An Anti-Money Laundering (AML) Specialist is a professional who is responsible for preventing, detecting, and reporting instances of money laundering and financial crimes within an organization. Their job is to make sure the organization follows the right laws and rules about money laundering and funding for terrorists.

AML specialists work in a variety of industries, including banking, financial services, and insurance. Their role involves checking for risks, making rules, and setting up safety measures inside the organization. This helps reduce the chances of money-related crimes and illegal financial activities.

Their daily tasks include:

- Conducting customer due diligence checks to verify the identity of customers and determine their risk level.

- Monitoring transactions and account activity for suspicious behavior and potential money laundering.

- Investigating and reporting suspicious activity to the appropriate authorities.

- Keeping up-to-date with changes in AML regulations and ensuring the organization is compliant.

- Providing training to employees on AML policies and procedures.

To become an AML specialist, individuals typically need a bachelor’s degree in a relevant field, such as finance, accounting, or business administration. Some organizations may require additional certifications such as the Certified Anti-Money Laundering Specialist (CAMS) certification.

In general, AML specialists have a really important job. They help keep the financial system safe and stop crimes like hiding money, supporting terrorists, and tricking people.

In this article, we will understand CAMS including its importance, certification details and methods for preparing for the exam.

CAMS Certification Importance

The CAMS certification is the only certification for anti-money laundering specialists. And, passing the CAMS exam will enhance candidates’ knowledge and expand their expertise needed to protect organizations and prevent crimes. With this certification, financial auditors prove they are committed to the development of their professional skills. Moreover, the CAMS certification keeps anti-money laundering specialists updated with new industry trends. Talking about career advancement, CAMS certification means better job opportunities and higher wages.

Now, we will understand the CAMS certification including other important details.

What is CAMS Certification?

The Certified Anti-Money Laundering Specialist (CAMS) certification means having an advanced understanding of international AML/CFT principles. And, the candidates who want to become anti-money laundering specialists should have expert authorization. Not to mention, the AML certifications are accepted globally by financial institutions, governments, and regulators for securing the financial system against money laundering. Moreover, ACAMS certifications provide aspirants candidates the skills and knowledge to get advance. But, for every certification exam, firstly, it is important to know about the exam details that include eligibility, skills required and other important areas.

So, let’s start with the eligibility requirements for the CAMS exam.

Certified Anti-Money Laundering Specialist Requirments

The requirements candidates should have to take the CAM exam includes,

- First thing, people who want this need to finish about 40 college credits. Good news is, ACAMS also counts work experience and gives you 10 credits for each year, up to three years – that’s 30 credits total. And the work can be in any kind of job or industry.

- Next, if you have financial certifications like CPA, CPE, or CPP, they can give you up to 10 credits for each certification.

- Lastly, if you’ve got an associate’s degree, you get 10 credits. A bachelor’s degree is worth 20 credits, and a master’s or doctorate degree gets you 30 credits.

Next is the skills part, in this we will talk about basic skills requirements for AML Specialists.

Essential Skills

- Firstly, Anti-money laundering specialists need to have strong analytical skills to organize and analyze multiple data sets.

- Secondly, it is necessary to have strong database skills to work with advanced pivot tables, data sets, and statistical search methods.

- Thirdly, they should be able to quickly identify risks, understand business unit processes and develop comprehensive mitigation solutions. In addition, written communication skills are also necessary.

- Lastly, they should have solid analytical skills with high attention that will help them to effectively perform their duties.

“What to do once we meet the requirements” This question strikes most of the time. So, the simple answer is to prepare and pass the exam.

Certified Anti Money Laundering Specialist: Glossary

Here are some terms that may be included in the Certified Anti Money Laundering Specialist (CAMS) glossary:

- Anti-money laundering (AML): A set of laws, regulations, and procedures designed to prevent, detect, and deter the laundering of illicit funds.

- Know Your Customer (KYC): The process of verifying the identity of a customer and assessing their risk level to prevent money laundering and terrorist financing.

- Customer Due Diligence (CDD): The process of collecting information about a customer and assessing their risk level to prevent money laundering and terrorist financing.

- Suspicious Activity Report (SAR): A report that banks make when they see something that seems suspicious and might be linked to money crimes like hiding or moving money in illegal ways.

- Beneficial owner: The natural person(s) who ultimately owns or controls a customer or legal entity, and whose identity must be verified under AML regulations.

- Money laundering: Hiding money earned from illegal actions by making it look like legal money so it won’t be noticed or taken away.

- Terrorist financing: The use of funds to support terrorism or terrorist activities.

- Risk assessment: The process of identifying, evaluating, and managing the risks associated with a particular activity, customer, or business.

- Financial Action Task Force (FATF): An intergovernmental organization that sets international standards for AML and counter-terrorist financing (CTF).

- Politically Exposed Person (PEP): An individual who holds a prominent public position or who has a high-profile role in society, and who may be at increased risk for involvement in corruption, bribery, or money laundering.

These are just a few of the terms that may be included in the CAMS glossary. Understanding the terminology and concepts related to AML and financial crime is essential for CAMS certification and success in the field.

Certified Anti Money Laundering Specialist: Exam Tips and Tricks

Here are some tips and tricks to help you prepare for and pass the Certified Anti Money Laundering Specialist (CAMS) exam:

- Understand the exam format: The CAMS exam is a multiple-choice exam with 120 questions that must be completed within three and a half hours. Understanding the format and time constraints will help you better manage your time during the exam.

- Review the CAMS Exam Preparation Toolkit: The CAMS Exam Preparation Toolkit is a comprehensive guide that provides information on the exam content, study resources, and exam-taking strategies. Reviewing this toolkit will help you understand what to expect on the exam and how to prepare effectively.

- Utilize study materials: You can find lots of study resources to get ready for the CAMS test, like study books, practice tests, and online lessons. Using different kinds of study materials can make you understand things better and get ready for the test.

- Understand the AML program elements: The CAMS exam covers the AML program elements, including policies and procedures, risk assessment, customer due diligence, and monitoring and reporting. Understanding these elements and how they relate to AML compliance is essential for passing the exam.

- Practice critical thinking skills: The CAMS exam requires critical thinking skills to identify and analyze suspicious activity, assess risk, and make decisions about whether to report suspicious activity. Practicing critical thinking skills can help you better prepare for these types of questions on the exam.

Preparing for CAMS Examination

Exam preparation is the part where you need to prove yourself best. That is to say, you have to prepare hard to crack the exam. And, this requires a focused mindset with a goal to achieve. However, for the Certified Anti-Money Laundering Specialist (CAMS) exam preparation, there are useful resources available to take the exam in confidence. This includes,

Certified Anti-Money Laundering Specialist Study Guide

The CAMS study guide is the main resource for preparing for the examination. Moreover, this includes various concepts that will provide benefits during the preparations.

- Firstly, the risks and methods of money laundering including terrorism financing

- Secondly, the compliance standards for anti-money laundering with combating the financing of terrorism.

- Thirdly, the compliance programs of Anti-money laundering

- Lastly, conducting or supporting anti-money laundering investigations.

Study Flashcards

The study flashcards will check what you know about the CAMS test using flashcards you can print out and use like a quiz. Plus, these flashcards focus on the most important stuff from the CAMS study guide.

Study Tips

ACAMS provides study tips and test-taking advice from those who have already taken and passed the CAMS examination. And, this will provide an advantage during the preparation as these aspirants will experience there as well as the part where you need to focus the most.

CAMS Studying with Expert Guidance

ACAMS provides Virtual Classroom for CAMS, which is a live web-based study course, providing candidates guided instruction to help cover the key concepts of the CAMS exam. Moreover, they provide study materials to make you understand the topics. However, virtual classrooms include six-week-long classes of 2-hour. And, here you will get a study guide with practice questions to assess understanding of the material.

Practice Test

We all know that with learning and understanding the exam content it is also necessary to practice it. In other words, to perform well in the exam practice test and assessing yourself using mock tests is important. Moreover, there are many websites out there that provide free practice tests for the Certified Anti-Money Laundering Specialist exam. This will help you in pointing out your weak points and then get perfection in them.

Now, we will put the spotlight on the most important part that is job and salaries. After passing the exam, you will get a chance to explore many new areas as well as getting advanced in that. So, below, we will talk about the various job roles, areas and salary details of CAMS.

CAMS: Top Job Roles

After having the CAMS certificate in hand, the most important thing is to get placed in a good organization with a high salary. So, the top roles which you can apply for depending upon the skills and experience includes,

- Firstly, Compliance managers

- Secondly, the Bank Secrecy Act officers

- Thirdly, Financial intelligence unit managers

- Surveillance analysts

- Lastly, Financial crimes investigative analysts

Top Companies

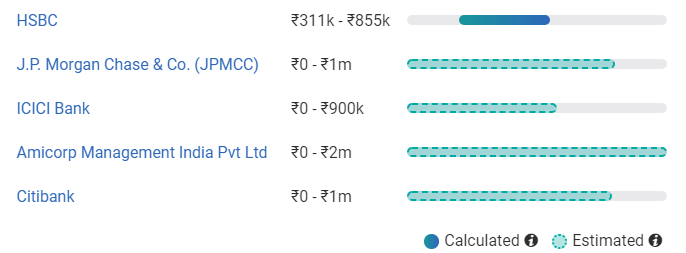

The top companies that are hiring for Certified Anti Money Laundering Specialist (CAMS) includes,

- WNS

- ICICI Banks

- HSBC

- J.P. Morgan Chase & Co. (JPMCC)

- Amicorp Management India Pvt Ltd

- Citibank

Payscale

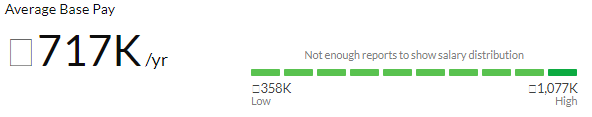

Certified Anti Money Laundering Specialist CAMs certification salary can have an average base pay is Rs 717k per year. However, this pay can exceed depending upon the experience you have as well as the organizations.

So, to clarify this below there is a chart showing the pay ranges for people with a Certified Anti Money Laundering Specialist (CAMS) certification with companies.

Now, we will explore the performance area where an Anti-money laundering specialists play an important role.

Performance Areas

- Firstly, Anti-money laundering specialists investigate money laundering risks in banks and financial institutions. As, they ensure the identification, monitoring, and documentation of suspicious transactions.

- Secondly, they are familiar with industry best practices, criminal typologies, and current FBI and law enforcement alerts. Moreover, they identify systemic vulnerabilities, procedural weaknesses and performance areas that require re-training.

- Thirdly, they provide expert advice to financial executives regarding taking appropriate actions for high-risk accounts and activities.

- Lastly, they maintain an understanding of money laundering issues related to white-collar, terrorist and criminal organization financing trends.

Final Tips

Getting certified as an Anti Money Laundering Specialist will not only prove that you have the required skills but, it will take your career to the next level. Moreover, you will get to explore many new opportunities as you get to advance in this. And, having CAMS certification will show that you have advanced professional skills during the time of hiring. So, you need to work hard for this exam and get it clear. Lastly, just be confident even during the preparation and it will all be worth it.

Learn and enhance your Anti-Money Laundering Specialist skills. Prepare for CAMS Certification Exam Now!