Project Finance Module (Intermediate)

The Project Finance Module (Intermediate) is an NSE certification. Projects are in high demand in developing countries like India. However, capital is in short supply. There is a pressing need to direct funds to the most deserving projects. Furthermore, the pool of capital must be enlarged through private sector participation. Better infrastructure can help boost the country’s overall growth. However, several unique demands must be addressed before non-government cooperation in creating infrastructure for the country may be envisaged. This module covers commercial and policy challenges that arise while establishing commercial initiatives and national infrastructure.

Who should take the exam?

- Students

- Finance Professionals

- Employees with banks and the financial service sector

- Anybody have an interest in this subject

Why should one take this course?

- To have a comprehensive and broad based knowledge about project finance.

- To get acquainted with estimating the cost of a project, various tools used to assess feasibility of projects, benefits of sensitivity analysis and scenario analysis, various sources of project finance and issues related to mobilizing project finance and newer structures of infrastructure financing, role of taxation and incentives in projects.

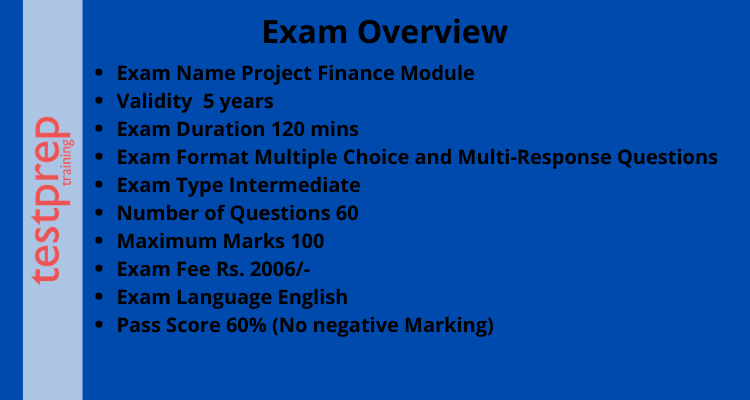

Exam Overview

The Project Finance Module (Intermediate) examination has 60 questions that are in the multiple-choice format. Furthermore, the total time duration given to complete this examination is 120 minutes and you need to pay INR 2006/- for this examination. This certification is valid for 5 years. Last but not least, this examination is available in the English language only. The passing score is 60% and above.

Course Outline

The Project Finance Module (Intermediate) examination covers the following topics:

Project Finance Background

- Evolution of project finance

- Project Types

- Critical steps in a project

Market Analysis

- Background

- Market Sizing:

- Demand function estimation

- Rule of Thumb

- Experts’ Poll

- Consumer, Customer and Influencer

- Market Insight areas

- Market Research Approaches

Business Model, Competencies and Promoter Analysis

- Business Model

- Competencies: (i) Core competency (ii) Competency Match

- Promoter Analysis: (i) Track Record (ii) Financial Standing (iii) Integrity

Estimating Cost of Project

- Project specifications

- Estimating Fixed Capital Investment in Project

- Estimating working capital investment in the project

Project Feasibility Analysis

- Background

- Net Present Value (NPV)

- Profit v/s Cash Flow

- Discount Rate

- Tax-Shield on Interest

- Tax-Shield on depreciation

- Internal Rate of Return (IRR)

- XIRR

- MIRR

- Project IRR and Equity IRR

- Payback Period

- Discounted payback period

- Economic IRR

Financial Projections

- Background

- Assumptions

- Cost of Project & Means of Financing

- Projected Profit & Loss Account

- Next, Projected Balance Sheet

- Projected Funds Flow

- Project IRR

- Equity IRR

- Loan Servicing Capability: (i) Interest Coverage Ratio (ICR) (ii)

- Debt Service Coverage Ratio (DSCR) (iii) Long Term Debt Service

- Coverage Ratio (LDR)

- Sensitivity Analysis

- Building Scenarios

Project Finance and their Sources

- Prudence in Mix of Long Term and Short Term Finance

- Forms of Long Term Project Finance

- Forms of Short Term Project Finance

- Lease

- Role of Non-Banking Finance Companies (NBFC)

- Loan Documentation

Infrastructure and Public Private Partnerships

- Background

- PPP Models

- Parties to a PPP Model

- PPP Process

- Model Concession Agreements (MCA): (i) Highways (ii) Greenfield

- Airports (iii) Transmission of Electricity

Novel Structures in Infrastructure Finance

- Background

- Take-out Financing

- Securitisation

- Viability Gap Financing (VGF)

- Infrastructure Debt Fund

- High Level Committee on Financing of Infrastructure

Taxation and Incentives

- Taxation: (i) Depreciation (ii) Amortisation of Preliminary Expenses (iii) Amortisation of Telecom License Fees (iv) Interest on borrowed capital (v) Disallowances under the Act (vi) Expenses, in General (vii)

- Compulsory Audit

- Incentives

- Maharashtra Package Scheme of Incentives

Project Risks and their mitigation

- Background

- Project Conceptualisation Risk

- Financial Closure Risk

- Project Construction Risk

- Political Risk

- Market Risk

- Supply Chain Risk

- Policy Risk

- Exchange Risk

- Environmental Risk

- Force Majeure

For more information, click on Project Finance Module (Intermediate) FAQ.

Preparatory Guide for Project Finance Module (Intermediate)

When it comes to any examination, you must prepare with the appropriate resources. There are a plethora of materials available to help you prepare for your exams. You must prepare, practise, and work hard in order to pass the Project Finance Module (Intermediate). To assist you, we have supplied all of the necessary materials and information, as well as a study guide for the Project Finance Module (Intermediate) here:

Refer the Exam Guide

To clear any examination it is very important to know the course content and outline. The Project Finance Module (Intermediate) has the following modules which you should prepare and practice:

- Project Finance Background

- Market Analysis

- Business Model, Competencies and Promoter Analysis

- Project Feasibility Analysis

- Financial Projections

- Project Finance and their Sources

- Infrastructure and Public Private Partnerships

- Novel Structures in Infrastructure Finance

- Taxation and Incentives

- Project Risks and their mitigation

Learning Resources

It is very important to prepare with the right resources. To clear any examination all you need to work hard but efficiently and in a smart manner. To help in your preparation for the Project Finance Module (Intermediate) examination we have provided the resources:

Reference Books

Books are an essential part of the preparation, searching for the right study material has always been a difficult and tedious task. For theProject Finance Module (Intermediate) examination you can refer to the following books:

- Principles of Project Finance by E. R. Yescombe

Join Study Groups

Joining study groups is a good way to get yourself fully involved with the certification exam you apply for. Furthermore, these groups will help you get up to date with the latest changes or any update happening exam. Also, these groups contain both beginners as well as professionals. You can ask any query related to the exam or you can talk about the exam without any hesitation. Moreover, here you can start any discussion about the issue related to the exam or any query. By doing so, you will get the best possible answer to your query.

Start Practicing with Testpreptraining

A man becomes flawless by practise. Practice will actually assist you in identifying the areas of your preparation that want improvement. After you’ve finished your studies, you should try out some sample papers and practise tests. This will assist you in self-evaluation and make you a more confident person on exam day. The emergence of practice tests has only added to its generous nature. They are regarded as one of the most effective resources for exam preparation. As a result, it is highly recommended that you take as many practice tests as possible. Now is the time to get started with Testprep Training!