Securities Market Basic Module (Foundation Module)

The Securities Market Basic Module (Foundation Module) certificate examination mainly focuses on the issues relating to different areas of the securities market in greater depth and detail than the Financial Market Beginner’s Module. In addition, the course helps understand the securities market structure and government securities market. With the increasing investments in securities, this certification will help you in developing a better understanding of the Securities Market. Let’s learn more about it:

Why should one take this course?

- Firstly, To understand the various products, participants, and functions of the securities market.

- Secondly, To understand the market design of Primary Market & Secondary Market

- . To understand the government securities market.

Advantages of NSE’s Certifications

NSE intends to skill the candidate in their preferred course m. NSE analysis the practical knowledge and skills of the candidates. Comprehensive modules are introduced by NSE that cover different areas of Finance and Commerce.

- A Good Start for a Career: NSE certifications accelerate candidates’ growth and provide knowledge and money both. Gaining practical knowledge is also significant and Mandatory, while studying for the certifications of the exam, as per that knowledge the candidates will also understand related concepts that will help better the skills of the candidates.

- Good earnings with Growth: A job with a good income is desired by every individual. NSE certifications provide exclusive eligibility to trade in mutual funds and give the candidate proper knowledge of the risk involved and earnings.

- Increases Hiring Opportunities: The competition in the department like Commerce, Finance and banking is always on a higher level. All the firms are interested in the candidates who give the best output to the firm. NSE certifications increase hiring opportunities as well.

Who will be benefit from this course?

- Students

- Investors

- Employees of Broker and Sub-brokers

- Depository Participants employees

- Employees of Mutual Funds, Research Houses/Analysts/Researchers

- Employees of BPOs/IT Companies

- Anybody having an interest in the Securities Market

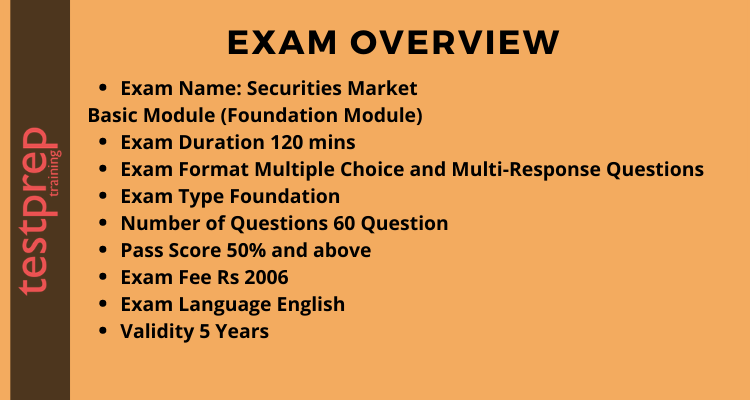

Exam Overview

The securities Market Basic Module (Foundation Module) examination has 60 questions that you need to answer in 120 minutes. It advised finishing your examination in 90 minutes so that you have 30 minutes for revision. Also, the questions are in multiple-choice and multi-response format. To clear the examination, you need to atleast get 50% marks. This certification is valid for 5 years and it will cost you INR 2006.

Course Outline

The Securities Market Basic Module (Foundation Module) covers the following topics:

Securities Market in India – An Overview

- Securities market and financial system; Products, participants and functions; Primary market; Secondary market; Derivatives market; Regulators; Exchanges; Depositories; Clearing corporations; Regulatory framework; Reforms.

Primary Market

- Book building; Credit rating; Merchant banking; On-line IPOs; Demat issues; Private placement; Virtual debt portals; ADRs/GDRs; Other regulations; Public issues; Euro issues; Debt issues; Collective investment vehicles viz., MFs, VCFs, CISs.

Secondary Market

- Membership; Listing; Trading and settlement mechanism;Technology;Trading rules- Insider Trading; Unfair trade practices;Takeovers; Buy back; Turnover; Market capitalization; Prices; Liquidity; Transaction costs; Risk management; Indices.

Government Securities Market

- Indian debt market; Primary market; Secondary market-NDS; NDS-OM; CCIL; Wholesale debt market (WDM) segment of NSE.

Derivatives Market

- Products, Participants and functions; Trading mechanism; Membership; Contract specification; Clearing & Settlement; Open interest; Implied interest rate; Implied volatility; Risk management; Debt derivatives.

Mathematics and Statistics

- Measures of central tendency; Return and Risk.

For more information, click on Securities Market Basic Module (Foundation Module) FAQ.

Preparatory Guide for Securities Market Basic Module (Foundation Module)

To crack any examination you need to have a proper plan and study guide. There is an endless list of resources that you can use for exam preparation. For acing the Securities Market Basic Module (Foundation Module) you need to prepare, practice, and work hard. To help you out, we have provided all of the required material and information along with the Securities Market Basic Module (Foundation Module) study guide here:

Refer the Exam Guide

To clear any examination it is very important to know the course content and outline. The Securities Market Basic Module (Foundation Module) has the following modules which you should prepare and practice:

- Securities Market in India – An Overview

- Primary Market

- Secondary Market

- Government Securities Market

- Derivatives Market

- Mathematics and Statistics

Reference Books

To help you out we have provided with the books that will help you in preparing for the Securities Market Basic Module (Foundation Module) examination.

- A Beginner’s Guide to the Stock Market: Everything You Need to Start Making Money Today by Matthew R. Kratter

- Stock Investing For Beginners: How To Buy Your First Stock And Grow Your Money by John Roberts

Join Study Groups

It is very important to interact with people who have a common aim in life. Joining study groups is a good way to get yourself fully involved with the certification exam you applied for. These groups will help you get up to date with the latest changes or any update happening exam. Also, these groups contain both beginners as well as professionals.

Practice with testpreptraining

It is very important to practice what you have learned so that you are in a position to analyze your practice. With, Securities Market Basic Module (Foundation Module) Mock Tests you will be able to improve your answering skills that will result in saving a lot of time. Moreover, the best way to start doing practice tests is after completing one full topic as this will work as a revision part for you. Start practicing now with Free Securities Market Basic Module (Foundation Module) Practice Tests!