Any retirement strategy must start with an IRA (Individual Retirement Account). To administer an IRA for a client and to design the correct portfolio for the customer, a qualified financial planner is required.

The Certified IRA Services Professional (CISP) certification can help distinguish financial planners who really know their role in helping clients manage their IRA effectively, with complete knowledge. Earning a CISP Certification is proof of knowledge and domain expertise for any wealth and trust professional. However, it is an optional credential and doesn’t convey any special privilege in any way. But, a CISP certification has been shown to be of value in showing that the professional is operating in industry-recognized standards for IRA knowledge and competence.

Furthermore, CISP certification demonstrates knowledge of not just standard IRAs, but also SEP-IRAs and SIMPLE IRAs. The CISP trained specialists are well-versed in IRA costs, investments, plan portability, and IRA withdrawal regulations.

Requirements of CISP

CISP Certification is issued by “The American Bankers Association (ABA)”. However, a mix of experience and education is required to take the certification test and get a CISP certificate.

Route 1

If you have a 4-year experience of the IRA, you can apply directly without any educational qualification, to take the exam.

Route 2

A minimum of 2 years of IRA experience is still required just to apply. And, if you have at least 2-year experience then, you would have to take an additional educational course/program from one of the five IRA-based institutions that ABA recognized.

- Ascensus IRA Institute,

- ABA IRA Online Institute,

- Cannon Financial Institute IRA Professional School,

- Integrated Retirement Initiatives IRA School

- The Entrust Trust Company IRA Academy.

The course usually takes 12 weeks if the learners devote 15 to 20 hours per week.

Learners get familiar with eligibility and how to set up IRAs, SEP and SIMPLE plans, and all the other details like beneficiaries, contributions, distributions, rollovers, and transfers.

Certified IRA Services Professional (CISP) Exam Format

- Firstly, to qualify for a CISP credential, the applicants need to pass multiple-choice tests. And, the Certified IRA Services Professional (CISP) exam questions will be in a number that will be a maximum of 150.

- Secondly, the students get 3 hours to appear for this exam and can use a calculator.

- Thirdly, these are the computer-based exams, and the result is declared immediately after the exam at the test site.

The official results are received in six weeks.

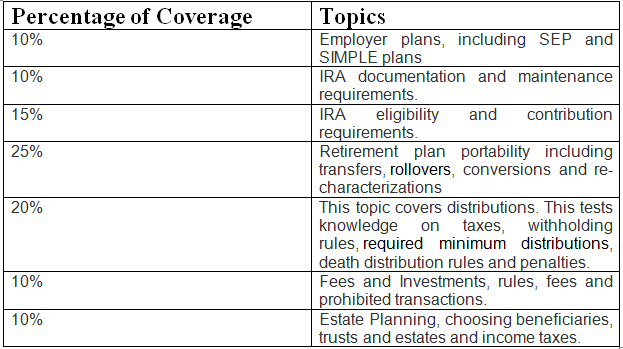

However, the test covers seven major topics.

This is what a sample test question looks like:

- Which of the following data is protected by the privacy provisions of the Gramm-Leach-Bliley law?

- Public personal information

- Public institutional information

- Nonpublic personal information

- Nonpublic institutional information

In case you haven’t been studying, the correct answer is, “c. Nonpublic personal information.”

CISP Costs

- ABA members get a discount on classes. It is $1595 for members and $1795 for non-members. However, an applicant with 4 years of IRA experience can skip the classes altogether.

- There is a $295 application fees and $550 exam fees for all applicants.

- Exam retake costs $300 and can only be done after 90 days. However, there is no limit to the number of retakes, but the applicant has to pass within 3 years of first attempting the exam. Otherwise, he has to start again and pay the application fees and the exam fee again.

- Applicants also have to agree to adhere to a code of ethics. They also need to take 24 credits of continuing education, equal to 20 hours of study, every three years.

- An annual fee of $199 membership fee must also be paid.

- Although it is not mandatory to have a CISP certification to work in the retirement planning field, it is taken as an advantage to have a certification, and many firms prefer to have their staff as certified.

- IRA advisors may choose to get other certifications like Certified Financial Planner, Certified Retirement Services Professional and Certified Trust and Financial Advisor. These alternatives to the CISP certificate may provide more distinction, at the price of additional study.

Bottom Line

The CISP certification shows that an adviser has a significant level of experience, education and practical knowledge about IRAs. However, CISP certification is optional and only enhances the profile of the advisor. It is not mandatory to work as a financial planner but does help you to differentiate yourself from the competition. It establishes your knowledge in the IRA services field.

Why should you take a CISP Certification?

Individual Recognition. Institutional Impact.

The CISP certification denotes excellence in banking skills and especially related to IRA which is an essential component of individual financial planning. Moreover, the provider is the American Bankers Association, the certification is helpful for continuous career development and promotes lifelong learning.

However, the certification is awarded after a minimum work experience requirement and passing a rigorous examination. The certification entails a process of lifelong learning which assures that the certified professional is knowledgeable and on top of his role. Moreover, by staying current in their fields, financial planners can attract high business and are useful for their organizations in attracting the best clientele. Remaining at the top of knowledge also mitigates the risk of wrong investments and mistakes in guiding clients. Further, this itself is a huge profit for any financial institution if there are fewer mistakes done by its employees or people representing it. Certification also is a signal to regulators that your organization takes its role seriously and pushes its employees to take certification and remain current in their work role. This also communicates to the clients that you are a safe and reliable business to deal with.

Learn and enhance your IRA service knowledge. Prepare with hundreds of free Certified IRA Services Professional (CISP) practice test questions Now!