Certified Regulatory Compliance Manager (CRCM)

The Certified Regulatory Compliance Manager (CRCM) credential is intended to be one of the most widely recognized and prestigious credentials for banking compliance professional. Because obtaining this valuable degree is a bit challenging, the certification is given significant respect and importance. The certification’s difficulty level is believed to be attributable to experience qualifications, well-structured and broad knowledge of the relevant subject, passing the actual test, and maintaining the certification. This highly regarded qualification is already held by many of the best compliance professionals and consultants.

Professional Experience of a Compliance Manager

The professional experience for this designation demands that the applicant has a detailed range of compliance risk functions. These processes include but are not restricted to:

- The accomplishment of compliance risk assessments, exams or audits

- Managing, formulating or putting to use all aspects of a compliance risk management program to make sure of compliance with U.S. federal laws and regulations.

The job duties should be aiming at compliance risk management:

- Consultation as a subject matter specialist

- Bank’s compliance program examination

- Oversight, implementation, and program designing

- Auditing, enforcement or administration of compliance-related policies, processes, methods.

CRCM Certification Requirements

To be qualified to take the ABA’s Certified Regulatory Compliance Manager (CRCM) exam, candidates must complete the following prerequisites.

- Candidates must have an experience as a Compliance Professional for at least Six (6) years. This experience is required to be within the last ten (10) years. three (3) years of which should be within the last five (5) years.

OR

- Candidates must have experience as a Compliance Professional for at least three (3) years

- And, must complete two of the below-mentioned compliance-related training options. These courses must, however, have been finished within the last five (5) years –

- ABA Compliance School – Foundational

- ABA Compliance School – Intermediate

- ABA Certificate in Deposit Compliance and ABA Certificate in Lending Compliance

- ABA CRCM Exam Prep or CRCM Exam Online Prep

- ABA-led in-bank ABA CRCM Compliance School

- 30 Training credits (1 credit = 50 minutes)

Certified Regulatory Compliance Manager (CRCM) Interview Questions

Training Credits

The training and courses relevant to the compliance-related training options’ 30 training credits are shown below. These credits differ according on the year in which ABA events were completed.

- ABA Compliance School – Advanced (40 credits)

- ABA Regulatory Compliance Conference (25 credits)

- ABA Financial Crimes Enforcement Conference (25 credits)

- ABA Training Courses

- State Bankers Association Regulatory Compliance Schools and Training

Exam Details

The Certified Regulatory Compliance Manager (CRCM) exam details include:

| Exam Name | Certified Regulatory Compliance Manager |

| Exam Code | CRCM (ABA Certification) |

| Exam Duration | 4 hours |

| Exam Format | Multiple Choice and Multi-Response Questions |

| Exam Type | Professional |

| Number of Questions | 200 Questions |

| Exam Fee | $750 USD |

| Retake Fee | $450 USD |

| Exam Language | English |

For More Details See – Certified Regulatory Compliance Manager (CRCM) FAQ

CRCM Exam Outline

The Certified Regulatory Compliance Manager CRCM exam outline encompasses the following domains –

Domain 1: Assessment and Management of Compliance Risk (28%)

- Task 1: Act as a compliance subject matter expert on projects and committees.

- Task 2: Evaluate development of, or changes to, products, services, processes, and systems to determine compliance risk and also impacts and ensure policies remain compliant.

- Task 3: Provide compliance support to internal and external parties (e.g., answer questions, review marketing and external communications, conduct research and analysis).

- Task 4: Review and/or provide compliance training to applicable parties.

- Task 5: Participate in conducting due diligence for vendors.

- Task 6: Design and maintain a comprehensive compliance risk assessment program to identify and also mitigate risk within the organization’s risk appetite.

- Task 7: Conduct compliance risk assessments in accordance with the risk assessment program to evaluate relevant information (e.g., inherent risk, control environment, residual risk, potential for consumer harm) and also communicate results to applicable parties

Domain 2: Compliance Monitoring (25%)

- Task 1: Define the scope of a specific monitoring or testing activity.

- Task 2: Test compliance policies, procedures, controls, and transactions against regulatory requirements to identify risks and potential exceptions.

- Task 3: Review and confirm potential exceptions, findings, and recommendations with business units and also issue final report to senior management.

- Task 4: Validate that any required remediation was completed accurately and within required timelines.

- Task 5: Administer a complaint management program.

- Task 6: Review first line compliance monitoring results and develop an action plan as needed.

- Task 7: Evaluate the reliability of systems of record and also the validity of data within those systems that are used for compliance monitoring

Domain 3: Governance and Oversight (10%)

- Task 1: Establish and maintain a compliance management policy to set expectations for the board, senior management, and business unit responsibilities.

- Task 2: Develop, conduct, and track enterprise-wide and/or job-specific compliance training.

- Task 3: Conduct periodic reviews of the compliance management program to evaluate its effectiveness and communicate results to appropriate parties.

Domain 4: Regulatory Change Management (15%)

- Task 1: Monitor and evaluate applicable regulatory agency notifications for new compliance regulations or changes to existing regulations to assess potential regulatory impacts and remediation needs.

- Task 2: Assess new, revised, or proposed regulatory changes for compliance impacts, communicate to the appropriate parties, and develop action plans as needed.

- Task 3: Assess regulatory guidance and compliance enforcement actions to determine if remediation is required to address potential compliance impacts.

- Task 4: Report on the status of regulatory changes and implementation to appropriate parties.

- Task 5: Monitor and validate action plans for confirmed regulatory impacts to ensure timely adherence to the mandatory compliance date.

Domain 5: Regulator and Auditor Compliance Management (11%)

- Task 1: Prepare and review requested audit/exam materials to ensure timely and accurate fulfillment and self-identify potential areas of concern.

- Task 2: Participate in audit/exam meetings to provide business overviews, address questions, discuss findings, or provide updates to appropriate parties.

- Task 3: Review and draft responses to audit/exam results and ensure action plans are developed and communicated to appropriate parties.

- Task 4: Report on action plan status to appropriate levels of management and auditors/examiners.

- Task 5: Coordinate and submit ongoing regulatory reports to auditors/examiners

Domain 6: Compliance Analysis and Internal/External Reporting (11%)

- Task 1: Analyze and validate data to support regulatory reporting and ensure accuracy and comprehensiveness.

- Task 2: Complete required reporting, ensure timely submission to the appropriate agency, and resubmit when required.

- Task 3: Develop, implement, and monitor a plan of action to prevent future reporting errors or breakdowns.

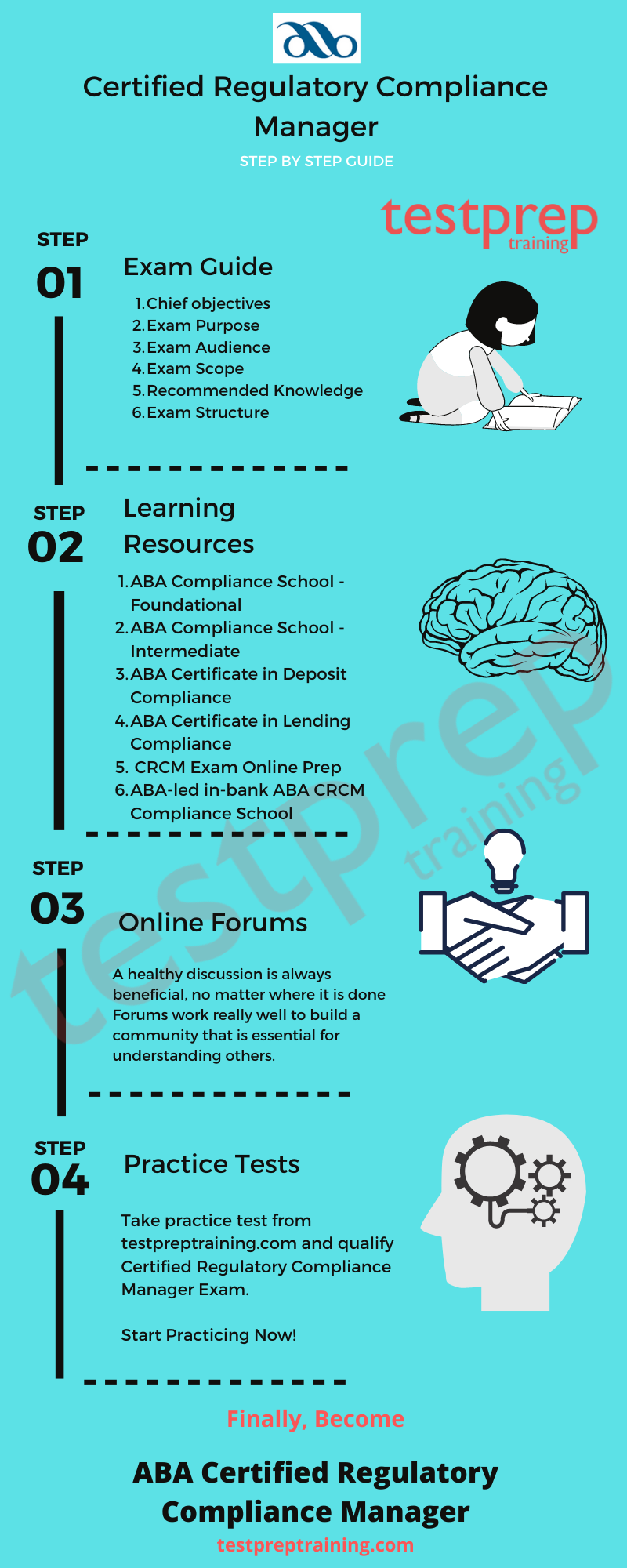

Certified Regulatory Compliance Manager CRCM Study Guide

– ABA Trainings:

1. ABA Compliance School – Foundational

The ABA Compliance School – Foundational training course is well designed by most esteemed compliance practitioners and others who have mastery in offering detailed educational experience in a changing environment. The course will help us comprehend and develop an essential technical awareness of major compliance problems and strengthen the pillar of developing and maintenance of an effective compliance program. It offers a combination of live and on-demand classes over a two and a half week period.

2. ABA Compliance School – Intermediate

The ABA Compliance School – Intermediate is an intermediate course. Not only does it provides a practical approach to compliance regulation but also helps in developing compliance professionals at all stages of career experience. It includes practical applications in conducting a risk assessment, compliance in loan servicing, identifying UDAAP susceptibilities and identifying loans, etc. Compliance regulations are required to be put into usage every day, concentrating on the important issues and matters that compliance professionals have to encounter nowadays.

3. CRCM Exam Online Prep

The ABA CRCM Exam Prep or CRCM Exam Online Prep course helps a student learn and know how to practice his/her aptitude to complete works in each knowledge field, prepare well for the actual examinations, examine knowledge in key compliance matters, processes, demonstrating compliance expertise. Features like confidence meters and self-assessment tools render effective feedback for self-development. The course consists of readings, audio-video lessons, practice tests, and online discussion boards.

4. ABA Certificate in Deposit Compliance

The ABA Certificate in Deposit Compliance training course is specifically planned and conducted to help students gain a complete understanding of basic deposit rules, as well as the capacity to recognize and respond properly to compliance needs. It provides a welcoming environment in which students can learn at their own pace and has unlimited access to all courses for a year.

5. ABA Certificate in Lending Compliance

The ABA Certificate in Lending Compliance is a full 17-course curriculum that is accessible for a definite period of 12 months at a candidate`s own pace is offered here. It is a good way of showcasing to examiners and bank management a candidate`s strongly built foundation in core lending regulations, the capability to recognize and respond quickly to the requirements of the compliance.

6. ABA-led in-bank ABA CRCM Compliance School

The ABA-led in-bank ABA CRCM Compliance School is a 5-day immersive learning experience with content getting delivered by some top industry experts and practitioners. The participants are required to cover the terminology, regulations, and the technical foundation which is essential for developing and maintaining an efficient compliance program. It gives sufficient preparation and course credits toward the CRCM designation. The program targets to cover all the basic fundamental knowledge on the Certified Regulatory Compliance Manager (CRCM) exam: financial crimes, bank operations, privacy, lending, and deposit operations regulations. The curriculum is therefore intended to provide the staff with a clear-cut comprehension of the responsibilities concerning compliance.

– Practice Tests

The more answers you get right in a CRCM practice exam paper, the more confident you’ll feel for the examination. Also, you will know exactly how much time and effort needs to be invested in a different section of the question paper. Your brain will get trained to be at its highest potential for the duration of the exam. All of these factors can make a huge difference. Remember, your result does not reflect how much you know, but how much you wrote. Talent can only be judged if it translates well in performance.