Fraud can take many forms, from financial statement fraud and corruption to asset misappropriation and cybercrime. To combat these threats, organizations need individuals who are well-versed in fraud prevention and detection. A Certified Fraud Examiner (CFE) is a recognized expert in this area, possessing the skills and knowledge needed to identify and investigate fraudulent activity.

To become a CFE, you must first meet certain eligibility requirements, such as having a bachelor’s degree and relevant professional experience. You’ll also need to join the Association of Certified Fraud Examiners (ACFE) and adhere to its code of ethics. Once you’ve met the eligibility criteria, you’ll need to pass the CFE Exam, which covers four main areas: Financial Transactions and Fraud Schemes, Law, Investigation, and Fraud Prevention and Deterrence. The exam is rigorous, but with the right preparation, you can increase your chances of success.

In this blog, we’ll cover everything you need to know about becoming a CFE, including the benefits of certification, the eligibility criteria, the exam process, and tips for exam preparation. Whether you’re already working in the field of fraud examination or looking to transition into this exciting and challenging field, this guide will provide you with the information you need to achieve your career goals.

Tips to become a Certified Fraud Examiner (CFE)

To become a Certified Fraud Examiner (CFE), you will need to follow these steps:

- Meet the eligibility criteria: You need to have a bachelor’s degree or equivalent from a recognized institution and have two years of professional experience related to fraud prevention, detection, and deterrence. If you do not have a degree, you can substitute this requirement with additional professional experience.

- Apply for the CFE exam: You need to submit an application and the required documents, including transcripts and proof of professional experience, to the Association of Certified Fraud Examiners (ACFE).

- Pass the CFE exam: The CFE exam consists of four sections: Fraud Prevention and Deterrence, Financial Transactions and Fraud Schemes, Investigation, and Legal Elements of Fraud. You need to score a minimum of 75% in each section to pass the exam.

- Meet the CFE ethical requirements: You need to agree to abide by the ACFE’s Code of Professional Ethics, which includes integrity, objectivity, confidentiality, and professional competence.

- Complete the CFE application process: After passing the CFE exam and meeting the ethical requirements, you need to complete the application process, which includes paying the membership fee and submitting the necessary documents.

- Maintain your CFE certification: You need to earn 20 Continuing Professional Education (CPE) credits annually to maintain your CFE certification. The ACFE offers various opportunities for CPE credits, including attending conferences, webinars, and training sessions.

Here are some additional details and tips to help you become a Certified Fraud Examiner (CFE):

- The ACFE recommends that you have at least two years of professional experience in a field related to fraud prevention, detection, and deterrence before taking the CFE exam. This experience can include work in accounting, auditing, investigations, law enforcement, or compliance.

- The CFE exam is computer-based and is offered in testing centers around the world. You can register for the exam on the ACFE website.

- The ACFE provides study materials to help you prepare for the CFE exam, including textbooks, study guides, and practice exams. You can also attend in-person or online CFE Exam Review Courses to prepare for the exam.

- The CFE exam consists of 500 multiple-choice questions and is divided into four sections. Each section has a time limit of two hours, and you must complete all four sections within a 30-day period.

- The ACFE’s Code of Professional Ethics requires CFEs to maintain confidentiality, avoid conflicts of interest, and act with integrity and objectivity in their work.

- Once you become a CFE, you can network with other fraud prevention professionals and access resources, such as job listings, research reports, and webinars, through the ACFE.

- Continuing Professional Education (CPE) credits are required to maintain your CFE certification. You can earn CPE credits by attending ACFE events, completing online courses, or publishing articles or books on fraud-related topics.

Becoming a Certified Fraud Examiner can be a challenging but rewarding process, and it can help you advance your career in fraud prevention, detection, and deterrence.

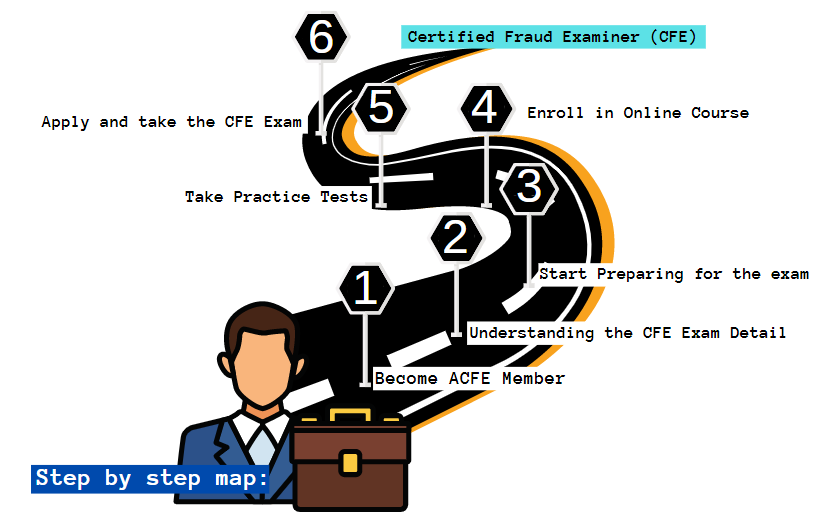

Pathway to Become Certified Fraud Examiner (CFE)

Certified Fraud Examiners (CFEs) are highly appreciated by businesses of all sizes, industries, and sectors for their skill in preventing and detecting fraud. However, the best way to get into this area is to join ACFE to get a membership and take the Certified Fraud Examiner (CFE). Let’s get better clarity on this on our pathway.

Step 1: Become ACFE Member

To take the CFE Exam and achieve your CFE certificate, you must be a member. However, associate members who want to take their career to the next level by obtaining the standard of professional excellence in the anti-fraud industry can join the Certified Fraud Examiner (CFE) program. Businesses, government organizations, and law enforcement agencies are progressively designating the CFE degree as the desired credential in their recruiting policies.

Prerequisites for CFE Membership:

- ACFE Associate membership in good standing

- Secondly, minimum academic and professional requirements must be fulfilled

- High moral character

- Lastly, agreement to abide by the Bylaws and Code of Professional Ethics of the Association of Certified Fraud Examiners

But, why become a member?

Become a member will:

- Increase your earnings

- According to a survey, CFEs earn 34% more than their non-certified counterparts.

- Secondly, advance your career

- The CFE certification represents a high degree of ability, knowledge, and professionalism. Moreover, it recorded as evidence of competence and experience.

- Thirdly, gain professional visibility and credibility

- The CFE is widely recognised as the standard in the anti-fraud field.

- Then, distinguish yourself from your peers

- The FBI, the United States Department of Defense, and the United States Securities and Exchange Commission all accept the CFE certificate in their recruiting and advancement processes (SEC).

- Lastly, impact your company’s bottom line

- According to ACFE data, firms with CFEs on staff identify fraud 50 percent faster. And, they have 62 percent lower fraud losses than organisations without CFEs on staff.

Step 2: Understanding the Certified Fraud Examiner (CFE) Exam

The CFE Exam assesses your understanding of the four primary areas that make up the body of fraud examination knowledge. The CFE Exam might take up to ten hours to complete. There are 125 questions in each of the four sections. Further, to pass the exam, you must get at least 75% of the questions right on each segment. You must request the Exam Activation Key before taking the exam. The areas include:

1. Financial Transactions and Fraud Schemes

- This test assesses your knowledge of the several forms of fraudulent financial transactions that may be found in accounting records. Therefore, you must demonstrate understanding of the following topics to pass Financial Transactions & Fraud Schemes:

- Fundamental accounting and auditing theory

- Fraud schemes

- Internal controls to discourage fraud

- Other auditing and accounting concerns.

2. Law

- This ensures that you are well-versed in the various legal implications of conducting fraud investigations, including criminal and civil law, evidentiary regulations, accused and accuser rights, and expert witness issues.

3. Investigation

- This covers topics such as:

- Interviewing

- Getting statements

- Acquiring information from public documents

- Tracing criminal activities, analysing deceit, and report drafting.

4. Fraud Prevention and Deterrence

- This improves your knowledge of why individuals commit fraud and how to avoid it. However, the topics covered in this section include:

- Crime causation

- White-collar crime

- Occupational fraud

- Fraud prevention

- Fraud risk assessment

- ACFE Code of Professional Ethics.

Exam Format:

Prometric’s exam delivery technology is used to conduct the CFE Exam. You have two options for taking your exam:

- Firstly, using Prometric’s online proctoring platform in a private location of your choice.

- Secondly, in your area, at a Prometric Test Center.

You must book your exam appointments directly via Prometric after getting clearance from the ACFE. You’ll have 60 days to finish the exam’s four components. Additional costs will apply to changes made within 30 days of an exam appointment. Further, you may take the CFE Exam from the convenience of your own home or workplace, eliminating the need to travel or test with other individuals. However, not everyone is a good fit for remote proctoring. Lastly, if you have technical or logistical difficulties with online remote testing, you can test in any of Prometric’s testing facilities located around the world.

Step 3: Preparing for the exam

ACFE provides methods to prepare for the CFE Exam. This includes:

➼ Self-Directed CFE Exam Course

Choose from a variety of self-directed exam preparation options to find the tool that best meets your needs.

CFE Exam Prep Course

Reference: CFE Exam Prep Course

- The Prep Course is a self-study computer application that includes a Pre-Assessment, questions with quick feedback, and direct connections to the source material in the included digital copy of the Fraud Examiners Manual, and sample examinations to help you prepare.

CFE Exam Prep Toolkit

Reference: CFE Exam Prep Toolkit

- The CFE Test Prep Course is a computer-based self-study program that helps you prepare for the exam while allowing you to work at your own speed. The Fraud Examiners Manual, from which the CFE Exam is formed, captures the body of knowledge of the anti-fraud profession. Further, enhance the CFE Exam Prep Course with an app that contains almost 800 flashcards to help you learn the vocabulary and topics presented on the exam.

CFE Exam Prep Course+

Reference: CFE Exam Prep Course+

- Upgrade to the CFE Exam Prep Course+ to get everything in the Prep Course plus 20 hours of on-demand video instruction from experts who will walk you through the most critical concepts, an additional workbook to help you concentrate your study efforts, and more.

Fraud Examiners Manual

Reference: Fraud Examiners Manual

- All questions in the CFE Exam are chosen from the Fraud Examiners Manual, which comprises the body of knowledge of the anti-fraud profession. Although this method of self-directed study is the most cost-effective, it also demands the greatest time and self-discipline in order to prepare for the exam.

➼ CFE Exam Review Course

This four-day instructor-led training will help you learn the financial transactions and fraud schemes, law, investigation, and fraud prevention and deterrence principles examined on the CFE Exam. This course, when combined with the CFE Exam Prep Course software, will give you an unparalleled advantage in passing the exam.

➼ Study Manual: The Essential Resource for Anti-Fraud Professionals

The Fraud Examiners Manual is the authoritative body of knowledge for the anti-fraud profession, offering anti-fraud specialists with comprehensive instruction that no other work can equal. Further, the Fraud Examiners Manual is now more accessible and valuable than ever before, thanks to internet access.

Further, benefits of Online Access:

- Content Updates in Real Time – Get the most up-to-date anti-fraud knowledge available.

- Supplemental Information — Search an ever-expanding database of nation and region-specific data.

- Designed for Multiple Devices — The Fraud Examiners Manual is accessible from any internet-connected device.

Step 4: Enroll in Online Course

To become a Certified Fraud Examiner, you’ll need a complete understanding of financial transactions and fraud schemes, law, investigation, and fraud prevention and deterrence (CFE). You’ll need to gain the appropriate abilities for this. However, this can be accomplished by taking the online Certified Fraud Examiner (CFE) course. Taking the online course will aid you in studying for the test by providing expert-level support in resolving any difficulties or queries you may have.

Here are a few online course providers that may assist you in becoming well-versed and equipped with in-depth knowledge in order to pass the test.

- Udemy

- Testprep Training

- IMFA Academy

- Exam labs

Step 5: Take Practice Tests

Practice Tests help you obtain a strong revision by allowing you to answer questions quickly. Additionally, this can help you focus on single-domain subjects, which is a good place to start while studying for a test. However, once you’ve mastered the material, begin taking full-length practice exams to identify your weak and strong areas and improve your revision skills. So, go with the above online course provider to get the best and most distinctive practice exam exams and start taking them.

Step 6: Apply and take the CFE Exam

We recommend that you apply at least one month before your CFE Exam date. Apply for the CFE Exam and pay for it online at ACFE.com/CFEExamApplication. Then, go to the Certification Portal and upload your supporting documents, which should include job experience, evidence of education, a recent photo, and professional recommendations.

➼ Applying for the CFE Exam:

Part 1: Completing the online application form and submitting payment.

Qualifications, Experience and Character, Signature Statement, and Payment are the four elements of the CFE Exam online application. However, the CFE Exam will cost you $450. The charge is $350 if you have purchased the CFE Exam Prep Course.

Part 2: Submitting your supporting documentation to the Certification Portal

You can manage your application through the Certification Portal by sending paperwork to the ACFE directly. Supporting documentation, on the other hand, includes:

- Proof of Experience:

- Information about your work experience, including duties and the proportion of time spent in each field.

- Education Proof:

- Proof of the education you declare on your exam application. Official transcripts, photocopies of degree certificates or diplomas are all acceptable forms of evidence (must be provided in English or translated to English). Further, transcripts from advisory sessions are not allowed.

- Photo:

- A recent picture. Images with poor file quality or those are blurry will not be allowed.

- Recommendations from Professionals:

- Three professional references from people who have worked with you in the past and can speak to your character, honesty, and professional abilities.

➼ Scheduling the CFE Exam:

- By clicking on your approved exam application, you may access your Certification Portal.

- Secondly, to schedule an exam, click the green “Schedule Exam” button. Make a note of the number that corresponds to your eligibility. It will lead you to the website of Prometric.

- Thirdly, choose between remote proctoring and test centre scheduling.

- However, when asked, enter your Prometric eligibility number (also known as your ACFE member number) and the first four characters of your last name.

- Then, make an appointment for your first exam.

- Lastly, repeat steps 3–5 for the remaining three exam portions on the Prometric website.

➼ Taking the CFE Exam:

- You must finish each section of the exam in one sitting once you begin it.

- Secondly, you don’t have to finish all four portions in one sitting. In fact, you should do one or two sections at a time.

- Thirdly, you have three chances to pass each portion of the exam.

- Lastly, the CFE Exam is a closed-book, no-notes examination.

Individuals who graduate from CFE – Association of Certified Fraud Examiners earn an average of Rs. 19 lakhs per year, with the majority earning between Rs. 13 lakhs and Rs. 25 lakhs per year as per a survey.

Concluding:

The CFE certificate is recognized, respected, and regarded as the gold standard of professional excellence across the world. CFE accreditation demonstrates skill, knowledge, and professionalism in the field of anti-fraud. Moreover, companies and government agencies place a high value on employing and promoting CFEs in order to address today’s challenging anti-fraud challenges as well as foresee future issues. As a result, more corporations, government organizations, and law enforcement agencies are using the CFE as a desirable credential in their employment processes. So, don’t wait and start preparing to become a Certified Fraud Examiner now.