The Certified Fraud Examiner (CFE) is a professional certification that is awarded to individuals who demonstrate expertise in fraud prevention, detection, and investigation. The CFE certification is granted by the Association of Certified Fraud Examiners (ACFE), a global professional organization that is dedicated to fighting fraud and white-collar crime.

Achieving the CFE certification requires fulfilling specific eligibility criteria and successfully navigating a challenging examination. This test evaluates candidates on their proficiency in various areas, including fraud prevention and deterrence, financial transactions and fraud schemes, investigation techniques, and the legal aspects of fraud.

Certified Fraud Examiner (CFE) Exam Glossary

Here are some key terms and concepts that are relevant to the Certified Fraud Examiner (CFE) exam:

- Fraud: Intentional deception or misrepresentation made for personal gain or to cause harm to others.

- Corruption: Misuse of public or private office or authority for personal gain.

- Asset Misappropriation: Theft or misuse of an organization’s assets, such as embezzlement, inventory theft, or false invoicing.

- Financial Statement Fraud: Intentional misrepresentation of financial statements through manipulation, omission, or falsification of financial records.

- Bribery: Offering, giving, receiving, or soliciting something of value to influence a decision or action.

- Kickbacks: Payment or compensation provided to an individual in exchange for business referrals or other favorable treatment.

- Cybercrime: Criminal activities that utilize a computer or network, encompassing actions like hacking, identity theft, or phishing.

- Whistleblowing: Reporting of illegal or unethical activity by an employee, often to a higher authority.

- Due Diligence: Process of investigating and verifying the accuracy of information before making a business decision.

- Forensic Accounting: Application of accounting and investigative skills to uncover financial fraud or irregularities.

- Internal Controls: Policies and procedures put in place to prevent and detect fraud and errors within an organization.

- Sarbanes-Oxley Act (SOX): Legislation in the United States that introduced fresh or broadened obligations for public companies and accounting firms pertaining to corporate governance and financial reporting.

- Money Laundering: Process of disguising the proceeds of illegal activity as legitimate funds.

- RICO Act: U.S. legislation that provides for the prosecution and punishment of individuals and organizations involved in racketeering activities.

- Litigation Support: Assistance provided by a CFE or other financial expert in a legal proceeding related to fraud or financial disputes.

Certified Fraud Examiner (CFE) Exam Guide

Here are some official resources for the Certified Fraud Examiner (CFE) exam:

- Association of Certified Fraud Examiners (ACFE) – This is the organization that offers the CFE certification. The ACFE website has information on the certification process, study materials, and continuing education requirements. https://www.acfe.com/

- Fraud Examiners Manual –

- This serves as the authorized study guide for the CFE exam, addressing areas like fraud prevention and deterrence, financial transactions and fraud schemes, investigation techniques, and the legal aspects of fraud. The manual can be purchased through the ACFE website. https://www.acfe.com/fraud-examiners-manual/

- CFE Exam Prep Course – The ACFE offers an online course to help candidates prepare for the CFE exam. The course includes lectures, practice questions, and interactive exercises to help students understand the material. https://www.acfe.com/training/self-study/cfe-exam-prep-course/

- ACFE Learning Center – The ACFE offers a variety of online courses and webinars related to fraud examination and prevention. These courses can be used to fulfill the continuing education requirements for the CFE certification. https://www.acfe.com/learning-center/

- CFE Exam Study Community – The ACFE has a community forum where candidates can connect with other CFE exam takers, ask questions, and share study tips. https://www.acfe.com/cfe-exam-study-community/

- CFE Exam Calculator Policy – The ACFE provides information on the types of calculators that are allowed during the CFE exam. Candidates should review this information to ensure they have the appropriate calculator for the exam. https://www.acfe.com/cfe-exam-calculator-policy/

Certified Fraud Examiner (CFE) Exam Tips and Tricks

Here are some tips and tricks that may help candidates prepare for the Certified Fraud Examiner (CFE) exam:

- Start Early: The CFE exam covers a wide range of topics related to fraud examination and prevention, so it is important to start studying early. Give yourself plenty of time to review the study materials and practice exam questions.

- Use Multiple Study Materials: The Fraud Examiners Manual is the official study guide for the CFE exam, but it can be helpful to supplement your study materials with other resources, such as online courses or practice exams.

- Focus on Core Concepts: While the CFE exam covers many different topics, it is important to focus on the core concepts of fraud examination and prevention. Make sure you have a solid understanding of the different types of fraud, the investigation process, and the legal and ethical considerations of fraud examination.

- Take Practice Exams: The ACFE offers practice exams that can help you identify areas where you need to focus your study efforts. Taking practice exams can also help you get used to the format and structure of the exam.

- Stay Up-to-Date: Fraud examination and prevention is a constantly evolving field, so it is important to stay up-to-date on the latest trends and techniques. Make sure you are familiar with current fraud schemes and prevention strategies.

- Manage Your Time: The CFE exam is timed, so it is important to manage your time effectively during the exam. Make sure you are familiar with the time limits for each section of the exam, and pace yourself accordingly.

Certified Fraud Examiner (CFE) Study Guide

Acquiring certifications not only enables you to secure a salary above the market average but also positions you for new opportunities and responsibilities. Consistency in your preparation is the pivotal factor for passing this exam. This cheat sheet offers the appropriate CFE study materials, resources, and a strategic approach, serving as your ideal tool for a last-minute revision just before the exam.

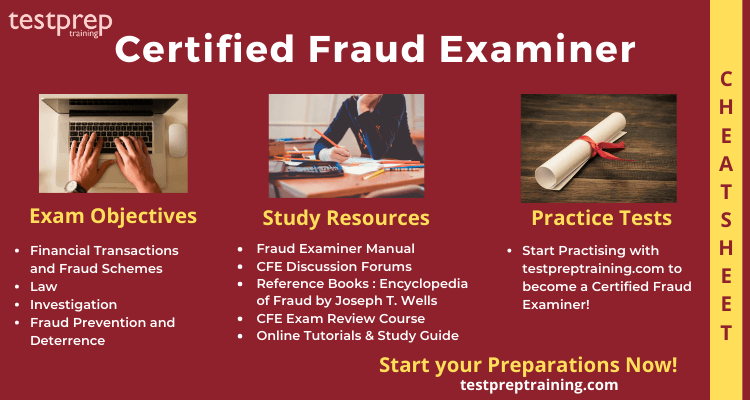

Review the Exam Objectives

The objectives are the most necessary part for any exam like the Certified Fraud Examiner (CFE) exam. Having utmost clarity about the exam course is indeed essential. These course objectives act as a blueprint for your exam and boost your preparations. Therefore, you must visit the Official Exam Guide to learn more about the exam policies and concepts. The CFE sections are:

First – Financial Transactions and Fraud Schemes

- It tests the candidate’s comprehension of the varieties of fraudulent financial activities acquired in accounting records.

- To claim Financial Transactions & Fraud Schemes, the candidate will be asked to illustrate knowledge of the subsequent concepts: fraud schemes, basic accounting and auditing theory, internal controls to prevent fraud, and additional accounting and auditing matters. (Documentation: Financial Transactions & Fraud Schemes)

Second – Law

- It ensures the liberties with the various legal divisions of managing fraud examinations, including rules of evidence, criminal and civil law, rights of the challenged and accuser, and expert witness concerns. (Documentation: Legal, Law Enforcement and Government Alliance)

Third – Investigation

Fraud investigation involves-

- Questions about taking statements

- Interviewing

- Collecting information from public records

- Investigating illicit transactions

- Assessing deception and report writing (Documentation: Investigation & Examination)

Fourth – Fraud Prevention and Deterrence

- It tests the candidate’s perception of why people engage in fraud and approaches to prevent it.

- Topics recounted in this section add white-collar crime, crime causation, occupational fraud, fraud risk assessment, fraud prevention, and the ACFE Code of Professional Ethics. (Documentation: Prevention & Deterrence)

Quick links for Resources to enhance your learning

Choosing the right resources with reliable content is very important. As a matter of fact, there are various resources to choose from. This makes it difficult to select authentic and genuine ones. As you have probably been preparing for this exam we hope that you have made a wise choice in terms of your learning resources. However, here are a few quick links that will definitely benefit your preparations by covering the CFE syllabus and help you ace the exam:

Fraud Examiner Manual

An excellent resource to utilize during your Certified Fraud Examiner Exam Preparation Course is the Fraud Examiners Manual. Recognized as the benchmark reference for anti-fraud education, this comprehensive guide thoroughly outlines the latest systems, techniques, methods, and procedures in fraud examination. It is available for download on the official page of the ACFE.

Discussion Forums

Joining discussion forums can be a great investment to prepare for the CFE exam. They help the aspirants to foster their preparation process. ACFE affiliates can visit the CFE Exam discussion conference to post problems online and receive feedback from other members and ACFE staff. However, the discussion forums remain in the Members Only section of ACFE.com.

Books your Best Friends

Books have been an age old tradition and essential ingredient when it comes to preparing for any exam. They provide deep understanding of the exam concepts. Also books offer real life scenarios that help you prepare for a practical exam. We recommend you to refer the following CFE exam book:

- Encyclopedia of Fraud by Joseph T. Wells and Association of Certified Fraud Examiners

- Certified Fraud Examiner A Complete Guide – by Gerardus Blokdyk

Training Course

Training is the best way to prepare for the exam while developing strong understanding of the concepts. Instructors who are well versed and have excelled in this field are on board for teaching in the best possible way. The Association of Certified Fraud Examiners offers its own course to help you prepare better for the exam.

CFE Exam Review Course : In this four-day, instructor-led course, you’ll gain proficiency in the topics assessed in the CFE Exam, covering Financial Transactions and Fraud Schemes, Law, Investigation, and Fraud Prevention and Deterrence.

Online Tutorials and CFE Study Guide

Online Tutorials enhance your knowledge and provide in depth understanding of the exam concepts. Moreover, Study Guides will be your support throughout your journey towards the exam. These resources will help you stay consistent and determined. They enrich your learning experience.

Practice Tests to self evaluate

Practice tests are the most important as well as helping tools to prepare for the exam. They help you find out your core strengths and iron out your weaknesses. Strengthening these weaknesses improvises your preparations and expands your knowledge. Therefore, after preparation, we suggest you to try a hands-on practice test. Moreover, attempting Multiple Practice Tests helps in boosting your confidence. Start using CFE Exam Sample Questions for Practice Now!