C_S4FCF_1909: Central Finance in SAP S/4HANA

SAP Central Finance in SAP S/4HANA (C_S4FCF_1909) is an associate-level certification exam that measures the candidate core knowledge required for the Central Finance profile. Moreover, the SAP Central Finance in SAP S/4HANA certification helps candidates to get a full understanding and gain in‐depth technical skills for participating as a member of a project team in a mentoring role.

Further, SAP Central Finance in SAP S/4HANA C_S4FCF_1909 exam is recommended as an entry-level qualification. And, this exam gives verification to the consultant, if they have the ability to contribute to the Central Finance implementation projects. However, this certification is the ideal starting point for a career as a Central Finance consultant.

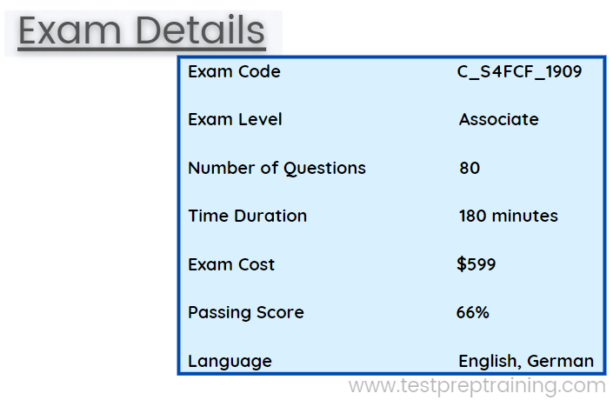

Central Finance in SAP S/4HANA (C_S4FCF_1909): Exam Details

SAP Central Finance in SAP S/4HANA (C_S4FCF_1909) is an associate level certification exam. In the exam there will be 80 questions which have to be completed in a time duration of 180 minutes. Mmoroever the C_S4FCF_1909 questions are in Multiple Choice Format. However, the certification might have unscored items and will not be counted in the final score. Further, to pass the exam, it is necessary to score at least 66%. The C_S4FCF_1909 exam questions are available in English and German Language. The price of this SAP exam is $599.00 (USD).

Scheduling the Exam

For scheduling SAP exam, check the below steps:

- Firstly, for booking an online exam, visit the Certification Hub. Then, review the available exams listed on the Exam Dashboard menu. After that, schedule a suitable exam appointment time and date.

- Secondly, a message will appear confirming that you have successfully placed an order. However, this does not mean the exam booking is completed. That is to say, a booking confirmation mail will be sent that confirms the details of your booking.

- Lastly, check all the details carefully. However, if any details are incorrect then contact your local SAP representative.

Exam Course Outline

SAP provides a list of topics for the SAP Central Finance in SAP S/4HANA (C_S4FCF_1909) exam that is divided into sections. The C_S4FCF_1909 syllabus includes:

1. Initial Load in Central Finance

- Describing how to set a filter for the initial load of Cost Object.

- Resolving errors of cost object initial load.

- Executing initial load of FI/CO postings.

- Resolving errors of FI/CO posting initial load.

- Setting up filters for the initial load of CO internal posting, and resolving errors of CO internal posting initial load.

- Defining validation and reconciliation in Central Finance.

- Performing reconciliation reports in Central Finance.

2. Real time Replication in Central Finance

- Describing prerequisites to activate real-time replication.

- Starting real-time replication.

- Correcting errors of real-time replication.

- Explaining the document flow functionality of Central Finance.

- Performing document drill back from the target system to the source system.

3. System Landscape Transformation Server (SLT)

- Describing options for activating data replication and how to transfer data, including the process of changing structures to source tables during replication.

- Configuring client-specific and cross-client replication.

- Describing starting recording and replication.

4. SAP Master Data Governance

- Describing MDG central governance and mass processing.

- Describing the general concepts and capabilities of SAP MDG, central governance.

- Activating and configuring the default processes for MDG.

- Defining MDG data models.

5. Central Finance Setup and Configuration

- Configuring the scope for the initial load of FI/CO posting.

- Defining decimal places for currencies.

- Differentiating between Key Mapping and Value Mapping.

- Defining mapping actions for Mapping Entities.

- Defining key mapping and value mappings.

- Configuring Cost Object Mapping scenarios.

6. Corporate Finance Processes supported by Central Finance

- Defining centralization of finance operations.

- Describing intercompany reconciliation in Central Finance.

- Determining open item management in Central Finance.

- Configuring central payments and central down payments.

- Describing AR/AP reporting in Central Finance.

- Defining SAP Credit Management.

- Describing the integration of Credit Management with Central Finance and the relationship between Credit Management and Central Payments.

7. Enhancements in the Controlling Area (CO-PA, WBS)

- Explaining improvements made when replicating from costing-based CO-PA into Profitability Analysis in the Universal Journal.

- Understanding account-based CO-PA COGS split in Central Finance.

- Defining account-based CO-PA price split in Central Finance.

- Describing the new replication scenario for internal EC-PCA postings.

- Explaining the simulation tool for EC-PCA and the Profit Center comparison report.

- Explaining how WBS elements and project structures can be transferred to Central Finance to enable a central reporting on projects.

8. Run Phase in Central Finance

- Designing the SAP S/4 HANA Central Finance project phases.

- Determining the SAP S/4HANA Central Finance pilot approach.

- Explaining the required organizational change with SAP S/4HANA Central Finance.

- Determining the stakeholders involved in a Central Finance project.

- Defining the change enablers and key success factors.

- Designing the operation model for Central Finance, and daily operations that might be needed in Central Finance.

9. Central Finance Landscape Architecture

- Defining options to SAP S/4HANA Central Finance Architecture links source systems to the central finance system.

- Designing SLT technical integration platform for Central Finance.

- Explaining MDG function in Central Finance for master harmonization.

- Descript AIF as interface and monitoring for Central Finance.

10. Integration Technology ALE

- Differentiating Application Link Enabling (ALE) from Electronic Data Interchange (ED).

- Defining logical system or logical system name, message type, and distribution model.

- Designing a Distribution model.

- Configuring logical system names and assigning them to clients in SAP systems.

11. System Integration Concepts

- Explaining technical communications modes and processes.

- Designing the types of communication transfer modes.

- Explaining business scenarios and the business hierarchy used by SAPConfigure RFC between two SAP systems, or non-SAP systems.

For More: Check Central Finance in SAP S/4HANA (C_S4FCF_1909) Exam FAQs

SAP Exam Policies

SAP provides certification policies that include terms and procedures related to exams. However, this also helps in gaining knowledge and getting familiar with the SAP certification methods and details. Some of the policy covers:

Cancelling or Rescheduling Exam

Candidates can cancel or reschedule an exam in Certification Hub by using the calendar icon available in the “Exam Appointments/Upcoming Appointments” section. However, this should be done at least 24 hours before the scheduled appointment date and time. SAP reserves the right to remove an exam attempt if you don’t cancel your appointment within the specified time.

Online exam taking process

- Firstly, test the system and prepare equipment at least 24 hours prior to the exam. This can be done using the System Test provided on the home page of Certification Hub. Moreover, prepare your equipment at least 2-3 hours in advance of taking your exam. Check the following equipment in place before taking your exam:

- Firstly, Questionmark Secure browser (must be downloaded and installed)

- Secondly, Webcam

- Thirdly, Microphone or headset

- Next, Adobe Flash

- Lastly, Broadband connection

- Secondly, you need to use your SAP user ID to log on to the system. Then, you have to present two forms of valid identification. This can be:

- Firstly, signed government-issued passport

- Secondly, signed driver’s license (must include a photo)

- Thirdly, signed military ID card

- Lastly, bank/credit card

- Lastly, ensure that you are in a quiet and secure location. As it is not allowed to take exams in public locations. Moreover, the exam supervisor or examiner will ask you to rotate your webcam around the room prior to beginning your SAP Global Certification exam.

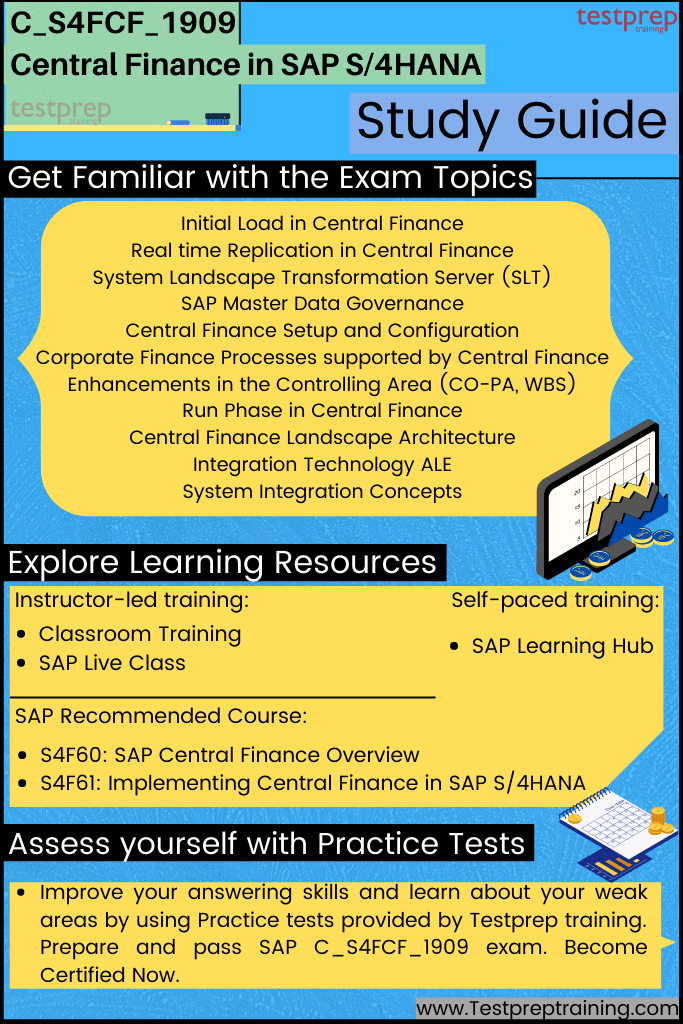

Study Guide: Central Finance in SAP S/4HANA (C_S4FCF_1909)

The C_S4FCF_1909 exam preparation is not an easy nut to crack. You need the right resources to pass the exam. To help you out we offer the C_S4FCF_1909 study guide that is loaded with all the resources you need to ace the exam.

Exam Objective

Exam course outline provides the list of topics divided into sections and subsections. This makes it easier for candidates to start according to their preferred concepts area. However, for SAP Central Finance in SAP S/4HANA (C_S4FCF_1909 certification exam the objectives include:

- Firstly, Initial Load in Central Finance

- Secondly, Real-time Replication in Central Finance

- Thirdly, System Landscape Transformation Server (SLT)

- Fourthly, SAP Master Data Governance

- Then, Central Finance Setup and Configuration

- Next, Corporate Finance Processes supported by Central Finance

- After that, Enhancements in the Controlling Area (CO-PA, WBS)

- Run Phase in Central Finance

- Then, Central Finance Landscape Architecture

- After that, Integration Technology ALE

- Lastly, System Integration Concepts

Instructor-led training

Instructor-led Training is good for those who prefer lessons to be presented live by an instructor. This provides a traditional or virtual classroom experience. Further, these C_S4FCF_1909 trainings includes:

Classroom Training

- Classroom training provides in-person training from SAP experts in the training facilities. This also offers a fully hands-on learning experience with a subject matter expert for guiding you through each exercise and answering all your questions.

SAP Live Class

- With SAP Live Class virtual training, candidates will get access to comprehensive live training from SAP experts. Moreover, the live class includes e-course materials and helps you to interact with classmates from around the world.

Self-paced training

Self-paced Training is suitable for those who prefer to take course materials and practice lessons on their own. This includes:

SAP Learning Hub

SAP learning hub provides access to a variety of learning resources and comprehensive SAP skill-building knowledge base. This also include:

- Firstly, self-paced digital learning content

- Secondly, expert-led social learning forums and access to training systems for real-world practice.

- Thirdly, this provides options to choose between a full catalog or a specific catalog depending on your learning needs.

- Lastly, this helps in building, maintaining, and validating your skills with flexible digital learning.

SAP Recommended Course

S4F60: SAP Central Finance Overview

SAP Central Finance refers to a specific deployment option for collecting accounting data from SAP ERP systems and Non-SAP Systems into one central SAP S/4HANA system. This course helps in understanding about the basic architecture and key scenarios that SAP Central Finance covers. Moreover,candidates will be able to explain the value proposition but also the business benefits of this solution. Further, this course will prepare candidates to:

- Firstly, understand and learn the use cases of SAP Central Finance.

- Secondly, describe the concept and architecture of SAP Central Finance.

- Thirdly, understand the main requirements in the SAP Central Finance project.

- Then, learn and understand the different roles needed to run SAP Central Finance Project.

- Lastly, understand and learn the organizational transformation and key success factors for SAP Central Finance Project.

S4F61: Implementing Central Finance in SAP S/4HANA

This course helps in understanding the scope and capabilities of SAP Central Finance for SAP S/4HANA in LoB Finance. In this candidates will be able to validate if the solution fits the customer’s business requirements. Moreover, they will also understand and learn about implementing SAP Central Finance as well as executing the main configuration steps. Further this course will prepare candidates to:

- Firstly, describe the concept and architecture of CentralFinance

- Secondly, learn the major requirements in the SAP Central Finance project

- Thirdly, get the basic knowledge about setting up and configuring SAP Central Finance landscape

- Lastly, learn and understand the process of executing the SAP Central Finance project

Attempt C_S4FCF_1909 Practice Tests

Practice tests can be a very essential source that can help you to prepare better for the SAP Central Finance in SAP S/4HANA (C_S4FCF_1909) exam. That is to say, by taking assessments topic wise you will know about your weak and strong areas. Side by side this will also improve your answering skills that will result in saving a lot of time. So, start practicing using the best available practice tests and get yourself prepared for the exam.