FIMMDA-NSE Debt Market Basic Module (Foundation)

FIMMDA-NSE Debt Market (Basic) Module helps in understanding the basic concepts of different types of debt instruments. This includes G-secs, T-bills, CPs, Bonds, and CDs. Further, this module provides:

- Firstly, useful insights into the Indian debt market and its various components

- Secondly, the trading mechanism of debt instruments in stock exchanges and bond valuation.

FIMMDA-NSE Debt Market (Basic) Module: Knowledge Enhancement

FIMMDA-NSE Debt Market (Basic) Module can help in gaining the knowledge and skills in various areas. This include:

- Firstly, this module will help to understand the fundamental features of debt instruments.

- Secondly, it includes concepts related to the trading of the debt instruments on the NSE-WDM Segment.

- Thirdly, this helps in understanding the regulatory and procedural aspects related to the debt market.

- Lastly, this module helps in learning the concepts of bond valuation, yield curve, bootstrapping, and duration.

Target Audience

For, FIMMDA-NSE Debt Market (Basic) Module, the best suitable audience include:

- Firstly, Students

- Secondly, Teachers

- Thirdly, Debt Market Dealers

- Then, Employees of BPO/IT Companies

- Lastly, individuals with interest in the Fixed Income Market

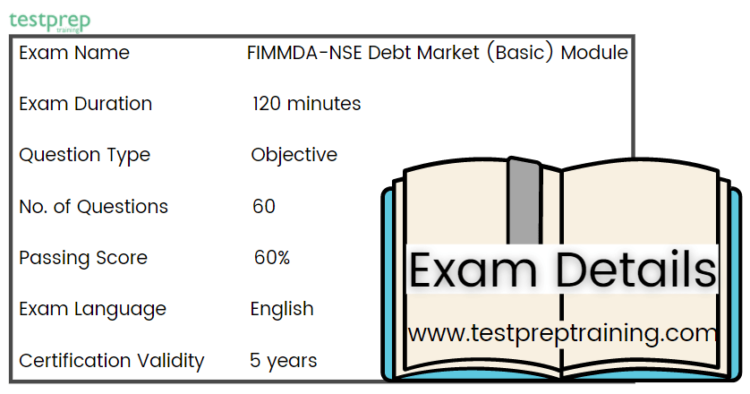

NSE FIMMDA Exam Details

NCFM offers online exams and self-study based exams that are conducted across India. FIMMDA NSE Debt Market Module Exam Questions are available in the English language. For the FIMMDA-NSE Debt Market (Basic) Module, Open Office Spreadsheet will be provided with an allowance for all types of calculators during the test. And, there will be a 0.25% negative marking for any incorrect answers.

In FIMMDA-NSE Debt Market (Basic) Module:

- Firstly, there will be a total of 60 questions in the exam with a time duration of 120 minutes. The questions will be objective type only in which, for every question, you will find four / five alternative answers from which you have to select the correct one.

- Secondly, it is necessary to score 60% in order to pass the exam.

- Lastly, the FIMMDA-NSE Debt Market (Basic) Module will cost Rs.2006/ inclusive of GST. And, the NCFM certification is valid only for 5 years.

Exam Registration

For the NCFM exam, registration can be done online by accessing the link ‘Online Registration’. This is available under Education. After opening the link, click on Certifications and then, Register / Enroll. Once registration is done, you will receive a unique NCFM registration number along with a user id and password. Alternatively, a confirmation will be sent both on your email id and mobile number provided during registration. After logging in you can:

- Firstly, have access to make payment for the NCFM exam.

- Secondly, enroll for the test.

- Thirdly, update the address details.

- Lastly, check the status of the study material. And, view the certificates

Point to remember:

- Firstly, it is necessary to provide the updated address in an online NCFM profile. However, for updating addresses candidates need to access the link ‘Edit Profile’ available in their NCFM online login.

- Secondly, the NCFM registration number is unique and a candidate has to use the same NCFM registration number while enrolling for any module.

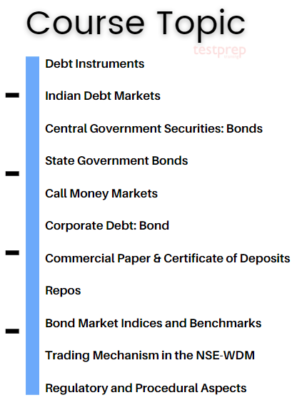

FIMMDA NSE Debt Market Module : Course Structure

NCFM provides a course outline for the FIMMDA-NSE Debt Market (Basic) Module to help in understanding the concepts in a sequential manner. This include:

1. Debt Instruments

- Basic concepts of debt instruments

2. Indian Debt Markets

- Different types of products and participants

- The secondary market for debt instruments

3. Central Government Securities: Bonds

- Primary issuance process

- Participants in Government bond markets

- Constituent SGL accounts

- Concept of Primary dealers, Satellite dealers

- Secondary markets for Government bonds

- Settlement of trades in G-Secs

- Clearing corporation

- Negotiated Dealing System

- Liquidity Adjustment Facility (LAF)

4. State Government Bonds

- Firstly, the Gross fiscal deficit of State Governments and their financing

- Volume, Coupon rates, and ownership pattern of State Government bonds

5. Call Money Markets

- Participants in the call markets

- Call rates

6. Corporate Debt: Bond

- Market segments

- Issue process

- Issue management and Book building

- Terms of a Credit rating

7. Commercial Paper & Certificate of Deposits

- Guidelines for CP Issue

- Rating notches for CPs

- Growth in the CP market

- Stamp duty

- Certificates of deposit

8. Repos

- Repo rate

- Calculating settlement amounts in Repo transactions

- Advantages of Repos

- Recent

- Issues in the repo market in India

- Secondary market transactions in Repos

- Repo accounting

9. Bond Market Indices and Benchmarks

- I-Bex: Sovereign bond index

- NSE-MIBID/MIBOR

10. Trading Mechanism in the NSE-WDM

- Description of the NSE WDM trading system

- Order types and conditions

- After that, Order entry in negotiated trades market

- Order validation and matching

- Trade management

- Reports

- Settlement

- Rates of Brokerage

11. Regulatory and Procedural Aspects

- G-Sec Act 2006

- SEBI (Issue and Listing of Debt Securities) Regulations 2008 and Market Practices and Procedures

For More Check: FIMMDA-NSE Debt Market (Basic) Module FAQs

NCFM Procedures

NCFM has various exam procedures to help the individuals in understanding the exam policies as well as the way of taking the exam. Some of them include:

Test Taking Procedure

- Firstly, NSE has designated test centers for giving exams that are selected at the time of enrollment.

- Secondly, NSE has a policy that candidates need to be present at the test center 30 minutes prior to the test time. If they reach late then they will not get access to take the test. Furthermore, they can also be required to enroll again for the exam.

- Thirdly, an original Photo ID proof of verification is necessary on the exam day. This can be, PAN card, Driver’s License, Passport, Employee ID, Voter’s ID card, or Student ID card.

- Next, a backup sheet and rough sheet(s) will be provided during the test that has to be returned after completion of the exam. And, the scientific calculator and a pen are also allowed during the test.

Uploading Photo

Candidates can upload photos by accessing the link ‘Upload Photo’. This link is available in their NCFM online login. However, for uploading photo there are certain things you need to check:

- Firstly, the photo being uploaded should be passport size (3 X 3 cms or 1 X 1 inch or 150 X 180 pixels).

- Secondly, it should be in JPEG format.

- Lastly, the photo file size should be below 30 KB.

Issuing Certificate

The certificates for modules will be given to the candidates passing the exam at the test center itself. Those getting failed will receive a scorecard at the test center. However, the candidates need to ensure that they must collect their results before leaving the test center. And, the certificates can be viewed online under the link ‘Query/Report’ available in their NCFM online login portal.

Preparation Guide for FIMMDA-NSE Debt Market (Basic) Module

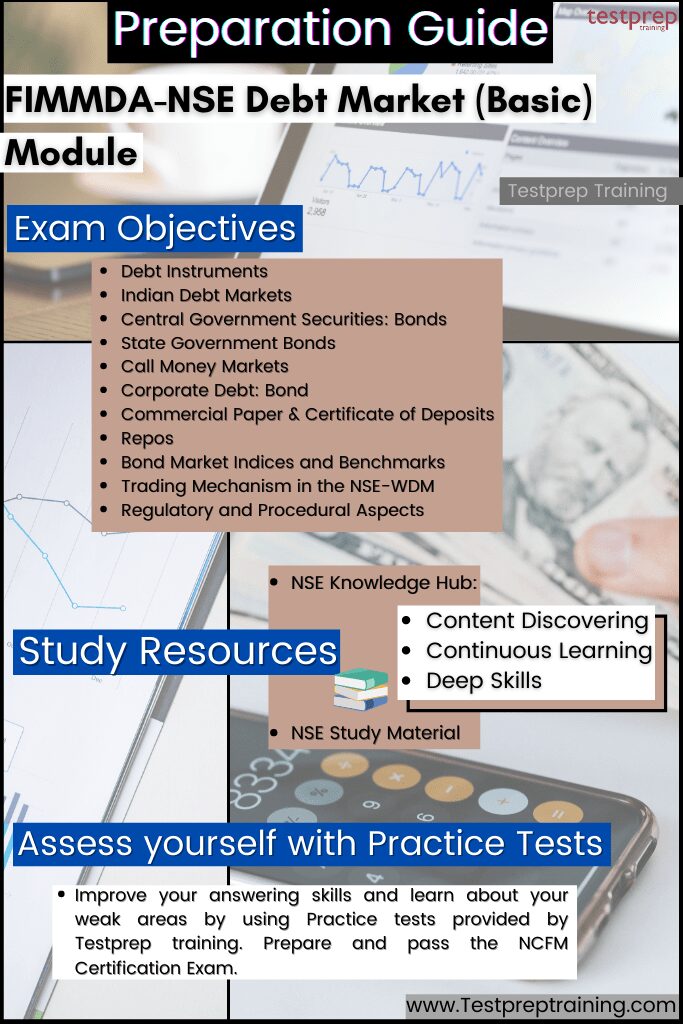

Getting Familiar with Exam Objectives

For FIMMDA-NSE Debt Market (Basic) Module, NCFM provides the course outline. This course outline includes topics categorized into various sections and subsections. Thus, to help candidates to start their preparation in a sequential way. For FIMMDA-NSE Debt Market (Basic) Module, the course outline includes:

- Firstly, Debt Instruments

- Secondly, Indian Debt Markets

- Thirdly, Central Government Securities: Bonds

- Then, State Government Bonds

- Next, Call Money Markets

- After that, Corporate Debt: Bond

- Commercial Paper & Certificate of Deposits

- Then, Repos

- After that, Bond Market Indices and Benchmarks

- Trading Mechanism in the NSE-WDM

- Lastly, Regulatory and Procedural Aspects

NSE Knowledge Hub

NSE knowledge hub is an AI-First and Mobile-First ecosystem that provides personalized and community-based learning. This knowledge hub provides a unique Artificial Intelligence (AI) powered learning platform to help in financial learning. Further, this also helps academic institutions in preparing advanced future-ready talent for the financial services industry. NSE Knowledge Hub offers candidates:

- Firstly, to become a part of a growing learning community.

- Secondly, to get access to unlimited content.

- Thirdly, to get learning assistance from experts in this field.

- Lastly, to learn from anywhere.

Content Discovering

Get familiarity with banking, insurance and finance topics by discovering content in various domains of finance.

Continuous learning

Use formal and informal learning through hours of arranged content tailored to the individuals areas of interests and goals.

Deep skills

Get free or paid deep skilling pathways at a marketplace with well-known providers of courses, assessments, labs and credentials.

NSE Study Material

NSE provides a workbook for its all certification exam that can be issued only after making payment for the module. This NSE FIMMDA Debt Module workbook can be easily downloaded by logging into your account from the E-Library option. However, NSE also offers candidates to purchase the Workbooks for NCFM modules by sending a request letter. This has to be done along with a demand draft of Rs. 500/- per module per workbook. But, they should remember that the request letter should have:

- Firstly, valid candidates name

- Secondly, the module name

- Thirdly, complete postal address

- Lastly, contact details as well as the demand draft details.

Start Taking Practice Tests

FIMMDA NSE Debt Market Module Practice Tests can be really helpful during the preparation of the exam. Assessing yourself after completing a topic/section will not only help you improve your answering skills but also to know about your weak areas. Moreover, these FIMMDA NSE Debt Market Module Sample Questions will enhance your knowledge about the concepts of this module to get more perfection in your revision. So, start doing research to find the unique practice tests and pass the exam with a good score. Try a FIMMDA NSE Debt Market Module Free Test now!