practices relating to, Securities market) regulations, 2003, the depositories act, 1996, Indian contract act, 1872, Income tax act, 1961.

- Fundamental Valuation Concepts

- Time value of money; Understanding financial Statements.

Capital Market (Dealers) Module (CMDM) (Intermediate) Interview Questions

Capital Market (Dealers) Module (CMDM) (Intermediate) Study Guide

With the correct amount of devotion and hard study paired with the right combination of materials, you may ace the Capital Market (Dealers) Module (CMDM) (Intermediate) test. There are various resources available on the internet, but we must choose which ones are most valuable to us. This will assist you with time management, allowing you to dedicate more time to practise tests and review. Let’s have a look at a few resources that will assist you in passing the exam with flying colours. Furthermore, the study guide is up-to-date and has been reviewed by experts. As a result, without wasting any time, begin studying for the exam.

Getting familiar with Course Outline

The main Objectives of the Capital Market (Dealers) Module (CMDM) (Intermediate) exam are as follow:

- An Overview of the Indian Securities Market

- Trading Membership

- Trading

- Clearing and Settlement

- Legal Framework

- Fundamental Valuation Concepts

Study Resources

The NSE highly recommend its candidates to a training program for an exam like the Financial Services Foundation exam. Moreover, its a candidates choice to join a training or prepare by self-study. IMS provides its candidates with:

- Classroom Program: This is available in all metro cities. It provides 12 weeks of classroom training with 100 hours Audio Video presentation on building models and also include weekend classes. Moreover, Study material- books and online material is also available

- Distance Learning Program: Study Material will be provided online & offline. At the end to the course the candidates will have to appear for the certification exam. The examination comprises of multiple choice questions.

- Live Virtual Classes: Live and interactive training program at CISCO platform. Get recorded lectures for future reference and clear all your doubts face-to-face with experts. Moreover, you also get the benefit of weekend classes all across India.

- NSE Workbook: Candidates can issue modules after making payment for the module. After that you can download the study material after logging into your account from E-Library option.

- Model Tests by NSE: In order to familiarize yourself about the pattern of question paper, you may attempt model test papers provided by NSE.

Join Online Study Groups

Joining online study groups is the most effective strategy to improve your test abilities and gain a deeper comprehension of concepts. Study groups give you with a forum to discuss and solve your doubts with the support of specialists in the best possible way. Furthermore, joining study groups keeps you up to date on any new updates or changes in the examination.

Take Practice Tests

While preparing for any examination the most important step is to take Capital Market (Dealers) Module (CMDM) (Intermediate) practice tests. These tests do not only help you to check your preparation level, build your confidence and time management but also help you to get familiar with different types of questions that are frequently asked in the examination. Moreover, the Capital Market (Dealers) Module (CMDM) (Intermediate) practice test consists of questions from basic to advanced level in a systematic manner.