The Certified Regulatory Compliance Manager (CRCM) is a professional certification for individuals who are responsible for managing and overseeing compliance issues within financial institutions. The certification is offered by the American Bankers Association (ABA) and is recognized as a mark of excellence in the compliance profession.

To earn the CRCM certification, individuals must have a minimum of three years of experience in compliance management and pass a comprehensive exam that covers a range of compliance-related topics. The examination comprises 200 multiple-choice questions and must be finished within a four-hour time frame.

The topics covered in the CRCM exam include:

- Compliance program management

- Regulatory analysis and implementation

- Compliance monitoring and testing

- Compliance auditing

- Ethics

- Fair lending laws and regulations

- Anti-money laundering laws and regulations

- Privacy laws and regulations

- Consumer protection laws and regulations

To prepare for the CRCM exam, individuals can take advantage of a variety of study resources provided by the ABA, including study guides, practice exams, and online courses. Additionally, attending compliance-related seminars and conferences and seeking mentorship or guidance from experienced compliance professionals can also be helpful in preparing for the exam. Once certified, CRCMs are required to maintain their certification through continuing education credits and ongoing professional development.

Certified Regulatory Compliance Manager (CRCM): Glossary

Here is a glossary of key terms and concepts related to the Certified Regulatory Compliance Manager (CRCM) certification:

- Compliance risk: The risk of legal or regulatory sanctions, financial loss, or damage to reputation arising from violations of or non-compliance with laws, regulations, rules, and standards.

- Compliance management system (CMS): A system of policies, procedures, processes, and controls designed to manage compliance risks and ensure compliance with laws, regulations, rules, and standards.

- Bank Secrecy Act (BSA): A United States law mandating that financial institutions collaborate with U.S. government agencies to identify and prevent money laundering.

- USA PATRIOT Act: A U.S. law that aims to prevent terrorism and improve national security by enhancing anti-money laundering and anti-terrorism measures.

- Dodd-Frank Act: A U.S. law that aims to prevent another financial crisis by improving financial regulation and consumer protection.

- Gramm-Leach-Bliley Act: A U.S. law that oversees the protection and confidentiality of consumer financial data held by financial institutions.

- Fair Credit Reporting Act (FCRA): A U.S. law that regulates the collection, use, and disclosure of consumer credit information.

- Equal Credit Opportunity Act (ECOA): A U.S. law that prohibits credit discrimination on the basis of race, color, religion, national origin, sex, marital status, age, or receipt of public assistance.

By familiarizing yourself with these key terms and concepts, you’ll be better equipped to understand and manage compliance risks within financial institutions and prepare for the CRCM certification exam.

Certified Regulatory Compliance Manager (CRCM): Study Guide

The Certified Regulatory Compliance Manager (CRCM) certification is a professional credential for individuals who manage compliance risks within financial institutions. Here is a study guide to help you prepare for the CRCM exam:

- Understand compliance frameworks: Know the major compliance frameworks, such as the Bank Secrecy Act, the USA PATRIOT Act, the Dodd-Frank Act, and the Gramm-Leach-Bliley Act. Understand the regulatory requirements of each framework and their implications for financial institutions.

- Learn compliance risks: Understand the types of compliance risks faced by financial institutions, such as money laundering, fraud, and data privacy. Understand how to assess, measure, and manage these risks.

- Know compliance management systems: Understand the key elements of a compliance management system, such as policies and procedures, risk assessments, training, monitoring and testing, and corrective action. Know how to design, implement, and maintain a compliance management system.

- Knowing compliance laws and regulations: Understand the laws and regulations that apply to financial institutions, such as the Fair Credit Reporting Act, the Equal Credit Opportunity Act, and the Community Reinvestment Act. Know how to interpret and apply these laws and regulations.

- Understand compliance audits: Know the types of compliance audits, such as internal audits and regulatory exams, and their objectives. Understand the audit process and know how to prepare for and respond to audits.

- Understanding consumer protection laws: Know the laws and regulations that protect consumers, such as the Truth in Lending Act, the Fair Debt Collection Practices Act, and the Servicemembers Civil Relief Act. Comprehend the procedures for adhering to these legal requirements and guidelines, as well as managing consumer grievances.

Certified Regulatory Compliance Manager (CRCM): Exam Tips and Tricks

Here are some tips and tricks to help you prepare for and pass the Certified Regulatory Compliance Manager (CRCM) exam:

- Understand the exam format and content: Get acquainted with the examination structure, which comprises 200 multiple-choice questions to be answered in a four-hour time frame. Additionally, review the exam’s subject areas, encompassing compliance program management, regulatory analysis, and implementation, as well as a range of laws and regulations.

- Create a study plan: Develop a study plan that works best for your schedule and learning style. Allocate sufficient time to cover each topic and use study materials provided by the American Bankers Association (ABA), including study guides and practice exams.

- Take advantage of online resources: The ABA provides a range of online courses, webinars, and additional materials that can aid in your exam preparation. Utilize these resources to enhance your comprehension of the exam subjects and their relevance to compliance management.

- Seek mentorship and guidance: Connect with other compliance professionals who have passed the CRCM exam or have extensive experience in compliance management. They can provide valuable guidance, advice, and resources to help you prepare for the exam.

- Practice time management: Since the exam is timed, practice time management skills to ensure that you can answer all the questions within the given time. Avoid spending too much time on difficult questions and mark them for review to come back to later.

- Read questions carefully: Thoroughly read each question and ensure you comprehend what it is asking before providing your answer. Refrain from making assumptions or conclusions, and eliminate answer choices that are evidently incorrect.

By following these tips and tricks, you can increase your chances of passing the CRCM exam and earning your certification as a regulatory compliance manager.

Professional Experience of a Compliance Manager

The professional experience for this designation demands that the applicant has a detailed range of compliance risk functions. These processes include

- Firstly, Accomplishment of compliance risk assessments, exams or audits

- Secondly, Managing, formulating or putting to use all aspects of a compliance risk management program to make sure of compliance with U.S. federal laws and regulations.

The job duties should be aiming at compliance risk management:

- To begin with, Consultation as a subject matter specialist

- Then, Bank’s compliance program examination

- Further, Oversight, implementation, and program designing

- Also, Auditing, enforcement or administration of compliance-related policies, processes, methods.

CRCM Certification Requirements

Candidates taking the Certified Regulatory Compliance Manager (CRCM) must meet the following requirements to become eligible for taking the certification exam offered by ABA.

- Either, Candidates must have an experience as a Compliance Professional for at least Six (6) years. This experience is required to be within the last ten (10) years. three (3) years of which should be within the last five (5) years.

OR

- Candidates must have experience as a Compliance Professional for at least three (3) years AND must complete two of the below-mentioned compliance-related training options. These courses must, however, have been finished within the last five (5) years –

- Firstly, ABA Compliance School – Foundational

- Secondly, ABA Compliance School – Intermediate

- Thirdly, ABA Certificate in Deposit Compliance and ABA Certificate in Lending Compliance

- Further, ABA CRCM Exam Prep or CRCM Exam Online Prep

- Also, ABA-led in-bank ABA CRCM Compliance School

- Moreover, 30 Training credits (1 credit = 50 minutes)

Training Credits

The training and courses related to the 30 training credits of the compliance-related training options are mentioned below. These credits vary and are dependent on the year of completion of ABA events.

- To begin with, , ABA Compliance School – Advanced (40 credits)

- Then, ABA Regulatory Compliance Conference (25 credits)

- Also, ABA Financial Crimes Enforcement Conference (25 credits)

- Further, ABA Training Courses

- Moreover, State Bankers Association Regulatory Compliance Schools and Training

Certified Regulatory Compliance Manager CRCM: Preparatory Guide

Obtaining industry-recognized certification gives you a distinct advantage over other candidates. Furthermore, achieving a professional certification boosts your attractiveness to employers and showcases your competence. Adequate study and preparation are necessary for this exam. This Study Guide equips you with ample CRCM study material and the essential resources to close the gap toward your desired job. This guide is undoubtedly your path to successfully passing the exam with flying colors.

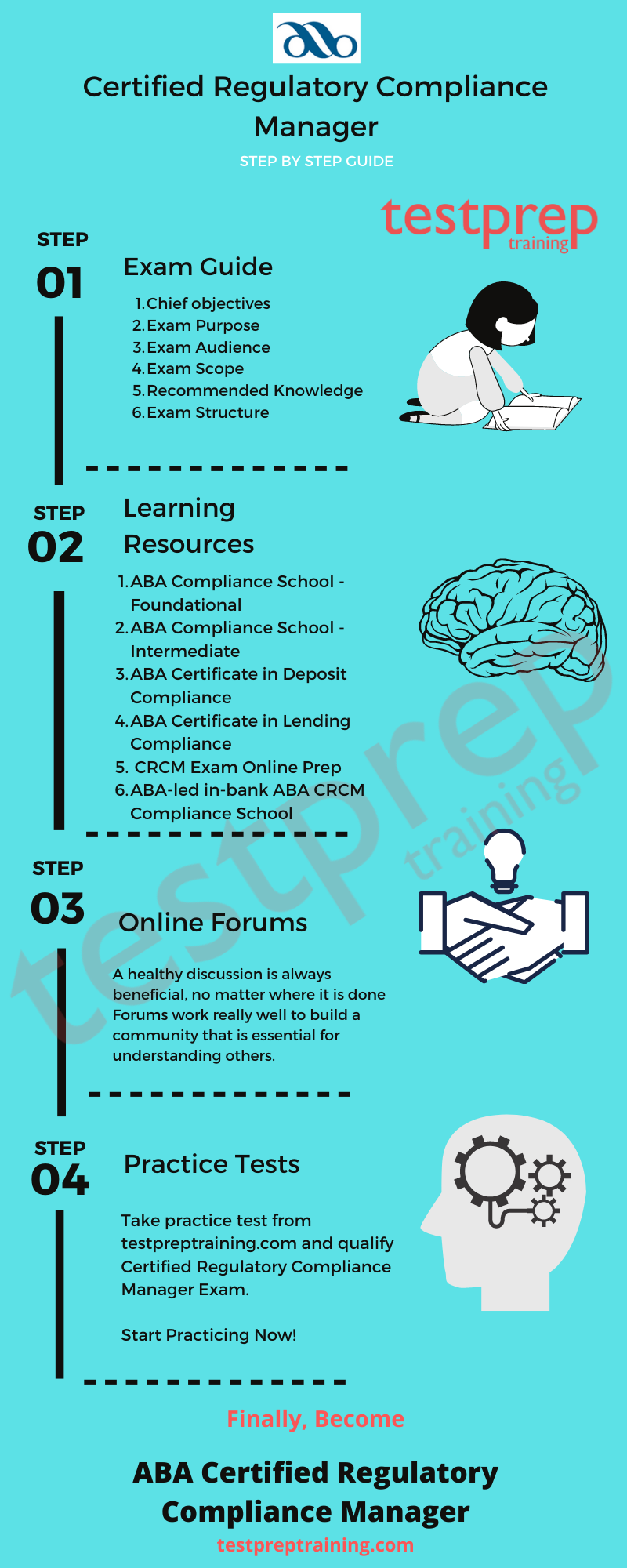

Step 1- Review the Certified Regulatory Compliance Manager Exam Objectives

After you’ve familiarized yourself with the exam details, it’s essential to ensure that you are well-versed with the Course Outline. As previously mentioned, the Course Outline is the fundamental component of the exam, serving as the exam’s syllabus. Naturally, all the questions on the exam derive from this specific list of domains. Having a clear understanding of the exam objectives and concepts is pivotal in your preparation process. The CRCM exam outline encompasses the following domains:

- Firstly, Assessment and Management of Compliance Risk (28%)

- Secondly, Compliance Monitoring (25%)

- Thirdly, Governance and Oversight (10%)

- Also, Regulatory Change Management (15%)

- Then, Regulator and Auditor Compliance Management (11%)

- Finally, Compliance Analysis and Internal/External Reporting (11%)

Step 2- Know your Resources

Your resources determine the level of your preparations. There are numerous resources available in the market. You need to b wise enough to choose the genuine an authentic ones. We know its a tedious task. Therefore, we have summarised some of the highly suggested resources you must include in your preparations journey. Lets discuss!

Enrol for ABA Trainings

ABA Compliance School – Foundational

The ABA Compliance School – Foundational training course is well designed by most esteemed compliance practitioners and others who have mastery in offering detailed educational experience in a changing environment. The course will help us comprehend and develop an essential technical awareness of major compliance problems and strengthen the pillar of developing and maintenance of an effective compliance program. It offers a combination of live and on-demand classes over a two and a half week period.

ABA Compliance School – Intermediate

The ABA Compliance School – Intermediate is an intermediate course. Not only does it provides a practical approach to compliance regulation but also helps in developing compliance professionals at all stages of career experience. It includes practical applications in conducting a risk assessment, compliance in loan servicing, identifying UDAAP susceptibilities and identifying loans, etc. Compliance regulations are required to be put into usage every day, concentrating on the important issues and matters that compliance professionals have to encounter nowadays.

CRCM Exam Online Prep

The ABA CRCM Exam Prep or CRCM Exam Online Prep course helps a student learn and know how to practice his/her aptitude to complete works in each knowledge field, prepare well for the actual examinations, examine knowledge in key compliance matters, processes, demonstrating compliance expertise. Features like confidence meters and self-assessment tools render effective feedback for self-development. The course consists of readings, audio-video lessons, practice tests, and online discussion boards.

ABA Certificate in Deposit Compliance

The ABA Certificate in Deposit Compliance training course is thoughtfully designed to enable students to acquire a comprehensive comprehension of fundamental deposit regulations. It equips individuals with the capacity to recognize and appropriately respond to compliance obligations. This course provides a flexible learning environment, allowing students to progress at their own pace and granting unlimited access to all courses for one year.

ABA Certificate in Lending Compliance

The ABA Certificate in Lending Compliance is a full 17-course curriculum that is accessible for a definite period of 12 months at a candidate`s own pace is offered here. It is a good way of showcasing to examiners and bank management a candidate`s strongly built foundation in core lending regulations, the capability to recognise and respond quickly to the requirements of the compliance.

ABA-led in-bank ABA CRCM Compliance School

The ABA-led in-bank ABA CRCM Compliance School is a 5-day immersive learning experience with content getting deliver by some top industry experts and practitioners. The participants are require to cover the terminology, regulations, and the technical foundation which is essential for developing and maintaining an efficient compliance program. It gives sufficient preparation and course credits toward the CRCM designation. The program targets to cover all the basic fundamental knowledge on the Certified Regulatory Compliance Manager (CRCM) exam: financial crimes, bank operations, privacy, lending and deposit operations regulations.

Step 3- Join Online Forums

Joining an Online Community is certainly an ideal way to know your actual stand in the competition. Here, you can interact with your competitors, and keep yourself focused. This will provide you the right exposure to appear for the exam, ensuring an increase in your expertise. This will not only be beneficial in the exam prep but will also help get your doubts clear.

Step 4- Attempt Practice Tests

The higher your accuracy in practice papers, the more self-assured you’ll become for the actual exam. Additionally, you’ll gain insights into how to allocate time and effort across various sections of the question paper. Your brain gets trained to perform at its peak during the exam. These factors collectively can have a significant impact. It’s important to remember that your exam result doesn’t solely reflect your knowledge but also how effectively you expressed it. So, Start using CRCM Practice Exam Tests now to boost your confidence!